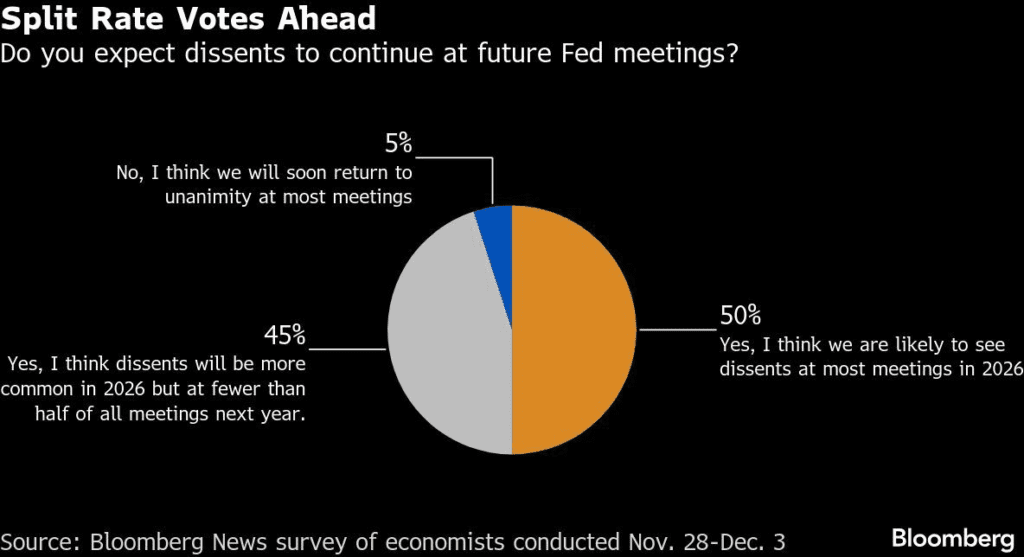

Deep disagreements inside the FED over inflation, jobs, and interest rates are not fading. They are expected to intensify in 2026, especially as political pressure grows and leadership at the central bank changes.

After a year in which the Fed’s dual mandate of price stability and maximum employment openly collided, policymakers are entering the new year still split on how to steer monetary policy in an economy shaped by tariffs, a cooling labor market, and uneven inflation data.

A divided Fed faces a tougher 2026

In 2025, Fed Chair Jerome Powell managed to guide the Federal Open Market Committee through three rate cuts, despite rising internal friction. Economists warn that maintaining consensus will be far more difficult next year.

Matthew Luzzetti, chief US economist at Deutsche Bank, says the most likely path still points to further rate cuts, but warns of a growing risk scenario where some officials may even push for rate hikes if inflation stays elevated.

“The next chair could face a committee that is deeply split,” Luzzetti noted, particularly if inflation remains sticky while the job market softens further.

Ian Wyatt of Huntington Bank echoed that concern, saying the new chair will face a challenge “herding cats” if their policy views diverge from the Fed’s median voter.

Trump’s influence looms larger

President Donald Trump’s economic agenda played a central role in shaping Fed tensions throughout 2025. Rapid changes in tariff policy, border restrictions, and fiscal decisions kept policymakers cautious for much of the year.

Trump repeatedly pressured the Fed to cut rates more aggressively, openly criticising Powell and raising concerns about central bank independence. While Powell remained in office, Trump fired Fed governor Lisa Cook over alleged mortgage fraud, a case now heading to the Supreme Court.

The president also appointed Stephen Miran, a White House economic adviser, to temporarily fill a Fed vacancy without requiring him to fully step away from the administration. That move unsettled Fed watchers who worry about political influence inside the central bank.

Tariffs and the labor market fueled internal rifts

Early in 2025, many Fed officials believed tariffs would cause only a temporary spike in prices. That view shifted sharply after Trump’s April 2 “Liberation Day,” which introduced the most sweeping tariffs in a century.

By midyear, officials were increasingly concerned tariffs could lead to longer lasting inflation, even as the labor market began to cool.

In July, the Fed held rates steady, triggering dissents from governors Chris Waller and Michelle Bowman, who wanted a preemptive rate cut to support employment. That moment marked one of the clearest signs of internal division.

By December, the fractures were unmistakable:

- Two voting members opposed the latest rate cut due to inflation concerns

- Stephen Miran dissented in the opposite direction, favoring a larger cut

- Six non voting members would have preferred no cut at all

Inflation uncertainty clouds the outlook

Despite fears, the inflationary impact of tariffs in 2025 was milder than initially expected. Some officials, including Powell and Waller, believe tariff driven inflation will peak early in 2026 and then ease.

Others remain unconvinced. Beth Hammack of the Cleveland Fed and Lorie Logan of the Dallas Fed, both voting members next year, worry inflation could stay elevated for longer.

Recent inflation data showed easing price pressures, particularly in housing. But data gaps caused by the record government shutdown have led many officials to question the accuracy of recent readings.

New York Fed President John Williams believes inflation may be understated by about 0.1 percentage points, while Hammack estimates the gap could be two to three tenths.

A cautious start to 2026

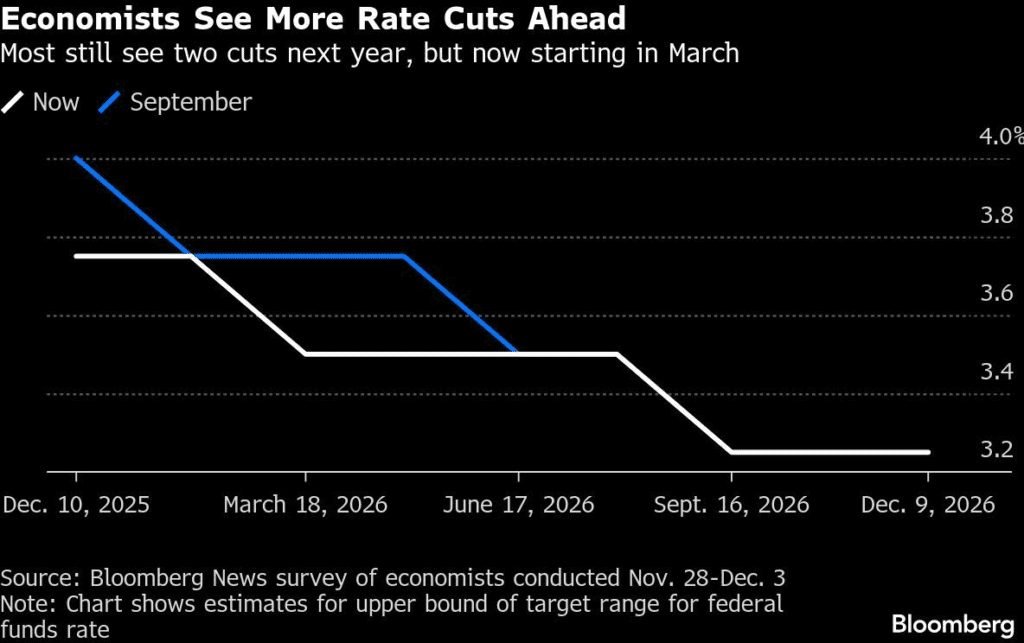

With inflation still above target and unemployment edging up to 4.6%, the Fed has signaled a pause to reassess before taking further action.

Most officials now expect only one additional rate cut in 2026, barring a sharp deterioration in the labor market. Growth is projected to pick up next year, supported by fiscal stimulus from tax policy and a rebound from the shutdown.

Jeffrey Roach of LPL Financial expects some bumpy inflation readings early in 2026, but believes cooling later in the year could open the door to more cuts.

Former Kansas City Fed President Esther George is more cautious, warning that large fiscal deficits, political pressure, and easy financial conditions could keep inflation elevated.

A new chair, but the same divisions

The Fed will also face a leadership transition in 2026, with Powell’s term ending in May. Trump is expected to nominate a chair more aligned with his preference for lower rates.

Even so, analysts say rate cuts will not be automatic.

Wilmer Stith of Wilmington Trust expects limited movement early in the year, with perhaps one cut before May, followed by more action later under a new chair.

“The Fed is going to be more tied to the administration than we’ve seen in a long time,” Stith said. “That suggests rate cuts are coming, but not without resistance.”

The internal Fed battles that defined 2025 are far from over. As 2026 approaches, policymakers face a complex mix of sticky inflation, cooling employment, political pressure, and unreliable data.

With leadership change ahead and divisions deepening, the path for interest rates next year looks slow, cautious, and increasingly contentious.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

What’s Ahead for Stocks and Gold in 2026? What Markets and Experts Are Watching

Stocks Look Bullish Entering 2026 — But What Could Go Wrong?

FOMO vs. Bubble Angst Signals More Stock Volatility in 2026

Gold Breaks $4,400 as Silver, Copper and Platinum Hit Record Highs: What Comes Next

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Want to Know Where the Market Is Going? Don’t Trust This, or Any, Forecast.