According to Michael Hartnett, Chief Investment Strategist at Bank of America, the US stock market is entering a late-stage AI boom driven by extraordinary optimism — and equally remarkable valuations.

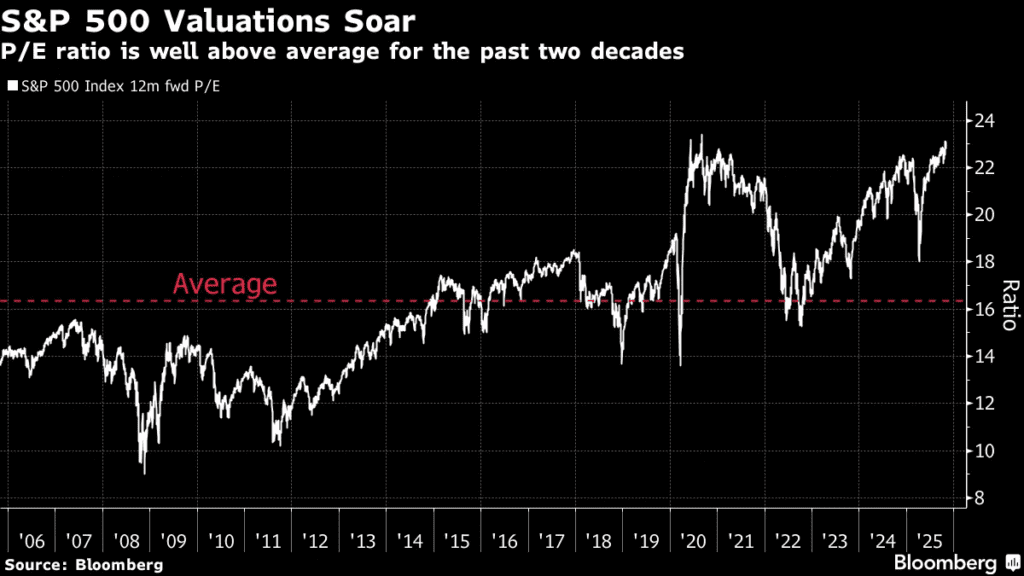

The S&P 500 now trades at 23× forward earnings, well above its 20-year average of 16×, while the Magnificent Seven — Apple, Microsoft, Nvidia, Amazon, Meta, Alphabet, and Tesla — trade at an average 31× forward earnings, representing more than one-third of the index’s weight.

Hartnett’s takeaway: the leadership of AI-driven megacaps “won’t be shaken in the short term,” but the risk of a correction is building.

“Gold and Chinese stocks are the best choices to hedge against AI prosperity — or bubble risks,” Hartnett wrote in BofA’s Flow Show report.

Three ‘Protective Umbrellas’ Keeping US Stocks Afloat

Hartnett identified three factors shielding US equities from a deeper correction:

- The Federal Reserve – ready to cut rates if growth weakens.

- Donald Trump – politically motivated to keep markets strong heading into midterm elections.

- Generation Z investors – who, facing job automation and inflation pressures, continue to “chase risk assets like stocks and crypto” to maintain living standards.

He warned, however, that this setup could unravel quickly if US inflation rises back toward 4%, which would threaten expectations of global rate cuts in 2026 and potentially reverse the AI-driven rally.

$17 Trillion AI Rally and Its Fragile Foundation

Since bottoming out in April 2025, the latest wave of AI euphoria has added nearly $17 trillion in market capitalization to the S&P 500.

The milestone came the same week Nvidia crossed a $5 trillion valuation, cementing its place as the world’s most valuable company.

Recent earnings added fuel to the fire:

- Amazon and Google both surged after strong Q3 results.

- Meta fell on fears its $30 billion AI capital expenditure could squeeze margins.

Hartnett’s warning comes amid this split sentiment — where growth remains strong, but debt-funded AI expansion is raising structural concerns.

Gold and China: The Contrarian Trades of 2025

BofA’s report argues that gold and Chinese equities offer the best counterbalance to an overheated AI market.

Spot gold recently retreated from its record $4,381 per ounce, as easing geopolitical tensions triggered $7.5 billion in fund outflows — the largest weekly withdrawal on record.

Yet Hartnett sees that as an opportunity, noting that “gold remains a hedge against inflation being reignited by fiscal expansion and AI-related capex.”

Meanwhile, China’s MSCI Index is up 33% year-to-date, outperforming the S&P 500, thanks to optimism over China’s AI competitiveness and policy easing.

Hartnett reaffirmed China as “the correct bet of 2025,” noting its resilience compared to the high-flying but crowded US AI trade.

A Hidden Warning: AI Debt and Bond Risk

Beyond equities, Hartnett’s team cautioned about bond volatility linked to the surge in AI infrastructure spending.

He pointed out that hyperscaler firms are increasingly financing growth through record corporate bond issuance, citing Meta’s $30 billion offering this week.

“Investors should consider shorting bonds issued by hyperscalers maturing in 2026,” he wrote, arguing that spreads versus Treasuries “may already be at their narrowest levels on record.”

The AI rally may still have momentum — but even its biggest believers are calling for caution.

Bank of America’s Hartnett sees the next phase of the bull market shaped not by tech euphoria, but by hedging discipline.

Gold glitters again, and China re-emerges as a contrarian winner, while Wall Street debates whether the AI supercycle has entered its most euphoric — or most dangerous — stage.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.