Just as AI stocks stabilize from the DeepSeek-driven sell-off, China is making headlines again—this time with advances in quantum computing.

Origin Quantum Computing Technology, a Chinese startup, announced a major milestone: its Wukong quantum computer, featuring 72 qubits, has received over 20 million remote visits from researchers in 139 countries.

The news underscores China’s rapid advancements in quantum computing—a field where the U.S. has historically led. But could this breakthrough be a reason why quantum computing stocks are now under pressure?

China’s Quantum Computing Push—Why It Matters

China’s Growing Quantum Presence:

- China Science and Technology Daily reported that Origin Quantum’s Wukong system has been widely accessed worldwide.

- China is also ahead in quantum networking—developing secure communications via fiber optics and satellites.

Global Quantum Competition Heats Up:

- The U.S. and China are racing to dominate quantum technology, similar to AI.

- The Biden administration has restricted quantum-related exports to China to slow its progress.

- China is developing its own encryption standards to counter U.S.-led efforts.

Other Major Players in Quantum Computing:

- IBM ($IBM), Alphabet ($GOOGL – Google), and Rigetti ($RGTI) all use superconducting quantum technology, similar to China’s new system.

- D-Wave ($QBTS) just secured a big quantum contract in Germany, but its stock is still struggling.

Are China’s Quantum Advancements Hurting Quantum Stocks?

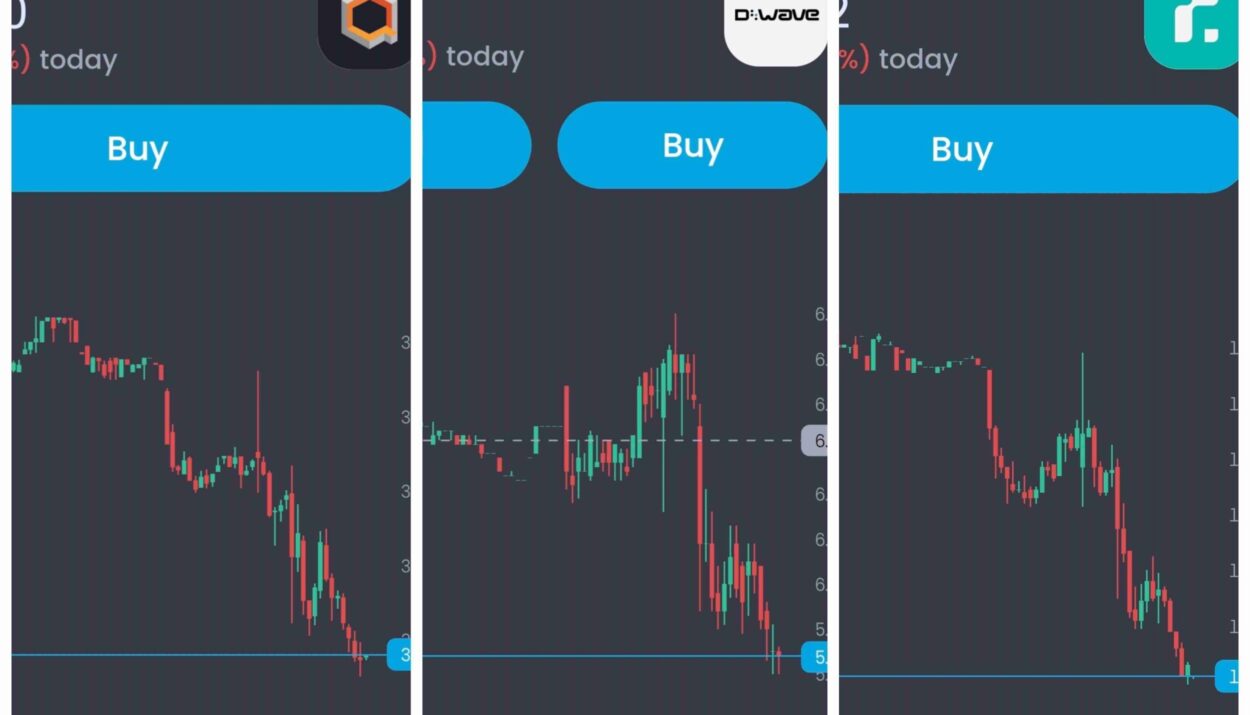

Quantum computing stocks rallied in December after Google’s “Willow” quantum chip announcement, but they have been selling off in 2025.

📉 Year-to-date performance (as of Feb. 18, 2025):

| Company | Ticker | YTD Performance |

|---|---|---|

| IonQ | $IONQ | -10.4% |

| Rigetti Computing | $RGTI | -9.8% |

| D-Wave Quantum | $QBTS | -8.2% |

| Quantum Computing Inc. | $QUBT | -7.9% |

This sell-off coincides with China’s recent quantum announcements. Investors may be concerned about China’s ability to compete in the sector, similar to how DeepSeek’s AI model disrupted AI stocks like Nvidia ($NVDA) by showing that AI training could be done with far fewer computing resources.

What’s Next for Quantum Stocks?

✅ Bullish Case:

- Quantum computing is still in its early stages, and companies like D-Wave, IonQ, and Rigetti continue to develop real-world applications.

- Governments and private sector interest (such as Germany’s D-Wave purchase) signal long-term demand.

- If more deals emerge, quantum stocks could recover quickly.

❌ Bearish Risks:

- China’s progress raises fears of U.S. companies losing their lead, similar to what’s happening in AI.

- Quantum computing is still far from mass adoption, making short-term profitability uncertain.

- Tighter regulations on U.S.-China tech trade could disrupt supply chains and investment in the sector.

Bottom Line

China’s latest quantum computing breakthrough is fueling concerns among investors, just like DeepSeek did with AI stocks.

With quantum stocks already under pressure, this could add further downside risk—but long-term investors betting on quantum’s potential may see this as a buying opportunity.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

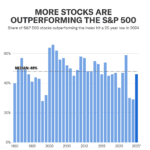

The 2025 stock market rally isn’t just about the Magnificent 7

Elon Musk plans to send a Tesla Bot with Grok AI to Mars by late 2026

Elon Musk Unveils “World’s Smartest AI”—Trained on 100K NVIDIA GPUs

Another CEO is speaking out against naked short selling

Key Events to Watch in This Week & Their Market Impact

Earnings Calendar for This Week: Stocks to Watch and Forecast

Trump’s Auto Tariffs: Will Auto Stocks Crash or Rally?

Car Tariffs May Start on April 2, What It Means for Stock Market

Trump’s Auto Tariffs: What It Means for Tesla Stock

The stock market just won’t crack. Bulls say it’s time for a breakout to new highs

Schwab reports GME stock price above $40,000 in latest glitch: Naked short-selling manipulation?

Javier Milei just DESTROYED market: Are meme coins officially DEAD?

What changes to the CHIPS act could mean for AI growth and consumers