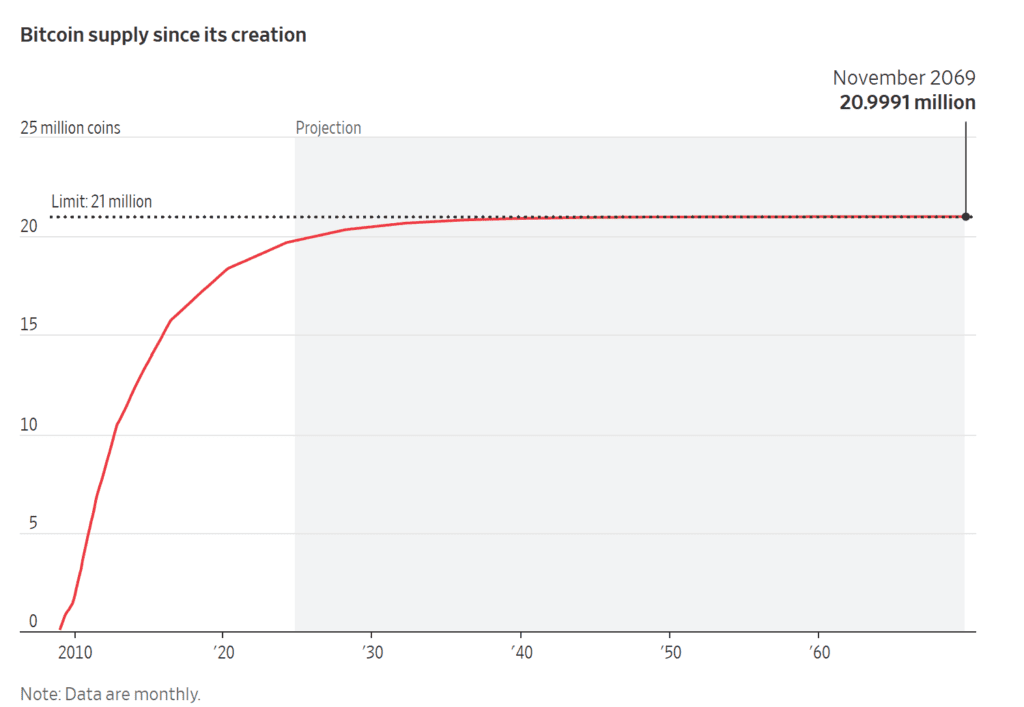

Bitcoin’s significant rally to recent highs underscores a fundamental aspect of the cryptocurrency: its supply is capped at 21 million. This fixed limit, embedded in Bitcoin’s original design, creates a scarcity that underpins its value and sets it apart from traditional fiat currencies, which can be printed at will.

Supply and Demand Dynamics

As of now, approximately 19.8 million bitcoins have already been mined, leaving fewer than 1.2 million yet to be created. This scarcity is further accentuated by the “halving” events that occur roughly every four years. In these events, the reward for mining new Bitcoin blocks is halved, slowing down the rate of new issuance. The most recent halving occurred in 2024, reducing block rewards to 3.125 BTC.

This design ensures that the rate of new Bitcoin entering circulation decreases over time, creating a deflationary environment. Investors see this fixed supply as a hedge against inflation, particularly during periods of economic uncertainty.

Investor Sentiment and Institutional Interest

The scarcity of Bitcoin has attracted institutional investors and corporations, driving demand even higher. Companies like MicroStrategy and other large funds have allocated significant portions of their portfolios to Bitcoin, citing its potential as a “store of value” akin to digital gold.

This trend has not only tightened the available supply further but also legitimized Bitcoin in the eyes of retail investors and traditional financial markets.

Challenges of a Fixed Supply

While Bitcoin’s capped supply is a strength, it also poses challenges. With mining rewards diminishing, miners will increasingly rely on transaction fees for income. This could lead to higher costs for using the network in the future.

Moreover, the scarcity combined with growing demand can lead to heightened price volatility. This volatility can deter some investors and limit Bitcoin’s utility as a medium of exchange.

Conclusion

Bitcoin’s capped supply is one of its defining features and a key driver of its value. As the world’s largest cryptocurrency continues its ascent, the dynamics of limited supply and growing demand will remain central to its story. However, the challenges of scarcity, including higher fees and potential volatility, are factors the market must navigate.

For further details, you can refer to the original article on the Wall Street Journal: Behind Bitcoin’s Rally Is a Simple Fact: Supplies Are Limited.

Related article: A Looming Threat to Bitcoin: The Risk of a Quantum Hack