AMD heads into tonight’s print with three levers that will likely set the tape: (1) data-center momentum across MI300/MI350 accelerators and EPYC CPUs, (2) the gross-margin bridge given an export-control inventory charge, and (3) the 2H outlook, including China licensing clarity and integration signals from the ZT Systems deal. As with other AI winners, the quality of guidance may matter more than a small headline beat.

Consensus snapshot (what Wall Street is modeling)

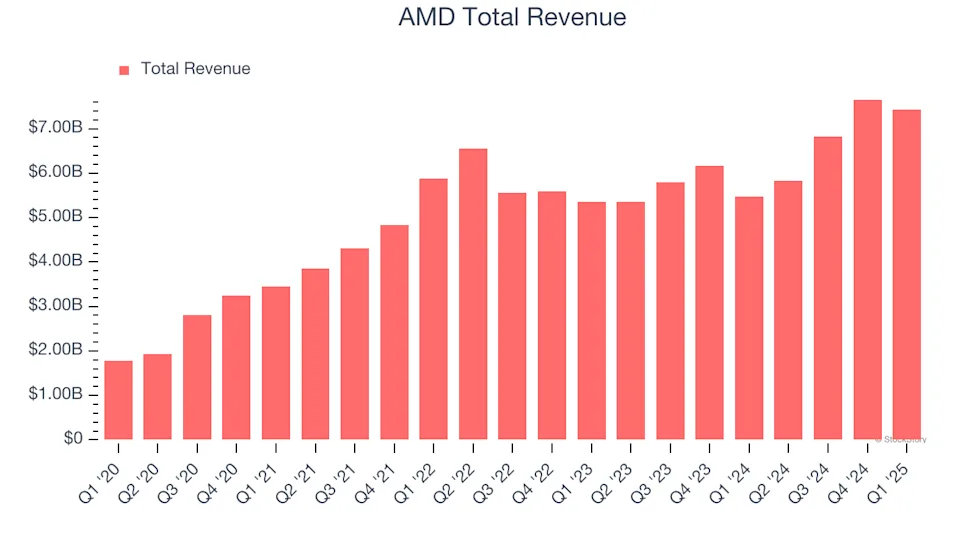

- Revenue: ~$7.41–$7.43B (≈ +27% YoY)

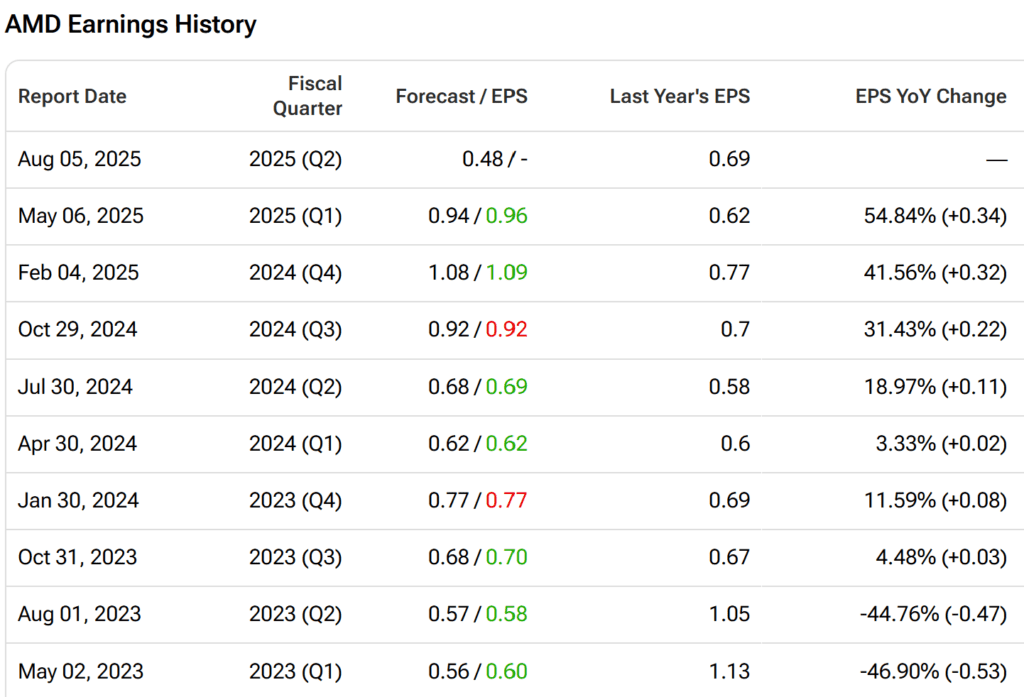

- EPS (non-GAAP): ~$0.48

- Segment checks (Street modeling):

- Data Center: ~$3.3B (≈ +17% YoY)

- Client: ~$2.3–$2.5B

- Gaming: ~$0.75B (≈ +16% YoY)

- Embedded: ~$0.82B (≈ –5% YoY)

- Company’s prior guide (from Q1): revenue $7.4B ± $300M; non-GAAP GM ~43% including an ~$800M export-control inventory/reserves charge; ~54% GM excluding the charge.

Why it matters: Accelerators and EPYC are driving growth, but the inventory charge and export limits pull gross margin lower this quarter. Investors will “look through” it only if the 2H trajectory and AI pipeline stay firm.

What to watch (and why it moves the stock)

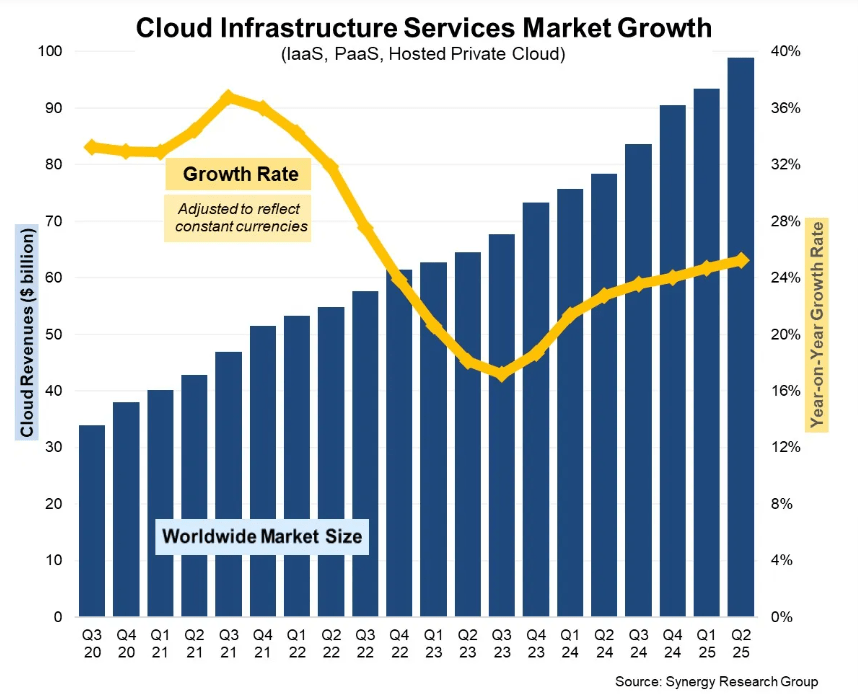

1) Data-center momentum: MI300/MI350 + EPYC

The bull script needs sequential GPU revenue growth and continued EPYC share gains. Listen for updates on MI350 supply, packaging (CoWoS) availability, and roadmap cadence (e.g., MI400/Helios) to anchor 2026 expectations. Bookings/backlog detail and cloud vs. enterprise mix will guide durability.

2) Gross-margin bridge and China export headwinds

Management already telegraphed ~43% non-GAAP GM with an ~$800M charge tied to export controls (~54% ex-charge). Street focus: how much is one-time, whether licensing approvals for MI308-class parts to China are progressing, and how much headwind remains in 2H.

3) Client/PC “AI PC” lift and pricing

High-end Ryzen mix and early AI-PC adoption could lift ASPs and support the margin story. A clean beat in Client would de-risk H2; if growth is promotion-heavy, margin read-through weakens.

4) ZT Systems acquisition and rack-scale strategy

Any early revenue synergy or pipeline color from ZT Systems (rack-scale AI servers) will shape expectations for vertical integration vs. pure silicon, with implications for both growth and margins.

5) Guide: Q3 revenue/GM and full-year frame

With options markets pricing a ~7–9% post-earnings swing, the Q3 revenue and GM guide will likely drive the first move. A path back toward mid-50s GM (ex one-timers) and an accelerating data-center cadence could outweigh near-term export drags.

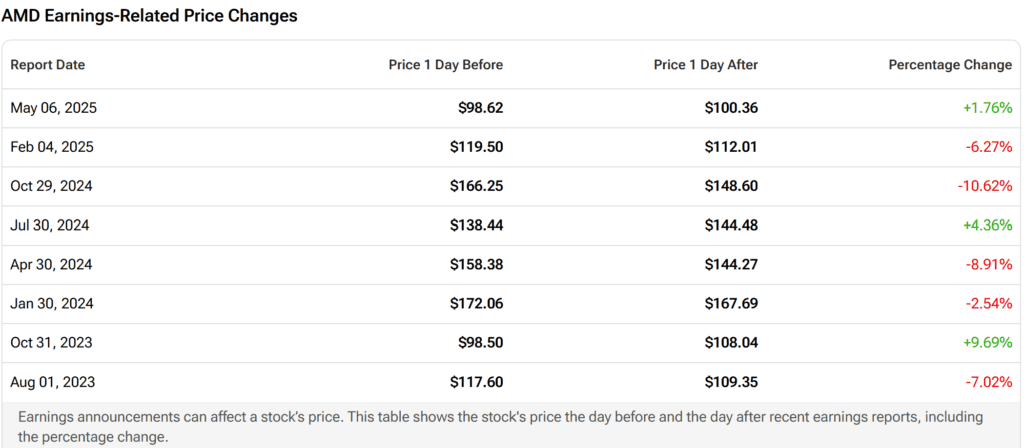

Trading setup (implied move & recent tone)

Options imply a ~7–9% move by week-end. Recent 1-day reactions have been mixed (roughly –10.6%, –6.3%, +1.8%, +4.4% over the last four reports). Sentiment is constructive but valuation-sensitive after a sharp YTD rally; the bar is elevated.

Bullish case — facts investors will try to confirm

- Data center outperforms Street: Segment ≥ $3.4B with firm accelerator shipments and healthy EPYC CPU growth; constructive notes on MI350 supply and the forward roadmap.

- GM recovery path is credible: Management underscores the one-time nature of the ~$800M charge, reiterates ex-charge GM ~54%, and guides H2 GM up as mix tilts to accelerators and packaging tightness eases.

- China licensing visibility improves: Signs that export approvals for constrained SKUs are progressing support a stronger 2H revenue arc.

- Client beats on AI-PC strength: Higher ASPs from premium Ryzen parts add incremental operating-income leverage.

- Rack-scale optionality: Early ZT Systems synergy/pipeline broadens TAM beyond chips, supporting longer-term growth math.

Bearish risks — where the narrative could wobble

- Data center shy of hopes: Segment nearer $3.2–$3.3B or cautious supply commentary raises questions about H2 ramps relative to competitors.

- Margins remain heavy: If the Q3 GM guide stays closer to low-40s or lacks a clear step-up, near-term profit expectations may fade.

- China drag persists: Limited licensing clarity keeps the full-year revenue headwind in focus.

- Client/Gaming softness: If ASP/mix gains ease or demand normalizes post pull-ins, consolidated growth leans even more on accelerators, raising execution risk.

Scenario map (how the tape could trade)

- Bullish: Revenue ≥ $7.5B, EPS ≥ $0.50, Data Center ≥ $3.4B; Q3 guide above Street with a clear gross-margin step-up; constructive China/licensing color → positive re-rate.

- Base/Neutral: Revenue ~$7.41–$7.43B, EPS ~$0.48, Data Center ~$3.3B; Q3 guide roughly in line; GM recovery framed for 2H → range-bound to modest move.

- Bearish: Revenue ≤ $7.3B or Data Center ≤ $3.2B; Q3 GM guide soft; limited China visibility → downside skew given elevated setup.

Final takeaway

Three levers will likely dictate tonight’s reaction: (1) data-center growth vs. Street, (2) the gross-margin bridge (charge vs. ex-charge) and the Q3 trajectory, and (3) tangible progress on China export licensing and rack-scale execution after ZT Systems. If AMD shows accelerating AI demand, a credible GM rebound path, and firmer 2H visibility, the growth story remains intact despite valuation sensitivity; if not, the options market’s ~7–9% expected move could skew lower.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years