European defense stocks rallied sharply on Monday following a diplomatic push from European leaders to support Ukraine amid ongoing tensions with Russia. The surge in defense equities was led by Germany’s Rheinmetall (DE: $RHM) and the UK’s BAE Systems (GB: $BA) after JPMorgan raised price targets on both stocks in response to the London summit over the weekend.

Other major European defense firms, including Sweden’s Saab (SAABF), Italy’s Leonardo (IT:LDO), France’s Thales (FR:HO), and Rolls-Royce (GB:RR), also posted gains exceeding 10% in early trade.

Why Are European Defense Stocks Soaring?

1️⃣ European Leaders Rally After Ukraine’s Tense Talks with Trump

The London summit on Ukraine followed a heated exchange between Ukrainian President Volodymyr Zelensky and Donald Trump in the White House, where the Ukrainian leader left without securing a mineral rights deal. The contentious meeting raised concerns about U.S. support for Ukraine, prompting European nations and Canada to step in and reinforce their commitment to Kyiv.

2️⃣ UK and France Unveil a Four-Step Peace Plan

At the summit, UK Prime Minister Keir Starmer and French President Emmanuel Macron proposed a four-step strategy for Ukraine, which includes:

✔ Continued military aid to Ukraine.

✔ Strengthening Ukraine’s defense systems post-peace agreement.

✔ A lasting security guarantee, potentially including European troop deployments.

✔ Ukraine’s full involvement in peace talks, ensuring sovereignty protections.

3️⃣ Fresh Defense Spending Announcements Boost Stocks

European governments signaled new defense spending commitments, further driving investor optimism:

✔ The UK pledged £1.6 billion ($2 billion) in new exports to supply 5,000 additional air defense missiles to Ukraine.

✔ Germany is considering unlocking billions in special funding for defense and infrastructure.

✔ France and the UK are reportedly discussing a one-month ceasefire and post-war security deployments.

While UK Armed Forces Minister Luke Pollard downplayed reports of a formal UK-France truce deal, he confirmed that multiple security options were being privately discussed.

How European Defense Stocks Reacted

🟢 Top Gainers in European Defense Stocks (Monday’s Early Trade)

- Rheinmetall (DE:RHM) ↑10% – German arms manufacturer, key supplier to Ukraine.

- BAE Systems (GB:BA) ↑9.5% – UK defense giant benefiting from increased European military funding.

- Saab (SAABF) ↑11% – Sweden’s defense leader, known for Gripen fighter jets.

- Leonardo (IT:LDO) ↑10.2% – Italy’s top defense firm, benefiting from NATO defense spending.

- Thales (FR:HO) ↑10% – France’s defense-electronics powerhouse, involved in missile systems.

- Rolls-Royce (GB:RR) ↑7% – Aircraft engine maker reaching record highs.

What’s Next for European Defense Stocks?

With Europe stepping up military commitments, analysts expect further gains in defense equities. Investors looking to capitalize on the defense sector rally may focus on companies benefiting from new military contracts and government funding initiatives.

Best European Defense Stocks to Buy Right Now

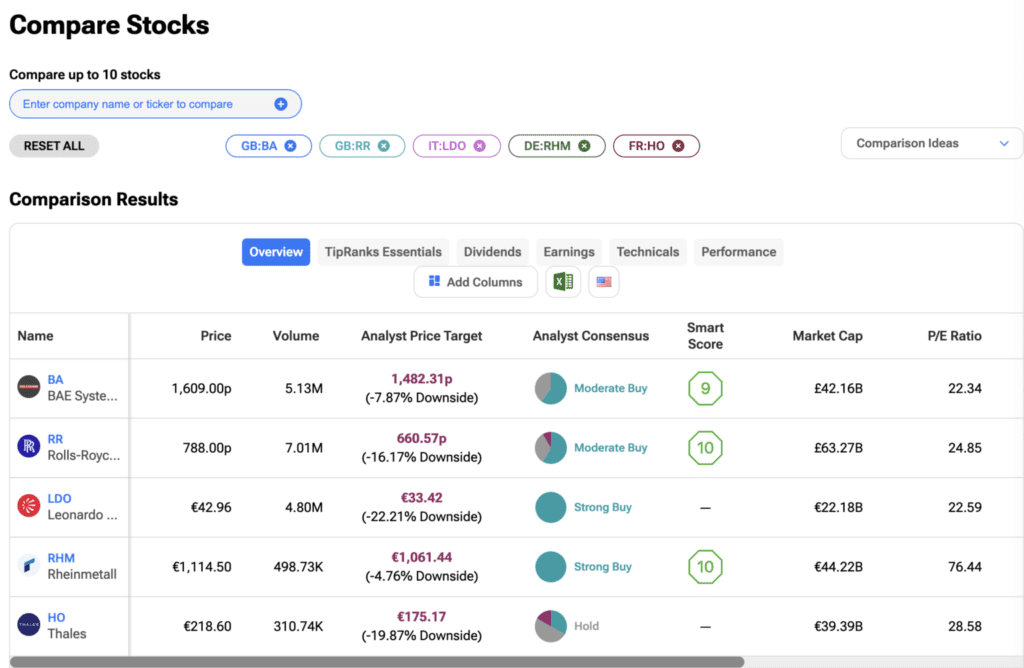

For those looking to invest in European defense companies, the TipRanks Stock Screener has identified the most bullish analyst-rated defense stocks in the region.

✔ 🛡️ BAE Systems ($BA) – Strong market position with a Moderate Buy rating, but price target suggests 7.87% downside.

✔ ✈️ Rolls-Royce ($RR) – Biggest market cap at £63.27B, but analysts see a potential 16.17% downside from the current price. – Moderate Buy rating.

✔ 🇮🇹 Leonardo ($LDO) – Analysts have a Strong Buy rating, but its price target suggests 22.21% downside, which could indicate overvaluation.

✔ 🇩🇪 Rheinmetall ($RHM) – The strongest performer in European defense growth, but its high P/E ratio of 76.44 suggests it’s priced for significant future growth – Strong Buy rating.

✔ 🇫🇷 Thales ($HO) – Only stock rated as “Hold”, with analysts expecting nearly 20% downside from its current price.

As Europe strengthens its security commitments amid geopolitical uncertainty, defense stocks remain in focus as a top-performing sector for investors.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Why Is the Stock Market Still Panicking after Nvidia Strong Earnings…?

Trump, Chip Maker TSMC Expected to Announce $100 Billion Investment in U.S.

After Trump announced the US Strategic Crypto Reserve, What’s coming next?

Market Debate: Economic Slowdown or Sector Rotation?

Methods for More Consistent Gains in Penny Stocks

3 Solar Stocks Worth Buying in 2025

ETF Inflows at Record Highs – A Bullish Signal or a Bubble?

Which Stocks Super Investors Bought Recently?

How long can NVIDIA stay untouchable?

Trump Organization Files Trademark for Metaverse & NFT Trading Platform

Trade war is back: After new tariffs S&P 500 erased $500+ BILLION of market cap, Bitcoin dropped

Trump vows March 4 tariffs for Mexico, Canada, extra 10% for China over fentanyl

How Trump’s 25% EU Tariffs Could Impact the Stock Market & Key Sectors