The world is undergoing a historic energy transition. The move from fossil fuels to renewable energy sources is reshaping commodity markets, inflation trends, and global investment flows. For investors, understanding this shift is essential to identifying opportunities and risks in the years ahead.

Let’s dive into how the energy transition impacts markets, explore the winners and losers, and discuss visions of tomorrow.

The Drivers Behind the Energy Transition

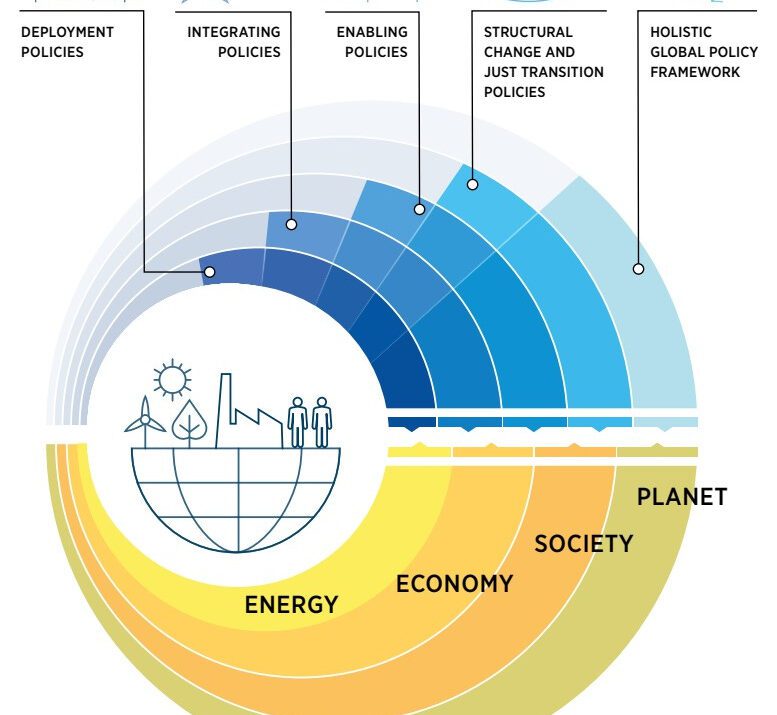

The global shift toward renewables is being driven by a mix of environmental, economic, and policy factors. Governments worldwide are implementing ambitious targets to reduce carbon emissions.

The European Union aims to reduce greenhouse gas emissions by 55% by 2030, while the United States has committed to net-zero emissions by 2050. Similarly, China plans to peak emissions by 2030 and reach net-zero by 2060.

These commitments are backed by massive investments in renewable energy, electric vehicles, and infrastructure. As energy systems evolve, this transition will create significant winners and losers across economies and sectors.

Impact on Commodity Markets

The shift to renewable energy is altering the demand for commodities. Fossil fuels face long-term decline, but materials for clean energy technologies are seeing soaring demand. Copper, for example, is essential for electrical grids, EVs, and solar panels, with demand expected to grow by over 50% by 2040.

Metals like lithium, nickel, and cobalt, critical for EV batteries, have already seen price spikes-lithium alone surged 500% between 2021 and 2022.

Meanwhile, demand for oil and gas remains strong in the near term but is likely to peak by the 2030s, forcing fossil fuel producers to adapt.

It is expected that commodities tied to clean energy continue to outperform, making sectors like mining, recycling, and battery innovation key areas to watch.

Inflation Trends: Greenflation and Energy Costs

The energy transition isn’t without costs. The rising prices of materials like copper, steel, and rare earth metals-a phenomenon called greenflation-are increasing the cost of clean energy projects. The cost of building wind and solar farms has risen as input costs climb.

At the same time, energy prices remain volatile. As fossil fuel investments decline faster than renewables can scale up, inflationary pressure could persist in the short term. In the near term, I believe inflation will remain elevated as economies navigate the transition.

However, long term, renewables promise lower and more stable energy costs, reducing inflation volatility and improving economic stability.

Investment Flows: The Future of Capital

The energy transition is driving trillions of dollars into clean technologies. Renewable infrastructure projects-including wind, solar, and battery storage-are attracting record investments.

In the United States alone, the Inflation Reduction Act is expected to generate over $370 billion in clean energy spending. The electric vehicle (EV) market is another major beneficiary, projected to grow to $1.1 trillion by 2030.

Companies across the EV supply chain, from battery manufacturers to charging infrastructure providers, are well-positioned for growth. Renewable energy and clean technologies becoming dominant investment themes. Companies at the forefront of this shift will lead the next wave of growth.

Winners and Losers in the Energy Transition

The energy transition is redefining which sectors and economies thrive.

Winners include renewable energy companies, clean technology innovators, and miners of critical minerals like copper, lithium, and nickel. Emerging markets with abundant resources, such as Chile, Australia, and parts of Africa, are also poised to benefit.

On the other hand, fossil fuel industries face long-term headwinds as demand peaks. Countries reliant on oil and gas exports- like Russia and parts of the Middle East- will need to diversify to remain competitive. Heavy industries slow to adapt will face rising carbon costs.

Companies and countries that embrace innovation and adapt to the new energy landscape will emerge as leaders. Those resistant to change risk being left behind.

Visions of Tomorrow

As the energy transition accelerates, a few key trends will shape the macroeconomic environment:

- Rising demand for critical minerals could lead to supply shortages and higher prices.

- Breakthroughs in technologies like battery storage, hydrogen, and carbon capture could transform energy markets.

- Government policies will continue to play a decisive role, with incentives and regulations driving investment.

- Emerging markets with natural resources will become focal points for growth and capital flows.

The energy transition highlights a fundamental shift in how economies produce and consume energy. Change brings opportunities, but it also brings risks.

As investors, staying ahead of this shift is crucial. While renewable energy and clean technologies offer immense potential, the road will be uneven.

By understanding the winners, losers, and macro forces at play, we can position ourselves for long-term success in this new energy era.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source: Macro Mornings