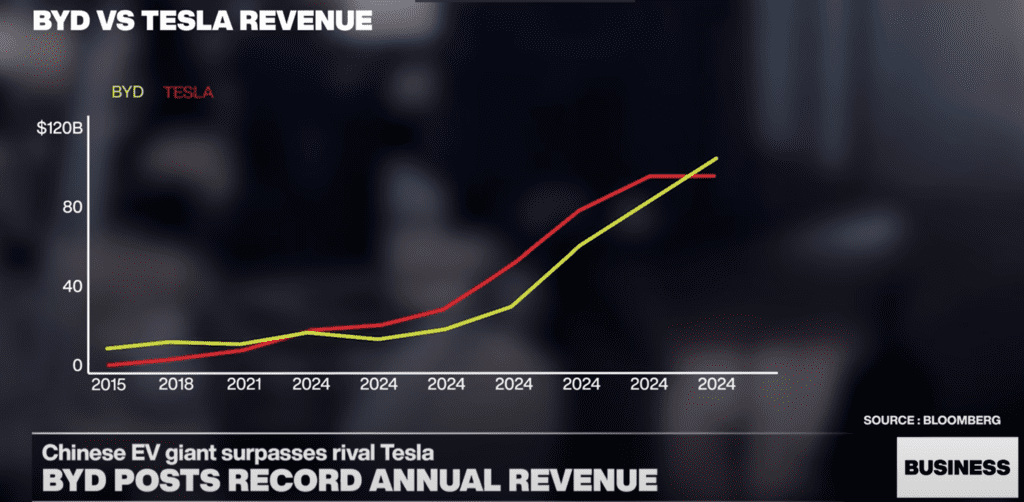

Chinese electric vehicle (EV) powerhouse BYD Co. has overtaken Tesla Inc. in global annual revenue, reporting a staggering 777 billion yuan ($107 billion) in 2024, compared to Tesla’s $97.7 billion, marking a new milestone in the intensifying EV battle.

BYD’s Rapid Growth and Global Lead

BYD posted a 29% year-over-year increase in revenue, fueled by sales of 4.27 million vehicles—a mix of electric and hybrid models. In comparison, Tesla delivered 1.79 million electric vehicles, with annual deliveries slipping 1.1%, their first decline on record.

“BYD has become an industry leader in every sector from batteries, electronics to new energy vehicles, breaking the dominance of foreign brands,” said Wang Chuanfu, BYD’s chairman and president.

In November, BYD became the first automaker to roll out 10 million new energy vehicles globally, underscoring its manufacturing momentum and appeal in China’s massive EV market.

5-Minute Charging: A Game-Changer?

Last week, BYD unveiled its new “Super e-Platform” battery tech, which it claims can add 400 kilometers (~250 miles) of range in just five minutes. If proven effective, this would significantly outpace Tesla’s Superchargers, which require around 15 minutes for a 200-mile charge. (BYD Launches Megawatt Super Charging System to Rival Tesla and NIO in China’s EV Race)

Analysts hailed the development as “out of this world,” predicting a major shift in EV charging expectations and ownership behavior.

AI & Driving Tech: Free vs Paid

BYD also stepped up its software game, rolling out its proprietary “God’s Eye” driver-assistance system for free on most models. Meanwhile, Tesla’s Full Self-Driving (FSD) package remains a $99/month subscription or $8,000 upfront—and still lacks regulatory approval in China.

Though Tesla began limited FSD trials in China last week, the program was suspended abruptly, with Tesla stating it’s “working to secure approval” from authorities.

“Eventually, Tesla may have to cut its FSD price in China,” said Seth Goldstein, an analyst at Morningstar.

Tesla’s Struggles in Key Markets

Tesla is losing ground in China, where BYD controls 32% of the new energy vehicle (NEV) market. Tesla’s share, despite record deliveries, was only 6.1%, according to the China Passenger Car Association.

In Europe, Tesla’s sales fell again in February, dropping nearly 40% year-over-year, marking two straight months of decline.

Tesla remains mostly locked out of the U.S. market due to tariffs on Chinese imports, giving it fewer options to fight BYD’s domestic strength.

BYD’s revenue milestone, supercharged battery tech, and aggressive pricing strategies are challenging Tesla’s global EV dominance. As BYD expands internationally, including building a new factory in Brazil, the pressure on Elon Musk’s company is growing—not just from innovation, but from a rapidly shifting global auto market where China is setting the pace.