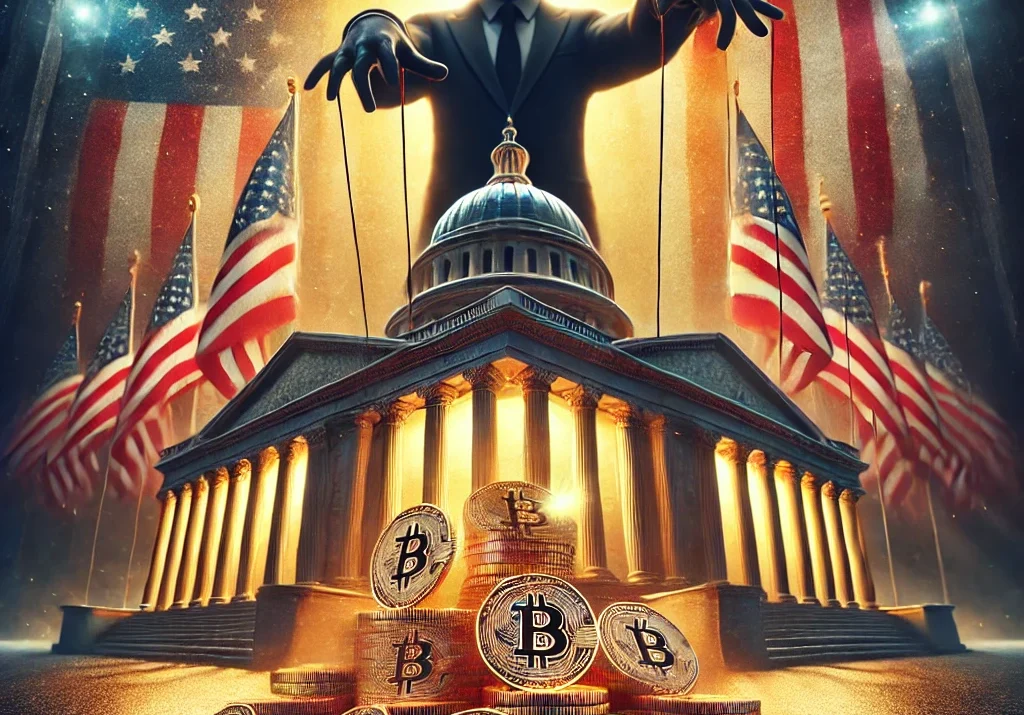

The idea of a U.S. government strategic Bitcoin reserve, as reportedly contemplated by President-elect Donald Trump, is a contentious proposition that raises significant questions about public purpose, fiscal responsibility, and the role of speculative assets in national strategy.

Key Points of Concern

- Lack of Practical Use or Economic Connection

Bitcoin lacks the intrinsic value or utility that commodities like oil or gold bring to strategic reserves. While oil ensures energy security and gold acts as a hedge against economic instability, Bitcoin serves no industrial purpose and has no fundamental ties to the broader economy. Its value hinges solely on speculative demand. - Speculation-Driven Inflation of Value

If the U.S. were to purchase significant amounts of Bitcoin, the market could experience a sharp rally fueled by anticipation and speculative trading. This would enrich current holders at the expense of taxpayers, with no guaranteed return for the public. The concept of the “greater fool” comes into play, as the government could overpay for an asset whose price depends on market sentiment rather than tangible value. - Cost and Inflation Risks

- Debt and Deficit: Funding a Bitcoin reserve would require borrowing or creating money, exacerbating the national debt or risking inflation.

- Volatility: Bitcoin’s historical price swings make it a risky store of value. Any significant decline could result in substantial losses for taxpayers.

- Institutional Risk and Moral Hazard

Government-backed Bitcoin reserves could legitimize the cryptocurrency in mainstream finance, encouraging banks and institutions to use it as collateral. This could lead to systemic risks, as a sudden drop in Bitcoin’s value might require government intervention or bailouts, reminiscent of the 2008 financial crisis. - Philosophical Contradictions

Bitcoin’s origins as a decentralized, anti-establishment currency clash with the concept of government hoarding it. This move would paradoxically shift Bitcoin into the very centralized framework it was designed to challenge.

Alternative Strategies

If the government wishes to explore Bitcoin-related policies, it could:

- Focus on regulation to ensure consumer protection, prevent market manipulation, and integrate Bitcoin into the broader financial system responsibly.

- Support blockchain innovation for its practical applications in transparency, supply chain management, and cybersecurity, rather than speculating on Bitcoin as an asset.

Creating a strategic Bitcoin reserve is fraught with risks and offers no clear benefits to taxpayers or the economy. It risks inflating Bitcoin’s price artificially, exposes the government to substantial losses, and potentially destabilizes the financial system. While crypto assets may play a role in the future financial ecosystem, they should not be underwritten by taxpayer funds in a speculative gamble.

If President-elect Trump proceeds with this idea, the government must carefully assess the implications and engage in transparent public discourse before taking any action.

This was published by Bloomberg Opinion.