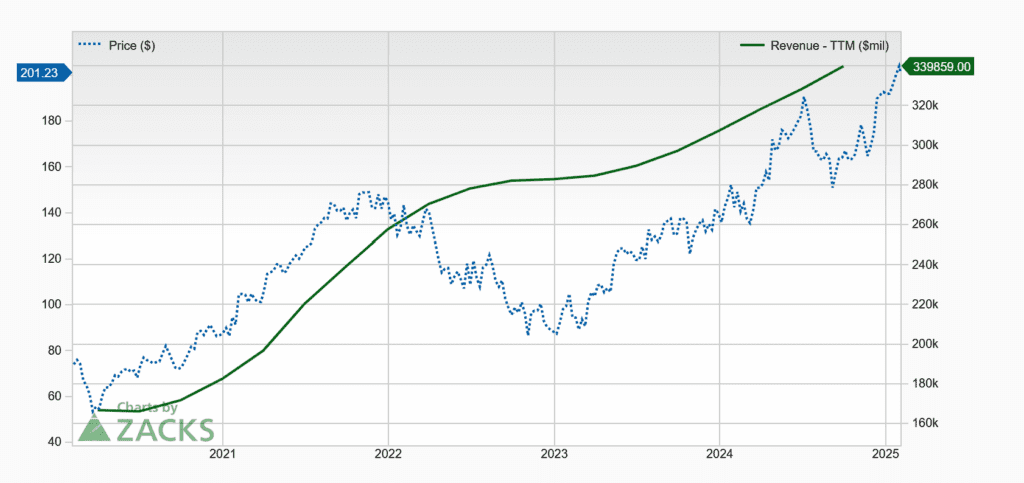

Alphabet Inc. (NASDAQ: GOOGL) is set to report its Q4 2024 earnings on Tuesday, February 4, 2025. The tech giant has delivered seven consecutive quarters of revenue and earnings beats, and investors are eager to see if Alphabet can continue its winning streak.

📈 Key Predictions on Alphabet’s Q4 Performance

Revenue & EPS Growth Expected

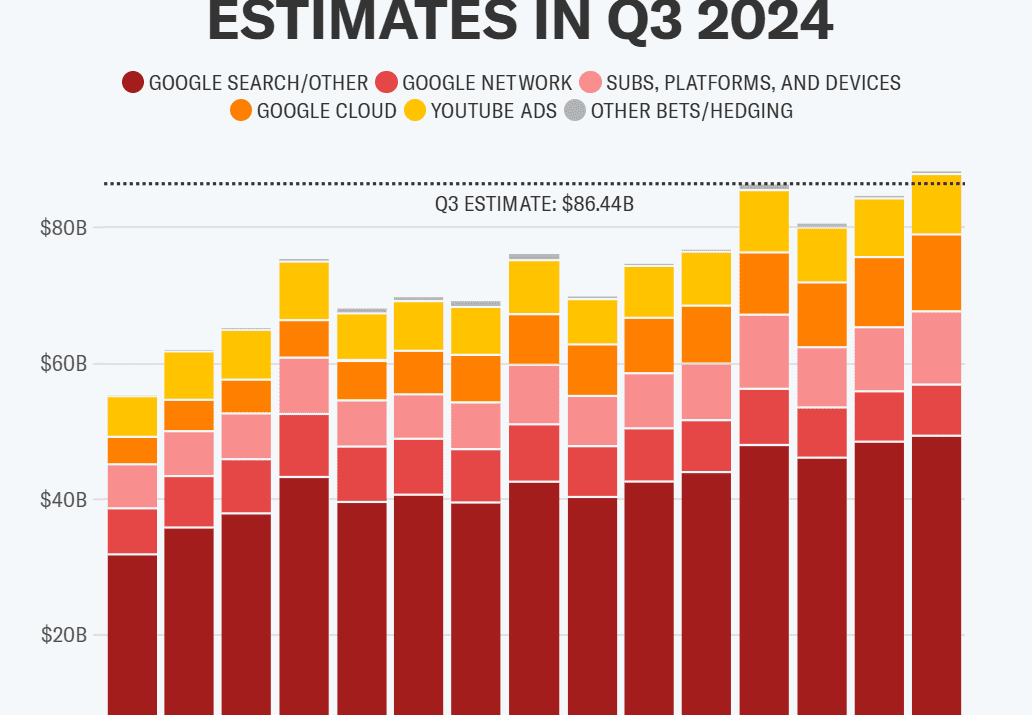

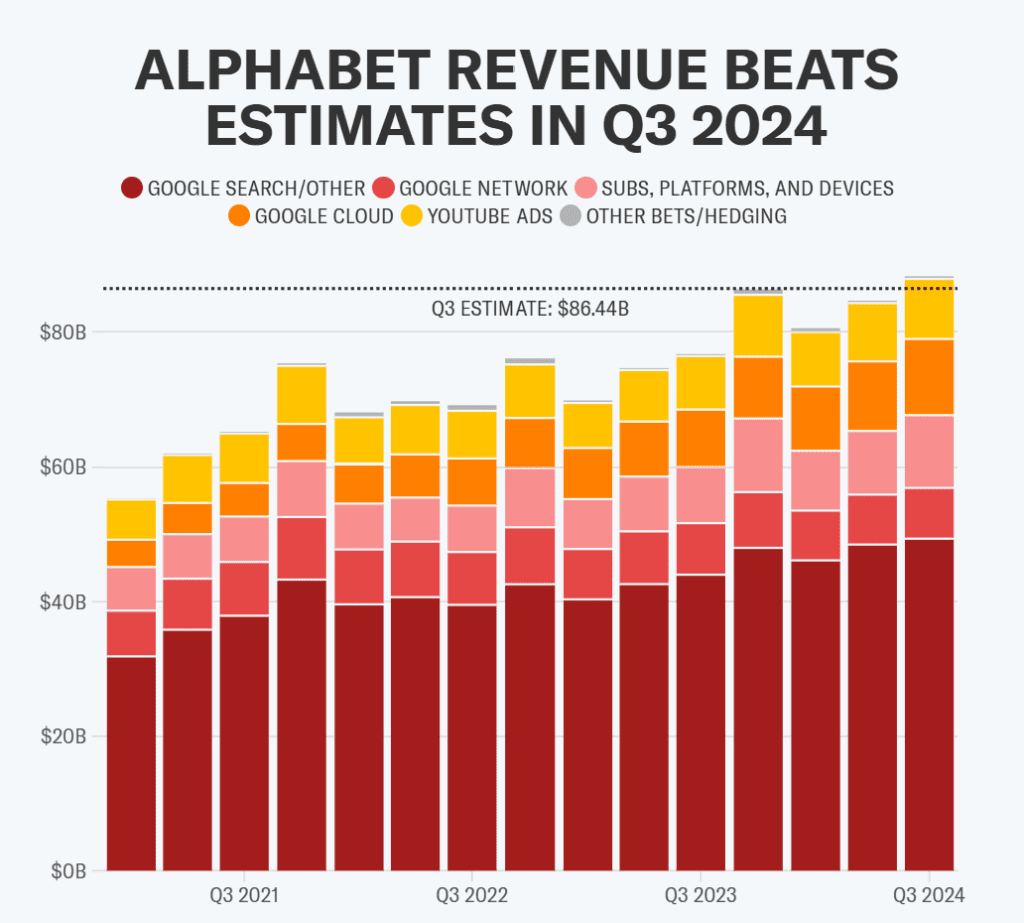

🔹 Revenue Projection: Analysts estimate Q4 revenue of $96.7 billion, reflecting a 12% year-over-year (YoY) increase.

🔹 Earnings Per Share (EPS): The consensus estimate is an EPS of $2.12, up 29% YoY, fueled by advertising recovery and AI expansion.

🔹 AI-Powered Growth: Alphabet’s AI initiatives, particularly Gemini AI, and its cloud business growth are expected to be major contributors to revenue expansion.

🚀 Bullish Outlook: Continued Strength Across Key Segments

🔹 Google Cloud Growth: Google Cloud revenue is projected to grow 32% YoY to $12.1 billion, benefiting from rising AI adoption and enterprise spending.

🔹 YouTube Revenue Recovery: YouTube ad revenue is expected to rise 11% to $10.24 billion, driven by strong engagement and ad spending.

🔹 AI Investments Paying Off: Alphabet’s Gemini AI model is expanding its footprint, helping integrate AI into search, ads, and cloud services.

⚠️ Bearish Concerns: Regulatory & Cost Pressures

🔹 DOJ Antitrust Case: The ongoing U.S. Department of Justice lawsuit against Alphabet’s search dominance poses potential legal and regulatory risks.

🔹 AI and Cloud Spending: While AI expansion drives growth, heavy capital expenditures (CAPEX) on AI and cloud infrastructure could impact profit margins.

🔹 Slowing Ad Growth: Despite the recovery, Google’s core ad business faces increasing competition from Amazon, TikTok, and Meta in the digital advertising space.

🔎 Conclusion: What to Watch for in Alphabet’s Earnings Report

Alphabet is expected to report solid revenue and earnings growth, but key areas to watch include:

✔️ Cloud & AI Growth: Google Cloud and Gemini AI’s impact on future profitability.

✔️ Advertising Rebound: The strength of YouTube and Search ad revenue post-pandemic.

✔️ Regulatory & Cost Control: Updates on the DOJ case and AI investment strategy.

If Alphabet delivers above-expectation earnings and provides strong AI and cloud guidance, it could drive further stock upside. However, regulatory headwinds and rising expenses remain concerns.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Earnings Calendar for This Week For Biotechs, Pharma And Econ, Plus Amazon And Alphabet

Has a new era begun? Investors have never been so optimistic…

Does Billionaire Warren Buffett Know Something Wall Street Doesn’t?

🔗 Sources:

📌 Alphabet Q4 Earnings: AI, Gemini, and Google’s Next Moves

📌 Alphabet Q4 Earnings Preview: AI, YouTube, DOJ Case Key Items to Watch

📌 Will Google Cloud’s Robust Performance Aid Alphabet’s Q4 Earnings?

📌 Alphabet to Report Q4 Earnings as Investors Look to Cloud Growth, AI Spending

📌 Alphabet (GOOGL) Q4 Earnings Preview

📌 Alphabet Likely to Gain Big in Near Future Following Q4 Earnings

📌 Alphabet’s Q4 Earnings: Bullish Trend Just Getting Started

📌 Alphabet Is About to Report Q4 Earnings: Here’s What to Expect

📌 Alphabet Likely to Gain Big in Near Future Following Q4 Earnings