Donald Trump is under fire again — this time for allegedly profiting from his presidency through his family’s booming cryptocurrency ventures.

A new investigation by Australia’s ABC Four Corners reveals that Trump and his sons have earned hundreds of millions of dollars from crypto projects launched before and during his presidency, raising fresh concerns about conflicts of interest and violations of U.S. ethics norms.

A Presidency Entangled With Crypto Wealth

Trump’s latest controversy centers around World Liberty Financial, a crypto investment platform launched by Trump and his sons in 2024. The venture allows investors to buy a digital token — with 75% of profits flowing directly to the Trump family.

In March, the company disclosed sales of $550 million worth of tokens, delivering an estimated $390 million to the Trump family, according to the report. The firm’s investors reportedly include crypto billionaire Justin Sun, who contributed $75 million, and the UAE’s sovereign fund MGX, which made a record $2 billion investment in Binance via a Trump-linked token.

Critics argue that these dealings blur the line between Trump’s private business and public office — particularly since the UAE investment came just weeks before Trump approved a deal allowing the country to purchase advanced Nvidia AI chips previously restricted under U.S. export rules.

Related: Trump Joins Billionaire Bitcoin Club With $870 Million Stake via Trump Media

Crypto Gala and Meme Coin Profits

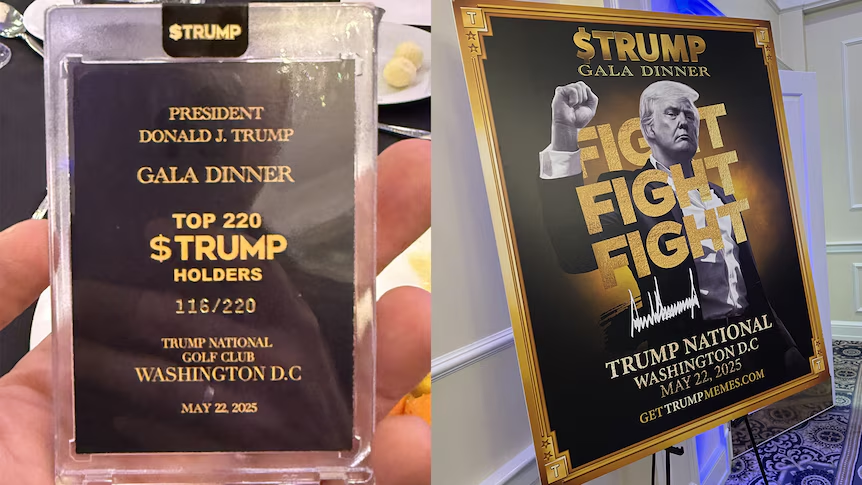

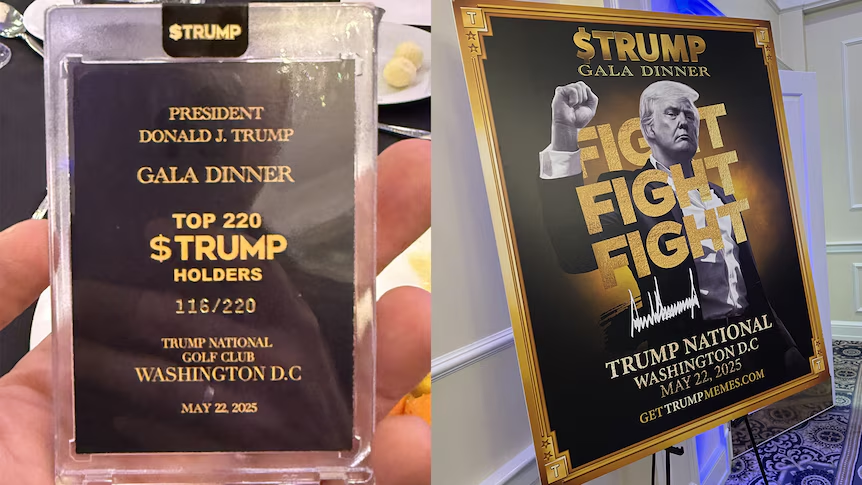

The Four Corners report also uncovered a black-tie gala at Trump’s Virginia golf club celebrating top holders of the $TRUMP meme coin, launched days before his 2025 inauguration.

More than 220 investors attended the event — having collectively purchased around $150 million worth of the token — while the Trump family earned a share of the $320 million in trading fees generated within four months of launch.

Attendees described the event as a “money-making spectacle.” One investor told reporters:

“Every time Trump tweets about the coin, the price moves. If I profit, I don’t mind if he does too.”

Ethics Experts Sound the Alarm

Former Obama ethics lawyer Norm Eisen called Trump’s actions “the exploitation of public office for private gain,” labeling him “the most corrupt president in modern U.S. history.”

He warned that Trump’s personal business stakes — from real estate to crypto — could compromise U.S. policy decisions.

Another prominent ethics adviser, Virginia Canter, noted that the UAE’s use of Trump’s token for its Binance investment “raises serious questions” about whether U.S. foreign policy is being influenced by the president’s financial interests.

White House Response

The White House maintains that Trump’s assets are held in a family trust managed by his children and that his presidential decisions are unaffected by business operations. Former Trump adviser Bryan Lanza defended the president, stating:

“There’s no law preventing a president’s family from earning money. Every president benefits from their policies. Trump is no different.”

The Four Corners investigation paints a striking picture of how Trump’s political power, business empire, and crypto ventures have become deeply intertwined.

While his supporters see a savvy businessman rewriting the rules, ethics experts warn the president’s crypto empire could redefine — and destabilize — the boundaries between personal profit and public service.