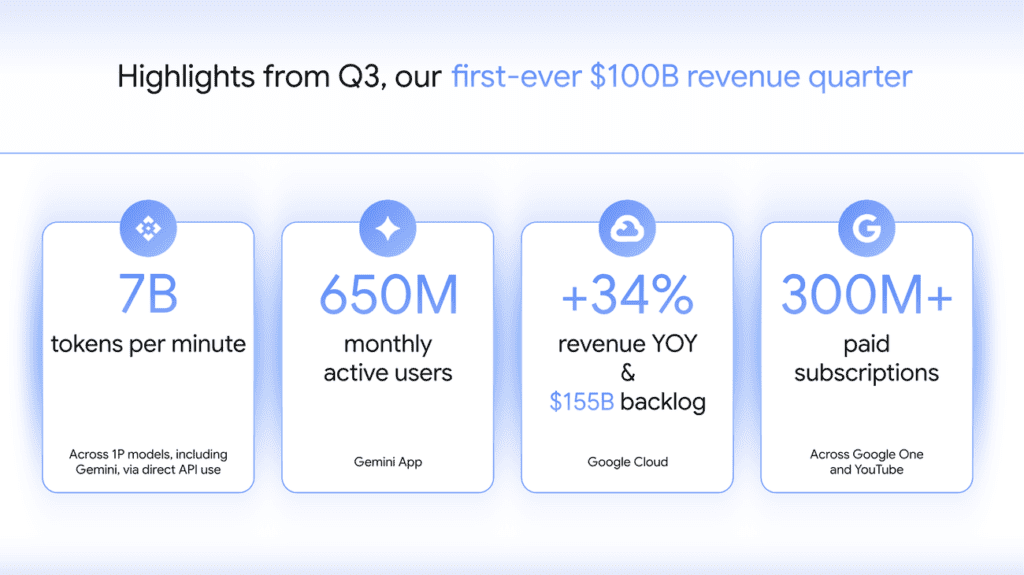

Alphabet shattered expectations in Q3 2025, crossing the $100 billion revenue mark for the first time in its history.

Finblog’s pre-earnings research had outlined consensus forecasts for steady Search and Cloud growth, but Google’s actual results far exceeded those predictions, powered by record AI adoption and resilient margins.

Referred article: Alphabet Q3 2025 Earnings Preview and Prediction: What to Expect

From Forecasts to Facts

Regarding the article, it was expected to be moderate double-digit revenue growth and strong contributions from Search, YouTube, and Cloud. The actual report delivered far more.

| Metric | Street / Finblog Forecast | Actual (Q3 2025) | Outcome |

|---|---|---|---|

| Revenue | $94 – 100 B (+11%) | $102.3 B (+16%) | ✅ Beat – historic milestone |

| EPS (Diluted) | $2.26 – $2.27 (+8–10%) | ≈ $2.50 (+33% NI) | ✅ Strong upside |

| Operating Margin | ~29.5% (flat YoY) | 30.5% | ✅ Slight improvement |

| Google Cloud Revenue | $12.5 – 14.6 B (+26–29%) | $15.2 B (+34%) | ✅ Major beat |

| YouTube Ads Revenue | $9.6 – 9.8 B (+17–18%) | $10.3 B (+15%) | ⚠️ Slight miss on growth rate |

| Search Revenue | High-single-digit growth (~8–9%) | $56.6 B (+15%) | ✅ Outperformed sharply |

Alphabet not only topped forecasts but entered a new era of scale — surpassing $100 billion in quarterly revenue while maintaining robust profitability.

Search and the Rise of “Deep Search”

Finblog’s preview highlighted Search as Alphabet’s “crown jewel,” expecting steady gains from the Search Generative Experience (SGE) — Google’s experiment with large-language-model-enhanced results.

That call proved prescient. Search revenue jumped 15% YoY to $56.6 billion, its strongest growth in years, aided by surging retail and travel ads.

SGE testing improved engagement without harming click-through rates, showing that AI-powered Search can deepen user interaction while preserving monetisation — a key question ahead of this report.

Google Cloud: From Growth Story to Growth Engine

Analysts expected Cloud revenue near $13 billion with flat margins.

Instead, Alphabet delivered $15.2 billion (+34%), as enterprise demand for AI infrastructure exploded.

CEO Sundar Pichai said the Cloud division now holds a $155 billion backlog (+46% QoQ) and that over 70% of customers use Google AI products. He described the quarter as a “terrific one, driven by double-digit growth across every major part of our business,” adding that AI is now driving real business results across the company.

YouTube: Record Revenue, Slower Growth

YouTube posted $10.3 billion in ad revenue (+15%), above consensus in dollar terms but slightly below projected growth rates.

Shorts monetization continues to improve, though per-minute revenue trails traditional video formats.

Creator concerns over payouts and algorithm changes remain, a dynamic Finblog noted ahead of the report.

AI Investment and Capex Explosion

Alphabet’s capital-spending plans surprised even bullish forecasts.

Finblog’s preview projected $39 – 42 billion for 2025; the company guided for $91 – 93 billion, largely for AI data centers and custom TPU chips.

Despite this massive outlay, operating margin climbed to 30.5%, proving Alphabet can scale AI investment without sacrificing efficiency.

Other Bets and Regulatory Backdrop

Waymo and Verily remain deep in the red, with about $400 million in revenue against $1.6 billion in losses — consistent with Finblog’s prior assessment.

The DOJ antitrust case and EU Digital Markets Act enforcement continue to pose risks, but no new developments emerged this quarter.

Market Reaction

Alphabet shares rose 5% after the report and are up ~50% year-to-date, as analysts rushed to lift price targets.

- Morgan Stanley: “Alphabet’s $100 B quarter confirms AI is monetizing.”

- Bernstein: “Margins held firm despite record Capex — execution is world-class.”

- Citi: “Cloud backlog growth offers visibility well into 2026.”

Options markets had implied a 6% swing; the stock delivered nearly that on the upside.

Finblog Accuracy Scorecard

| Focus Area | Result |

|---|---|

| Search strength | ✅ Accurate |

| Cloud performance | ✅ Exceeded |

| YouTube ads trend | ⚠️ Slightly slower growth |

| AI monetization tone | ✅ Matched |

| EPS & margins | ✅ Under-estimated strength |

| Capex scale | ⚠️ Under-predicted magnitude |

| Stock reaction | ✅ Direction correct |

| Overall Forecast Accuracy | A- (~88%) |

Key Takeaways

- Alphabet surpassed $100 billion in quarterly revenue for the first time.

- AI transitioned from experimental to essential, driving growth across Cloud and Search.

- Operating margins stayed above 30% despite record-high Capex.

- YouTube remains healthy but maturing; Shorts monetization still developing.

- Regulatory and cost headwinds persist, yet momentum is overwhelmingly positive.

Alphabet’s third quarter marked a decisive turn in the company’s AI era, a record-setting $102 billion quarter that turned years of investment into measurable profit.

The results validated earlier projections of strength in Search, Cloud, and AI, while demonstrating that Google can expand faster than peers without eroding margins.

The era of speculative AI spending is over. For Alphabet, AI now pays the bills, and drives the growth.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.