Investors are preparing for a crucial week packed with high-profile earnings reports as markets navigate rising economic uncertainty and brace for President Trump’s reciprocal tariffs, set to take effect in just 10 days.

Some of the most anticipated earnings this week include Intuitive Machines, Inc. (LUNR), GameStop (GME), Lululemon (LULU), Paychex (PAYX), and Jefferies (JEF). Market participants will be closely watching these results for clues about consumer behaviour, corporate health, and potential ripple effects from trade policy shifts.

In addition to company earnings, Thursday’s release of the US Q4 GDP data and Friday’s PCE Inflation report could significantly influence market direction heading into April. (Key Economic Events to Watch This Week (24-28 March)

Key Reports to Watch

- Monday: Lucid Diagnostics (LUCD), KB Home (KBH), Oklo Inc. (OKLO)

- Tuesday: Rumble (RUM), Canadian Solar (CSIQ), GameStop (GME)

- Wednesday: Chewy (CHWY), Dollar Tree (DLTR), Paychex (PAYX), Jefferies (JEF), Petco (WOOF)

- Thursday: Bitfarms (BITF), Lululemon (LULU), KULR Tech (KULR), Braze (BRZE), US Q4 GDP

- Friday: zSpace (ZSPC), Xos Inc. (XOS), and February PCE Inflation data

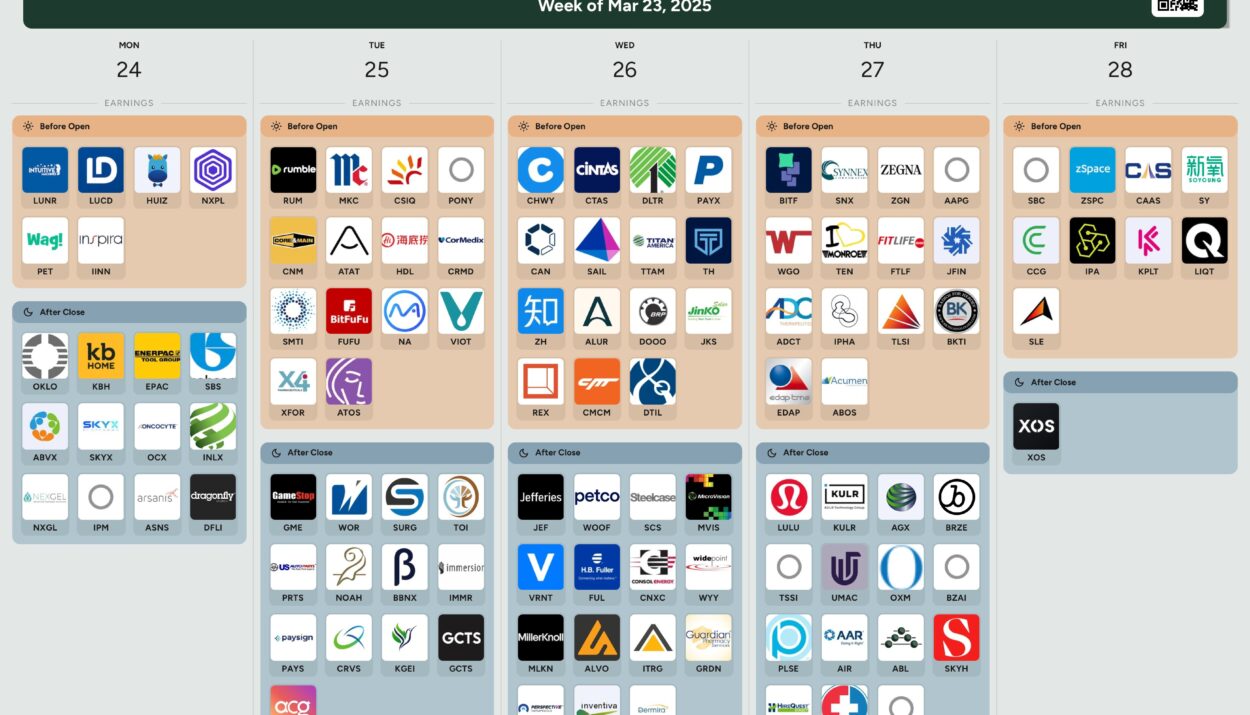

Full Earnings Calendar – Week of March 24, 2025

| Date | Before Open | After Close |

|---|---|---|

| Monday 24 | LUNR, LUCD, HUIZ, NXPL, Wag!, Inspira, PET, INN | OKLO, KBH, ENERPAC, SBS, ABVX, SKYY, OCX, INLX, NXGL, IPM, ASNS, DFLI |

| Tuesday 25 | RUM, MKC, CSIQ, PONY, CNM, ATAT, HDL, CRMD, SMTI, FUFU, NA, VIOT | GameStop (GME), WOR, SURG, TOI, PRTS, NOAH, BBNX, IMMR, Jefferies (JEF), WOOF, SCS, MVIS |

| Wednesday 26 | CHWY, CTAS, DLTR, PAYX, CAN, SAIL, TITAN, TH, ZH, ALUR, DOOO, JKS | Petco, Steelcase, VRNT, FB Financial, CNXC, WYY, MLKN, ALVO, ITRG, GRDN |

| Thursday 27 | BITF, SNX, ZEGNA, AAPG, WGO, TEN, TLF, JFIN, CCG, IPA, KPLT, LIQT | LULU, KULR, AGX, BRZE, TSSI, UMAC, OXM, BZAI, PLSE, AAR, AIR, ABL, SKYH |

| Friday 28 | SBC, ZSPC, CAAS, CCG, IPA, KPLT, LIQT, SLE | XOS |

What’s at Stake?

This week’s earnings, alongside the upcoming GDP and inflation reports, will provide critical insight into how corporations are handling rising costs, slowing growth, and the looming tariffs that threaten to disrupt global trade.

Markets are on edge, and these reports could either reinforce concerns about an economic slowdown or offer a much-needed confidence boost as we head into Q2.