A weaker US dollar could reshape global trade in 2026, with both President Donald Trump and influential voices in China openly discussing a potential reset in currency dynamics.

US President Donald Trump has repeatedly argued that a weaker dollar would help revive American manufacturing, boost exports, and shrink the US trade deficit. At the same time, a growing group of Chinese economists and policy advisers believe a stronger yuan could help China rebalance its economy and unlock domestic consumption.

While no major currency shift occurred in 2025, several forecasters now see exchange rates as a key wildcard for 2026, including analysts at Goldman Sachs.

Trump’s Case for a Weaker Dollar

Trump has long complained that a strong dollar hurts US exporters and tourism. Speaking in July, he said the US earns “a hell of a lot more money with a weaker dollar,” arguing that American products become harder to sell abroad when the currency is too strong.

He has also suggested that his tariff policy would be far more effective if exchange rates adjusted alongside trade barriers. According to Trump, countries like China and Japan resist currency appreciation because they benefit from weaker currencies that support exports.

Despite the rhetoric, the administration has stopped short of aggressive steps such as formally labeling China a currency manipulator or imposing financial penalties tied to China’s US debt holdings, ideas floated earlier by advisers before taking office.

Why the Yuan Matters

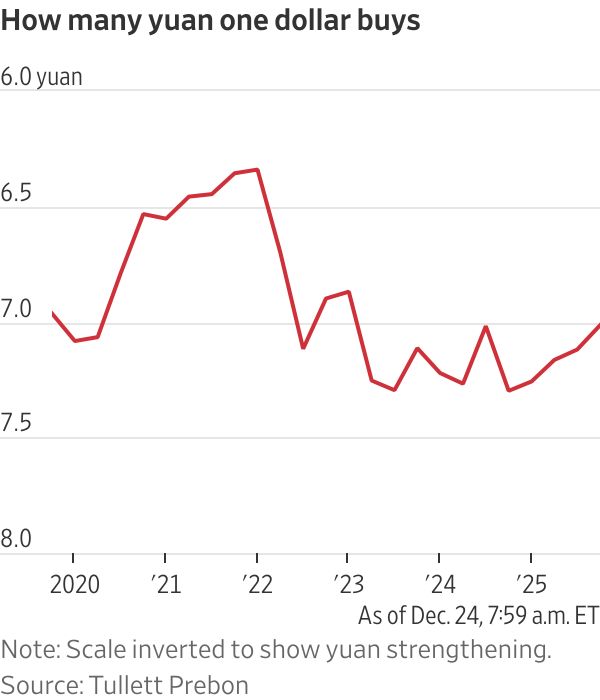

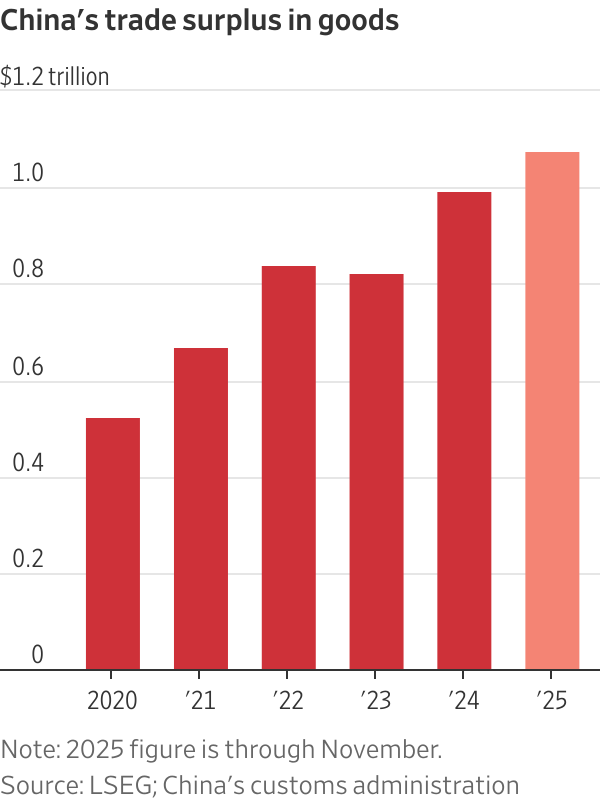

China currently runs a trade surplus above $1 trillion, while the yuan trades just above seven per dollar. That is stronger than earlier in 2025 but still around 7% weaker than five years ago.

In a fully free market, persistent trade surpluses would normally push the local currency higher. Instead, Beijing actively manages the yuan, keeping it within a tight range by recycling excess dollars into US assets, including Treasury bonds. This policy helps Chinese exports stay competitive but keeps household purchasing power lower.

According to Logan Wright of Rhodium Group, China’s trade strategy remains focused on maximizing export market share, even if it limits domestic consumption.

Goldman’s View: Yuan Undervalued

Several analysts argue the yuan is significantly undervalued. Brad Setser of the Council on Foreign Relations has estimated undervaluation near 30%, a view echoed by Goldman Sachs strategist Teresa Alves, who put the range at 20% to 30% depending on methodology.

Alves recently said a stronger yuan in 2026 is one of Goldman’s highest conviction forecasts, citing growing internal pressure in China to rebalance its economy away from export dependence.

European policymakers are also watching closely. Christine Lagarde said in December that the current level of the renminbi is something global central banks are paying attention to.

Debate Inside China Is Shifting

Chinese leader Xi Jinping has long emphasized manufacturing strength as the foundation of national power. But some influential economists now argue that true economic power requires a strong, widely used currency, similar to the dollar today or the British pound during the UK’s imperial era.

Veteran adviser Liu Shijin recently argued that a stronger yuan could boost consumption, lower import costs, and help China escape its economic slowdown. He pointed to Trump’s tariff leverage as evidence of the power that comes with strong consumer purchasing capacity.

Former central bank official Sheng Songcheng went even further, suggesting that a fair exchange rate could be five or even four yuan per dollar, far stronger than current levels.

Why Change Is Still Hard

Despite growing debate, resistance inside Beijing remains strong. Policymakers remain wary of repeating Japan’s experience after the 1985 Plaza Accord, when a rapid yen appreciation contributed to a massive asset bubble and decades of stagnation.

As Wright of Rhodium Group noted, shifting away from China’s export-led model would require painful trade-offs, including slower growth and challenges to entrenched interests.

What to Watch in 2026

Currency policy is emerging as a quiet but powerful fault line between the world’s two largest economies. A weaker dollar could support US exports, while a stronger yuan could redefine China’s growth model. Whether political will aligns on either side remains uncertain, but markets and policymakers are increasingly treating dollar-yuan dynamics as one of the most important macro risks of 2026.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

What’s Ahead for Stocks and Gold in 2026? What Markets and Experts Are Watching

Stocks Look Bullish Entering 2026 — But What Could Go Wrong?

FOMO vs. Bubble Angst Signals More Stock Volatility in 2026

Gold Breaks $4,400 as Silver, Copper and Platinum Hit Record Highs: What Comes Next

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch