Alphabet Inc. (GOOGL) is set to report Q3 2025 earnings after the bell today, and investors are watching closely to see whether Google can continue its steady rebound across Search and YouTube, offsetting high AI investment and growing competitive pressure in the Cloud space.

Wall Street expectations are cautiously optimistic: Google has benefited from a healthy recovery in digital advertising and user engagement, but faces high stakes from its multi-billion-dollar AI strategy and intensifying rivalry with Microsoft, Amazon, and Meta.

Here’s what to expect from today’s report, including forecasts, analyst sentiment, strategic updates, and potential surprises.

Street Consensus

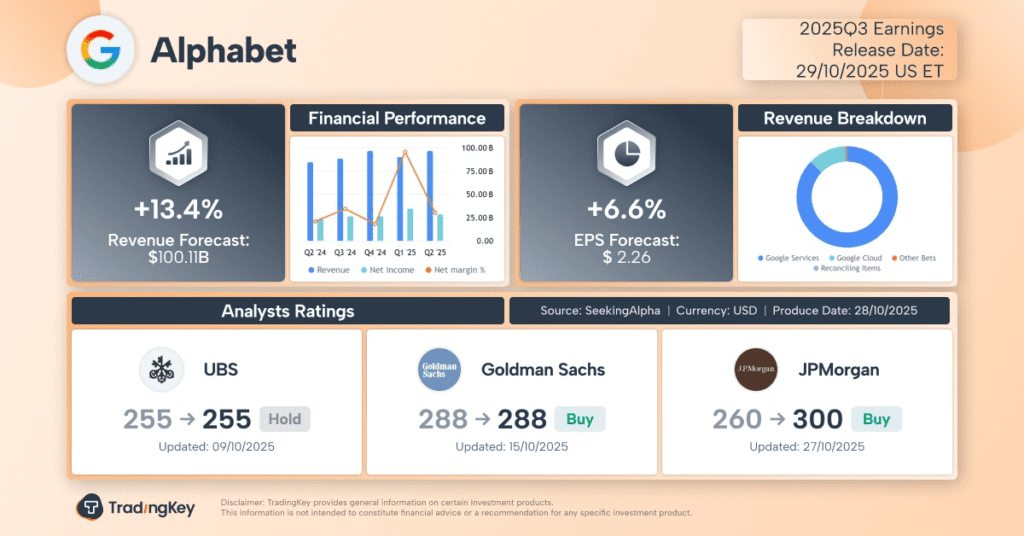

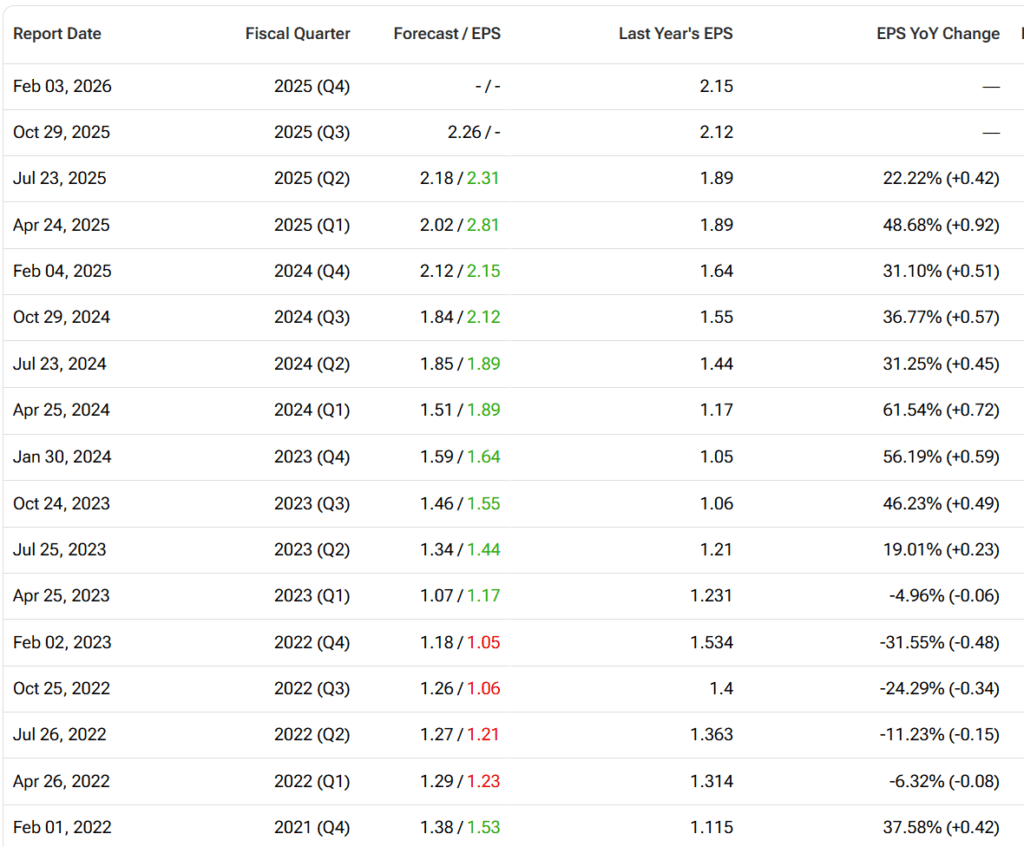

| Metric | Consensus Estimate | YoY Growth |

|---|---|---|

| Revenue | $94 -100 billion | +11.2% |

| EPS (Diluted) | $2.26–$2.27 | +8–10% |

| Google Cloud Revenue | $12.5–$14.66 billion | +26–29% |

| YouTube Ads Revenue | $9.6–$9.8 billion | +17–18% |

| Operating Margin | ~29.5% | Flat YoY |

Analysts expect solid top-line growth driven by strength in Search and YouTube ads, while Google Cloud’s profitability will be under the microscope after it posted back-to-back operating profits earlier this year. EPS growth remains moderate as Alphabet absorbs the cost of its ambitious AI investments.

Google Search: Steady Growth with Generative AI Tailwinds

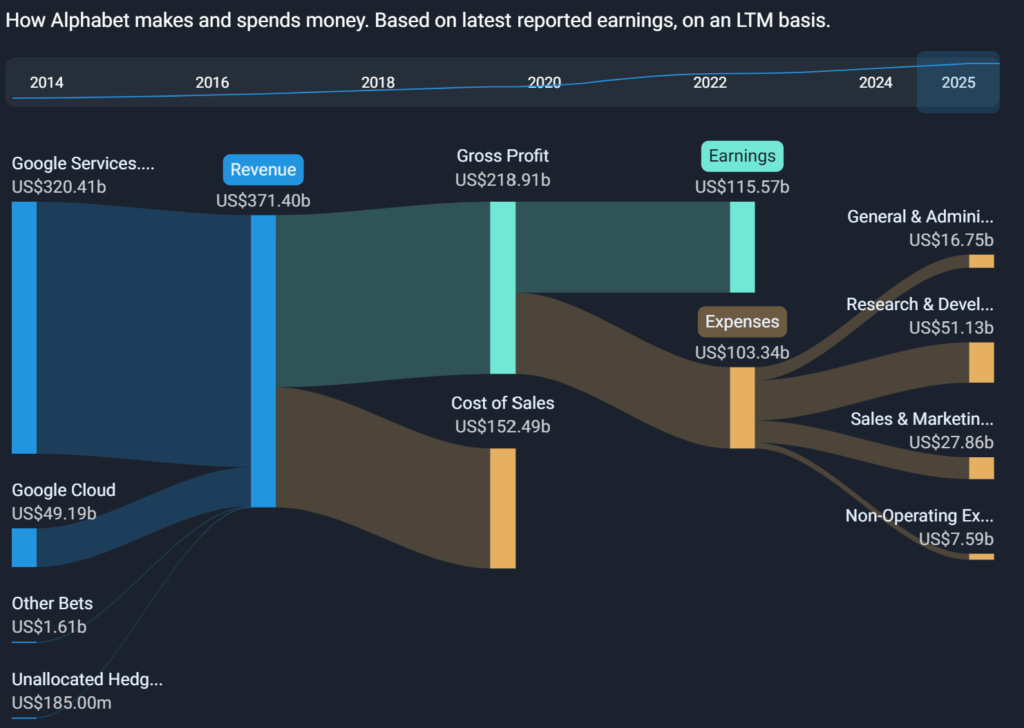

Search remains Alphabet’s crown jewel — still contributing nearly 60% of total revenue. Analysts expect high-single-digit growth in core Search revenue, boosted by robust travel, retail, and services demand.

Crucially, Alphabet continues to experiment with its Search Generative Experience (SGE), integrating large language models into traditional search results. Executives claim early SGE testing has improved user engagement without significantly cannibalizing ad clicks.

Prediction: Google Search outperforms slightly, with AI enhancements boosting query depth and CPCs.

YouTube: Shorts Monetization Progress and Creator Tensions

YouTube has regained momentum in 2025, particularly with YouTube Shorts, which now delivers 70+ billion daily views. Shorts monetization is improving, but the format still lags traditional video in revenue per minute.

Ad revenue is expected to grow ~18% YoY, driven by better direct response performance and growth in commerce-related campaigns. However, some media analysts warn of rising tension with creators due to lower payouts and algorithm changes.

Prediction: YouTube revenue slightly exceeds expectations (~$9.8B), but commentary may highlight creator monetization concerns.

Google Cloud: Profitability vs. Pressure

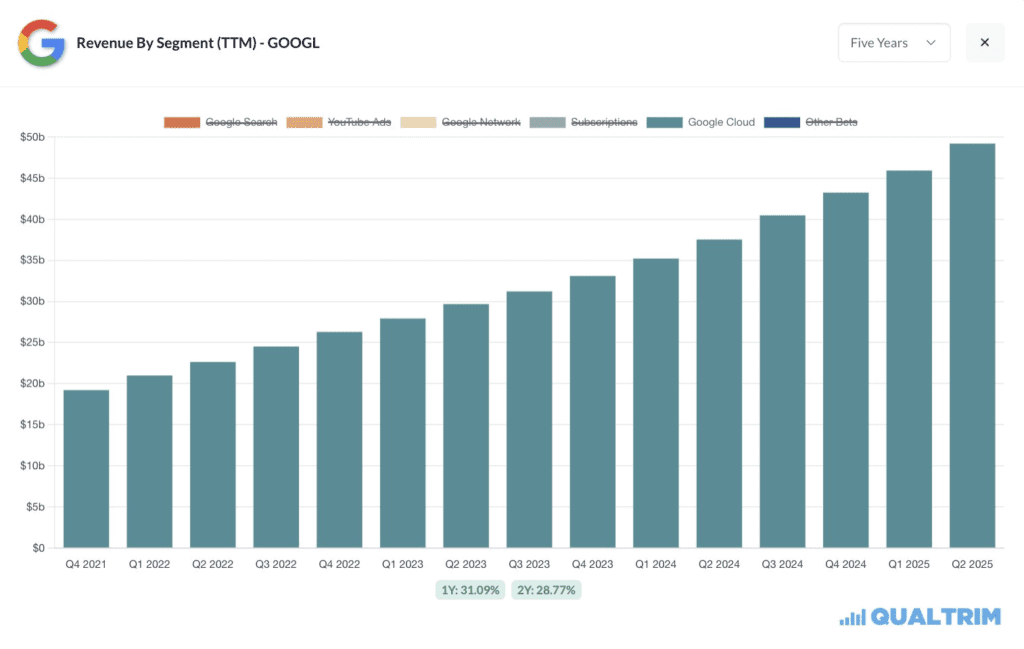

Cloud is Alphabet’s fastest-growing division, projected to grow nearly 30% YoY. It turned profitable in early 2025, but faces fierce price and innovation competition from Microsoft Azure and AWS.

Analysts expect Q3 Cloud revenue near $12.6B, with a ~5% operating margin. However, AI infrastructure costs (especially custom TPU deployments and enterprise Gemini models) are pressuring margins.

Prediction: Cloud beats revenue expectations but shows flat margins, raising near-term ROI concerns.

AI Investment: Gemini, Bard, and the Monetization Puzzle

Alphabet has committed billions to its AI ecosystem — spanning Gemini models, Bard chatbot, and AI features in Workspace, Search, and Android.

Despite heavy investment, monetization remains nascent. Gemini Pro and Ultra models power enterprise tools and cloud APIs, but user traction and pricing strategy are still evolving. Bard usage is growing, but consumer monetization (via ads or subscriptions) is unclear.

Prediction: Executives reaffirm long-term AI potential but avoid giving short-term monetization targets, keeping investors in “wait and see” mode.

Capital Spending and Other Bets

Capex is expected to reach $39–42 billion for 2025, largely focused on AI data center expansion and chip R&D (TPU v6). That’s up sharply from $32B in 2024.

Meanwhile, Other Bets (like Waymo and Verily) remain deeply in the red. Waymo is expanding robotaxi pilots in LA and Austin but faces regulatory hurdles. These moonshots are expected to post ~$400M in revenue and over $1.6B in losses.

Prediction: Capex guidance holds steady, with limited new details on Other Bets.

Competitive Pressure: Microsoft, Meta, Amazon Close In

Alphabet faces intense AI and cloud pressure from Microsoft (Copilot, Azure OpenAI), Meta (Llama, Advantage+ ads), and Amazon (Anthropic stake, AWS AI suite).

In Q3, Microsoft grabbed headlines with strong Azure AI growth and widespread Copilot adoption in enterprise. Alphabet will need to show that Gemini and Bard can keep pace, especially in enterprise productivity.

Prediction: Google executives defend product differentiation but remain vague on enterprise AI revenues, possibly disappointing some bulls.

Regulatory Clouds: EU DMA, DOJ Trial, and Political Risk

Alphabet’s legal exposure is growing. The U.S. DOJ antitrust trial on Search is ongoing, and early testimonies have revealed aggressive default payment strategies (e.g., to Apple). A ruling isn’t expected until 2026, but investors fear remedies could dent Search margins.

In Europe, the Digital Markets Act (DMA) enforcement is creating headaches. Google may soon be forced to adjust self-preferencing and ad data sharing, which could impact ad yield.

Prediction: No major updates, but risks remain flagged as “material” in commentary.

Investor Sentiment and Stock Setup

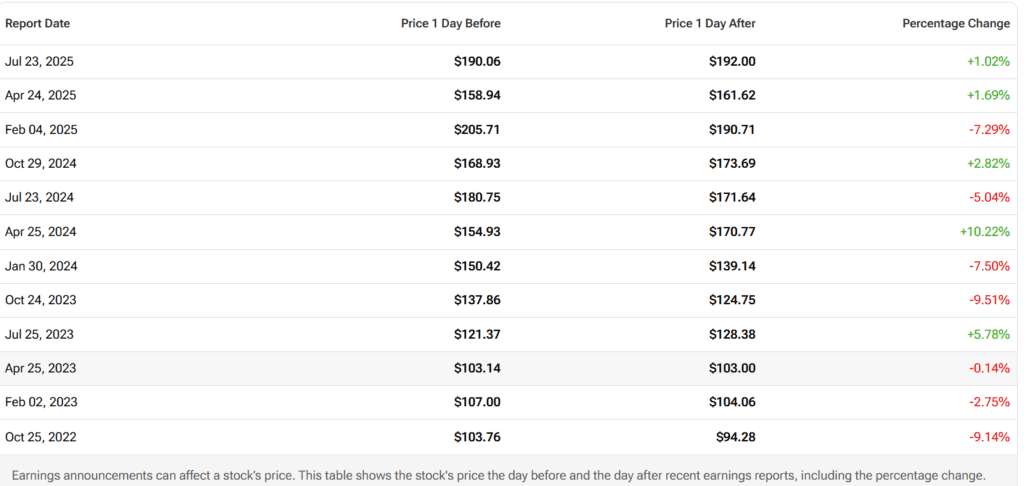

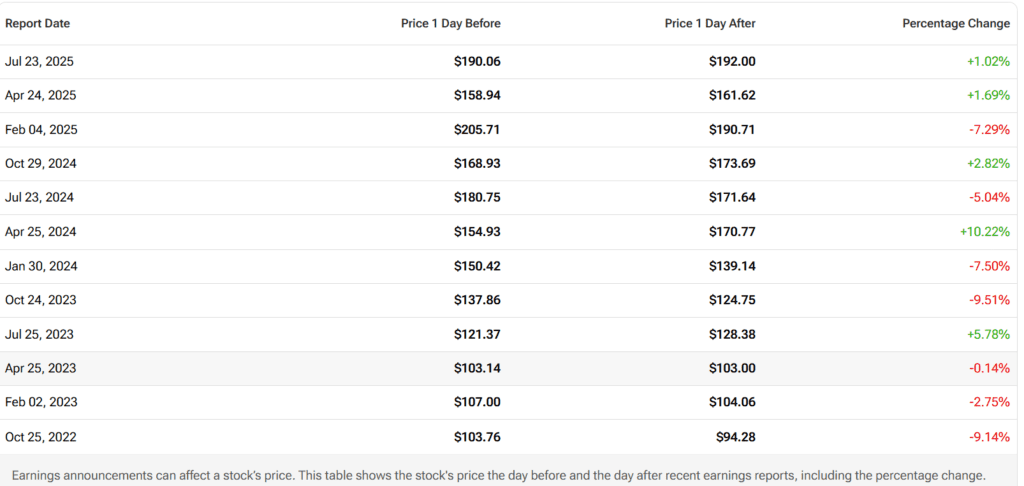

Alphabet stock is up ~23% YTD, underperforming Meta (+35%) and Nvidia (+44%), but outperforming Amazon and Apple. Options markets imply a ~6.2% post-earnings move, indicating moderate expectations.

Analyst ratings remain bullish overall: 42 buys, 5 holds, 0 sells (per FactSet). However, several firms warn that AI monetization must show tangible progress soon or investors may rotate elsewhere.

Recent commentary: Bernstein analysts wrote, “Investors want to see Gemini move beyond demos.” Meanwhile, Citi expects a slight top-line beat but warns of margin headwinds.

Solid Growth, but AI Needs Payoff Soon

Alphabet’s Q3 report is shaping up to be a solid-but-not-spectacular quarter, driven by resilient Search and improving YouTube. Google Cloud will be a focal point — any wobble in revenue or profitability could weigh on the stock.

The biggest question for long-term investors: When does Alphabet start seeing real revenue from AI? So far, the answer remains elusive.

Prediction: Google beats on revenue, meets or slightly misses on EPS due to margin pressure, reaffirms AI strategy, but offers few near-term monetisation specifics. The stock may rise modestly unless Cloud or capex commentary spooks investors.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.

Related: Meta Q3 2025 Earnings Preview and Prediction: What to Expect