A prominent short-seller has accused used-car retailer Carvana of lax underwriting practices, accounting manipulation, and undisclosed transactions involving hundreds of millions of dollars with a related party. Carvana responded by labelling the report “intentionally misleading and inaccurate” in a statement to the press.

#Carvana, $CVNA, CEO when asked to explain boosted profitability specifically, says "it would take a while to talk about and I would bore your viewers." pic.twitter.com/U59pmtDxam

— Finblog.com (@FinBlog452366) January 13, 2025

Despite the company’s denial, its stock took a hit. Shares fell about 6% the day after the report’s release, and the fallout extended to the fortunes of the father-son team behind Carvana.

Ernie Garcia III, Carvana’s CEO and co-founder, initially launched the company as a subsidiary of DriveTime Automotive, a car dealership owned by his father, Ernie Garcia II, who is also Carvana’s largest shareholder. Following the report, Garcia III’s net worth dropped by $115 million, leaving him with over $6 billion, according to the Bloomberg Billionaires Index. His father, Garcia II, saw his wealth decline by $173 million, bringing his net worth to approximately $15 billion. Together, they have lost around $288 million in 2024 so far. However, with a combined wealth of $21 billion, the losses may not feel substantial—though further stock declines could deepen the impact.

The situation could benefit Hindenburg Research, the short-seller behind the report, as further stock price drops may validate their allegations.

Carvana ranked No. 377 on the Fortune 500 list, and gained prominence by revolutionising the used-car buying experience. Its giant car vending machines allow customers to shop for vehicles online, then either have them delivered or pick them up at fully automated, coin-operated vending machines.

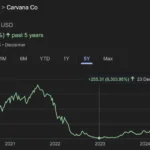

Over the past five years, Carvana’s stock has seen dramatic swings, soaring and then plummeting before beginning a rebound. The Garcias added $11 billion to their combined net worth during a 3,000% stock surge reported by Bloomberg, a sharp contrast to when the stock traded at $4 just two years earlier.

Hindenburg’s report claims Carvana’s turnaround is a “mirage.” It alleges the company is “exorbitantly valued,” faces significant business challenges, and insiders have cashed out billions in stock. Fortune could not immediately verify these claims. Carvana’s stock has dropped below $200 per share for the first time since October, and its trajectory remains uncertain.

The article is featured on Unusual Whales.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.