Understand what matters, what to ignore, and what all these confusing terms actually mean in options flow.

First Things First: What Is Options Flow?

Options flow is the record of big trades being made in the options market — it’s like watching what the smart (or big) money is doing. These trades show when someone buys or sells a lot of options contracts at once.

Now, what’s an option?

🔹 An option is a contract that gives you the right (but not the obligation) to buy or sell a stock at a specific price (called the strike price) before a certain expiration date.

There are two types of options:

- Call option = You expect the stock price to go up

- Put option = You expect the stock price to go down

Each options contract controls 100 shares of the stock. So when someone trades 10,000 contracts, it’s a very large trade — they’re betting on 1 million shares.

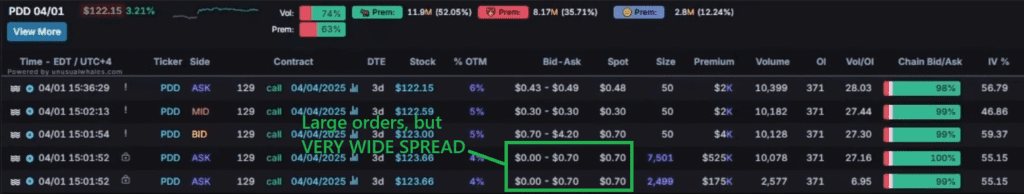

Example 1: Confusing Flow – PDD $129 Calls

- Stock: PDD Holdings ($PDD)

- Option: $129 call (means they expect PDD to go above $129)

- Expiration: April 4

- Trade size: 10,000 contracts

- Price paid per contract (premium): $0.70

- Total money spent: $700,000

- Fill type: Ask-side fill (they paid the full asking price)

- Bid/Ask spread: $0.00 (bid) / $0.70 (ask)

💡 Bid = highest price a buyer will pay

💡 Ask = lowest price a seller will accept

Why this is confusing: The bid was $0.00, meaning no one was trying to buy this contract at all — that’s a red flag. The trader jumped in and paid the full ask price, but with no real buyers lined up, it’s hard to know why they did it.

- Was it a hedge?

- Were they already short the stock?

- Was it even a bullish bet?

Key takeaway: If a trade doesn’t make sense, don’t force it. Just move on.

Example 2: Mixed Signals – DAR $40 Call Spread

- Stock: Darling Ingredients ($DAR)

- Trade: 10,000 contracts of $40 calls (buying the right to buy at $40)

- Fill: At $1.37 (near the ask side)

- But… it’s a multi-leg trade (more than one option was involved)

When we look deeper, we see the trade was paired with:

- $35 calls (5,000 contracts)

- Both trades were ask-side fills, meaning they were both likely being bought

💡 Normally in a spread, you buy one option and sell another to limit risk or cost.

So why are both legs being bought?

This is where things get confusing again:

- Could be a ratio spread (complex strategy)

- Could be two different traders

- But we can’t know for sure

Key takeaway: If you can’t tell what someone’s doing, don’t guess — just skip it.

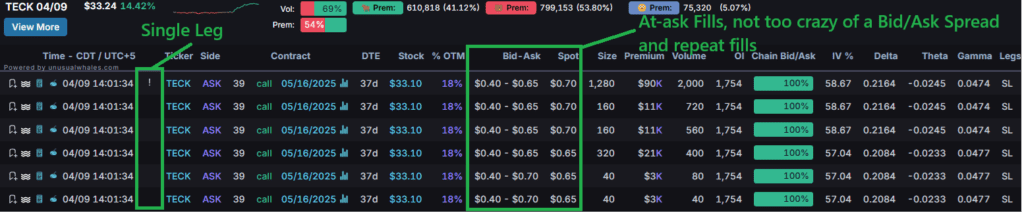

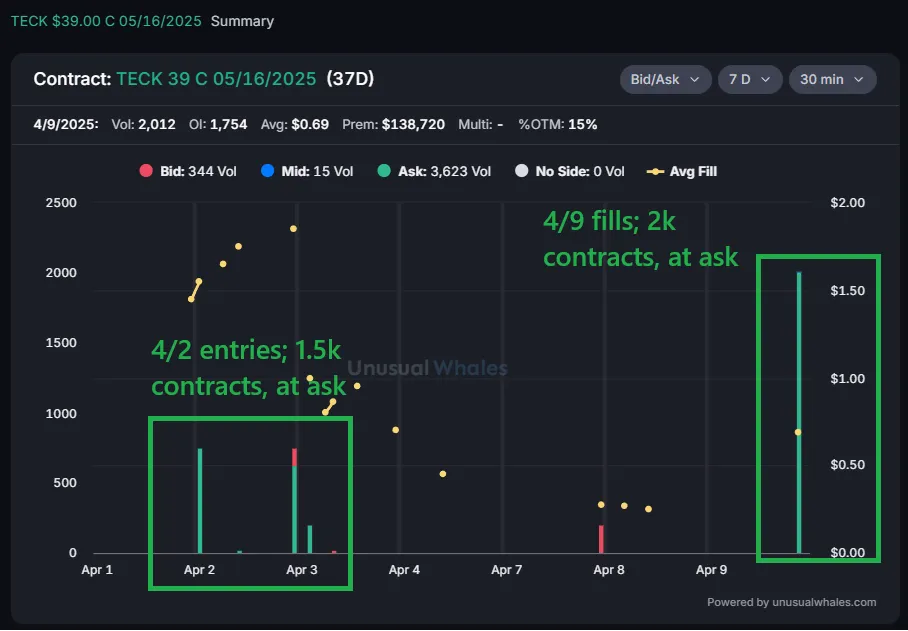

Example 3: Clean and Simple – TECK $39 Calls

- Stock: Teck Resources ($TECK)

- Option: $39 call

- Expiration: May 16

- Type: Single-leg trade (just one option)

- Repeated activity at the ask price

- Volume is high, and open interest suggests new positions

💡 Open interest = total number of existing contracts that haven’t been closed

If volume is higher than open interest, it likely means new trades

Also:

- This option was traded earlier on April 2

- Back then, the contract cost 3x more, but now it’s cheaper — likely a new entry

Key takeaway:

- Clean flow

- Single-leg trade

- Repeated ask-side fills

- Much more reliable signal than the last two

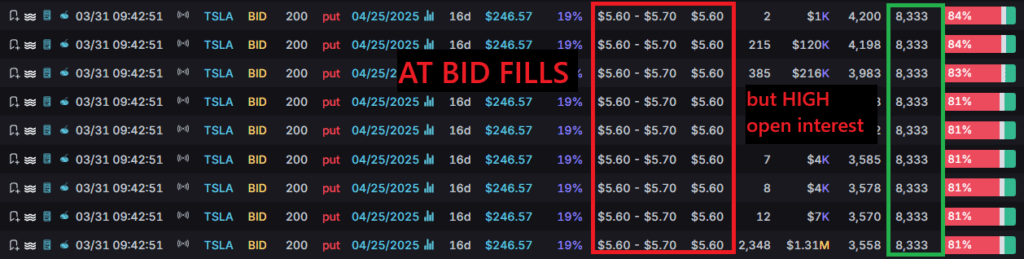

Example 4: Full Round-Trip – TSLA $200 Puts

- Stock: Tesla ($TSLA)

- Option: $200 puts (expecting stock to go down)

- Expiration: April 25

- March 30: Big bid-side action (means someone was selling puts, probably bullish)

- But the same amount of contracts were traded at the ask on March 27 — likely buying puts

And then what happened?

- Open interest dropped the next day — meaning someone closed their position

Chart data shows two equal-sized trades:

- One buy-to-open

- One sell-to-close

Key takeaway:

- Use volume + open interest to see if a trade is opening or closing

- This trade tells a full story: entry and exit

How to Think About Options Flow (Especially During Volatile Markets)

Options flow is a helpful tool — but only when you can understand what’s going on.

Here’s your simple checklist as a beginner:

- Stick with single-leg trades (one option, not a combo)

- Look for repeated trades at or near the ask price

- Check open interest — if volume is higher, it might be a new position

- Avoid trades with wide bid/ask spreads or zero bids — that’s a red flag

- If you’re confused, skip it. No shame in that.

And remember: just because a trade is big doesn’t mean it’s smart.

Main source: Unusual Whales

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Bear Market Survival Guide: How to Stay Smart, Calm, and Positioned for the Rebound

De-Dollarization: The Global Shift That Could Redefine the Future of Money

Dollar Role in Global Economy: Analyzing US dollar future’s reserve currency status

The Dot-com bubble burst: How irrational exuberance led to tech stock collapse

Energy Transition and Its Macro Impact

Collapse of Enron (2001) – How corporate fraud reshaped corporate governance