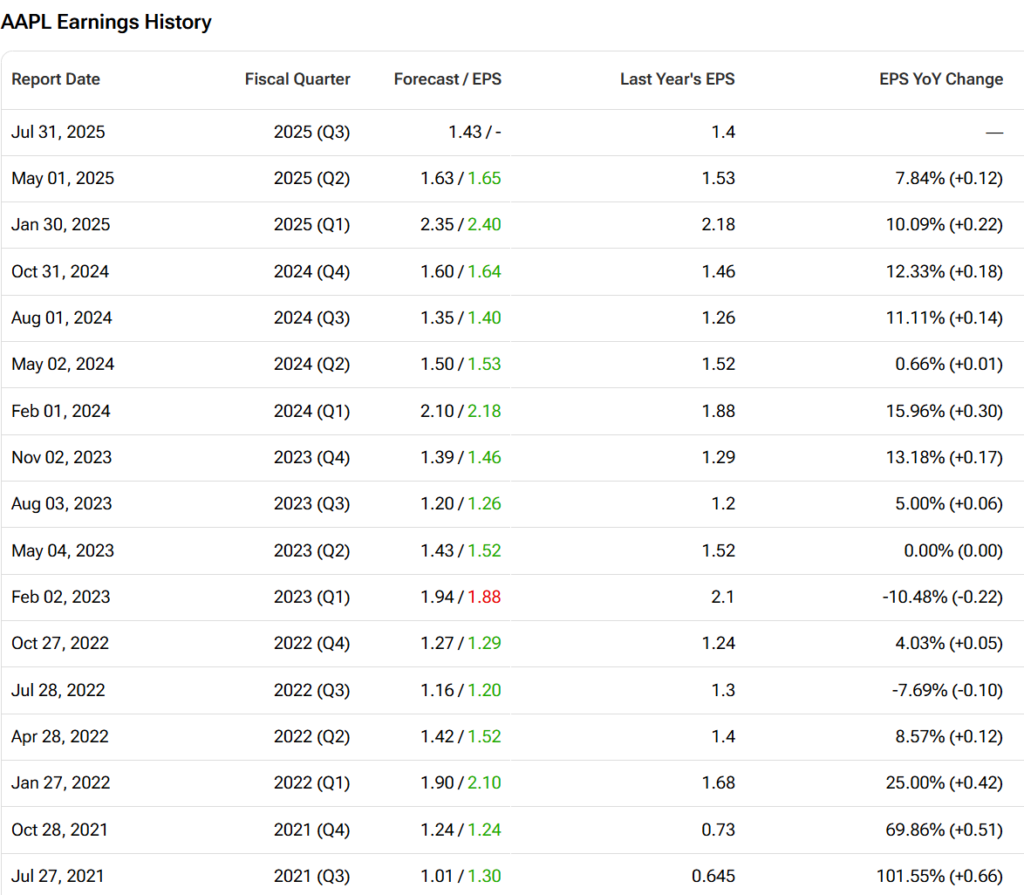

Apple walks into tonight’s print with a tight focus on three swing factors: (1) how tariffs and supply-chain shifts are flowing through gross margin, (2) whether iPhone demand (especially China) steadied enough to support the top line, and (3) the pace and clarity of Apple Intelligence (AI) roll-out and monetization. Expectations aren’t low, but they’re not heroic either—making guidance and margin color as important as the headline numbers.

Consensus Snapshot (what Wall Street is modeling)

- Revenue: ~$89.2–$89.5B (≈ +4% YoY)

- EPS (diluted): ~$1.43–$1.44

- Gross Margin: Street expects ~45.5%–46.5%, reflecting an estimated ~$900M tariff cost in the quarter

- iPhone revenue: ~$40.0–$40.5B (≈ +2% YoY)

- Services revenue: ~$26.8–$27.0B (≈ +11% YoY, high-70s margin)

- Mac/iPad/Wearables: mixed to down low-single digits YoY, with iPad the softest line item in many models

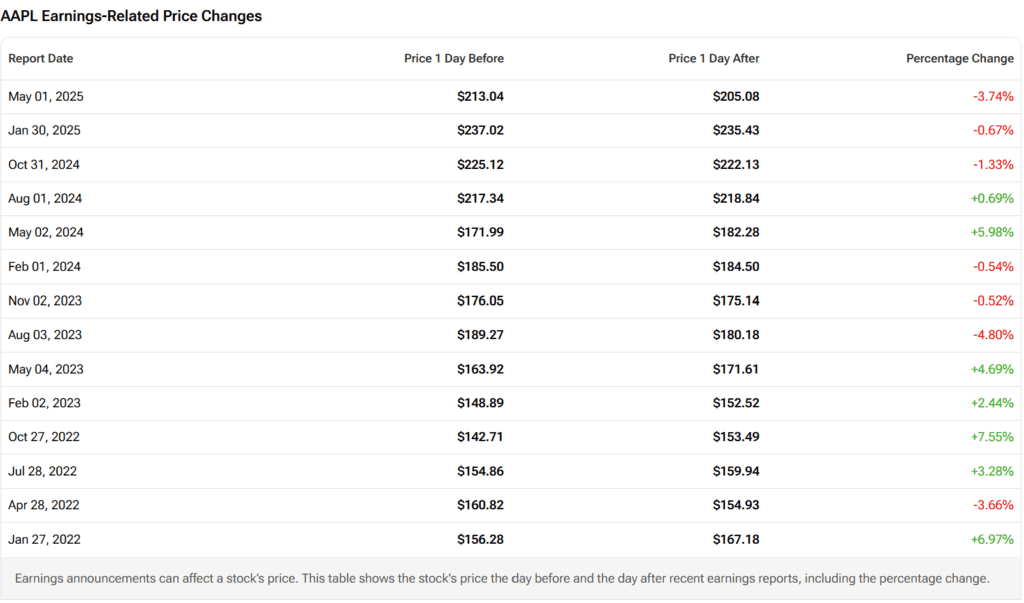

- Implied stock move: options pricing points to ~4% in either direction by the week-end

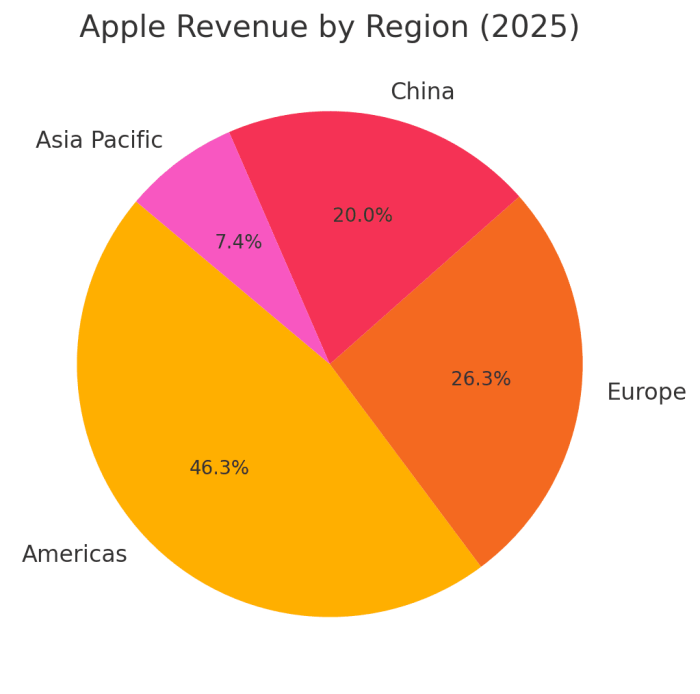

Why it matters: Services and iPhone still anchor the quarter; gross margin is the real swing line given tariff accounting, while AI cadence and China determine how investors handicap FY26.

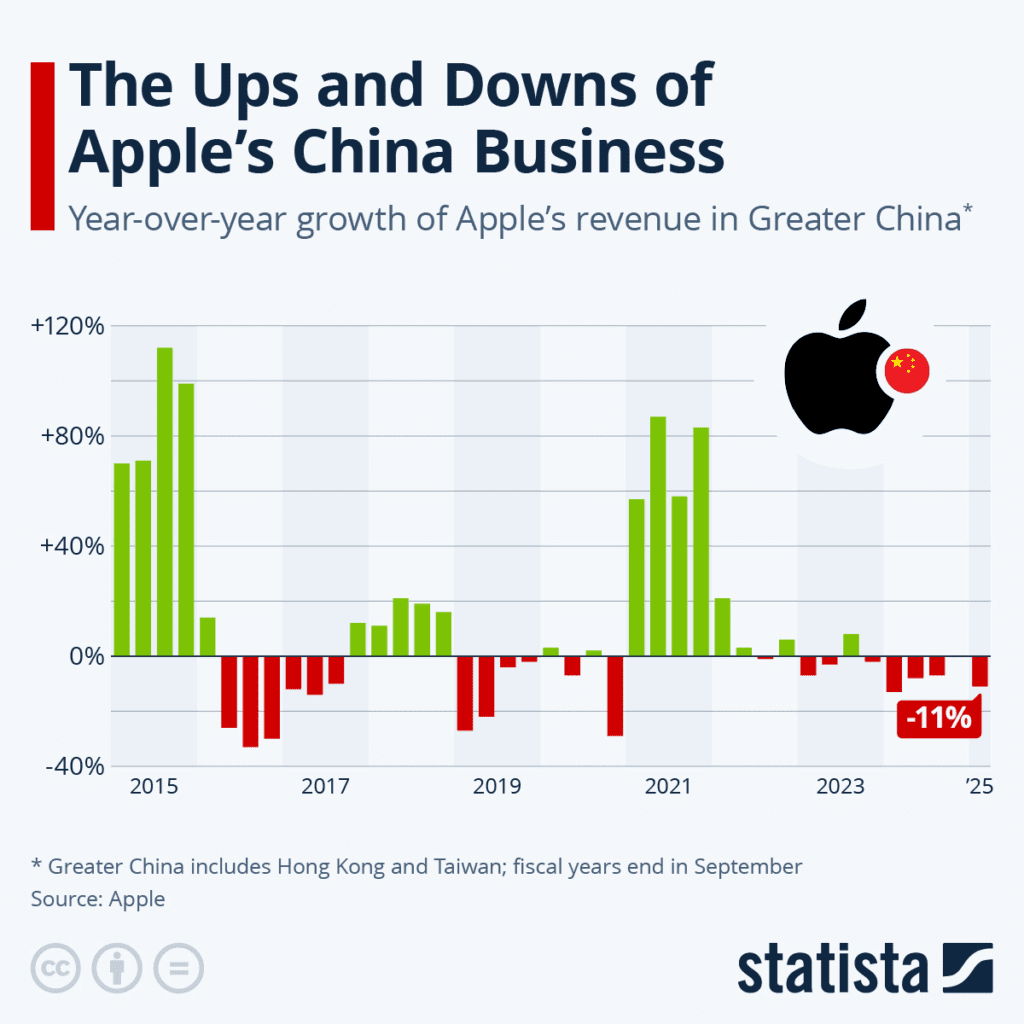

iPhone & China Check: Discounts helped, but durability is the question

Analysts expect ~+2% YoY iPhone growth in the June quarter, aided by China promotions (the 6/18 shopping festival, trade-in subsidies) and channel normalization. Counterpoint/LSEG trackers cited an 8% lift in China unit sales during the quarter, though foreign-brand share is still under pressure versus local leaders. The core debate is whether the uptick was promotion-driven (and thus margin-dilutive) or a sign that iPhone demand is stabilizing into the fall cycle. Tonight’s regional commentary and channel inventory color will be key.

Services: High-margin ballast vs. mounting regulatory overhangs

Services remains the structural profit engine (App Store, iCloud, Media, Payments, Advertising, and Google TAC). Consensus looks for ~$26.8–$27.0B (~+11% YoY), another record June-quarter print, with gross margin in the high-70s supporting the consolidated margin. The overhang: legal and regulatory risks to App Store fees and the Google search distribution deal—two of Services’ fattest profit streams. Any guidance on Services growth drivers (subs, ads, payments) and regulatory contingency planning will be price-relevant.

Gross Margin & Tariffs: The number everyone will model first

Street models a consolidated GM ~45.5%–46.5%, with management having telegraphed an ≈$900M tariff impact landing in Q3. Watch for: (a) how much of that was offset via pricing, mix, or cost saves; (b) any Q4 (Sept) margin framework as tariffs evolve; and (c) how India production (and supplier localization) is blunting longer-term tariff risk. Commentary tying tariff run-rate to FY26 margin targets will likely steer the stock more than a penny or two on EPS.

AI/“Apple Intelligence”: Cadence, China availability, and on-device economics

After WWDC, investors want more than sizzle: availability timelines, regional coverage (notably China), and hardware attach into the fall iPhone cycle. Near-term revenue may be modest, but the Street wants conviction that AI features can (1) drive upgrade intent, (2) raise device ASPs, and (3) eventually open services/ads optionality. Any update on partnerships, inference on-device vs. in-cloud, and developer traction would help counter the narrative that Apple is late to AI.

What Will Move the Stock on the Call

- Gross-margin bridge (Q3 actual → Q4 guide): how much tariff pain is transitory vs. embedded; levers to offset (mix, cost downs, India/ASEAN sourcing).

- China trajectory: sustainability of June-quarter lift vs. promo fade; iPhone channel inventories into September.

- Services runway: subs growth, ads contribution, Google TAC visibility, and regulatory contingency.

- AI cadence: concrete milestones for Apple Intelligence roll-out (features, geographies, device requirements) and whether management expects upgrade elasticity into the fall.

Bullish Setup (with facts the Street will look to confirm)

- Services up ~11% YoY with resilient margins, cushioning tariff headwinds and supporting consolidated GM ~45.5–46.5% despite $900M costs.

- iPhone +2% YoY and stabilizing China demand (618 festival + subsidies) suggest the base is firming into the fall launch, limiting downside to unit assumptions.

- AI features as upgrade catalyst: Even if monetization is back-loaded, clarity on the Apple Intelligence roll-out and device requirements can support ASP and mix assumptions for FY26.

- Options setup modest: With an implied ~4% move, a clean beat-and-reassure on margins and China could be enough for a positive reaction.

Bearish Watch-outs (and why they matter)

- Tariffs heavier-for-longer: If the $900M drag proves sticky and the GM framework for Sept is softer, FY26 margin estimates likely get trimmed.

- China elasticity: If promotions were the only support for June and demand softens, the Street may cut fall unit/mix—pressuring revenue and GM.

- Regulatory torque on Services: Adverse movement on App Store economics or search distribution would dent the most profitable segment—worth monitoring into FY26 modeling.

- AI cadence/availability gaps: Limited near-term availability (especially in China) or vague milestones risks reinforcing the “late to AI” narrative.

Scenario Map (how the tape could trade)

- Bullish: Revenue ≥$90B, EPS ≥$1.45, GM ≥46.0%; confident Q4 GM guide, steady China commentary; tangible AI milestones.

- Base/Neutral: Revenue ~$89.2–$89.5B, EPS ~$1.43–$1.44, GM ~45.5–46.0%; pragmatic Q4 guide; China “stable”; AI details incremental.

- Bearish: Revenue ≤$88.7B, GM ≤45.0% or cautious Q4 margin guide; China re-softens; AI timelines stay hazy.

For tonight, margin math and forward tone matter as much as the print: if Apple shows it can absorb tariff friction while keeping Services compounding and China steady, the path to a constructive FY26 (with AI-assisted upgrades) remains intact. If, instead, tariffs weigh on the Sept-quarter GM and China traction looks promotion-dependent, investors may fade any inline quarter. Either way, Apple Intelligence milestones—not just marketing—will increasingly anchor the multiple as we head into the fall launch.

Sources: Yahoo Finance; MarketWatch; Investopedia; Reuters / BNN Bloomberg; Business Insider; Barron’s (Live Blog); Visible Alpha / 9to5Mac summary; Nasdaq / Zacks; AppleInsider; MarketPulse (OANDA); Tech in Asia.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years