Invest $1,000 wisely, and you can unlock opportunities for significant financial growth. Whether you’re just starting your investing journey or diversifying your portfolio, this guide outlines actionable strategies to make the most of your money in 2025. Here’s a comprehensive approach to investing $1,000 strategically.

Step 1: Define Your Financial Goals

Before you begin, it’s crucial to understand why you’re investing. Ask yourself the following questions:

- Are you saving for retirement, a home, or education?

- Do you want quick returns, or are you looking for long-term growth?

- How much risk are you willing to take?

For example, if your goal is to grow your money over the next 10 years, index funds or ETFs are great options. If you’re planning for short-term needs, a high-yield savings account or low-risk bonds might be better suited.

Invest $1,000 in Diversified Options

1. Index Funds and ETFs

Investing in index funds or ETFs (Exchange-Traded Funds) offers diversification at a low cost. These funds track market indices, such as the S&P 500, allowing you to invest in a wide range of companies with minimal effort.

Advantages include:

- Steady Growth: Over the last 50 years, the S&P 500 has averaged an annual return of approximately 10%.

- Low Costs: Platforms like Vanguard and Fidelity charge minimal fees for managing these funds.

- Ease of Access: With $1,000, you can purchase fractional shares on platforms like Schwab or Robinhood.

For beginners, index funds like Vanguard Total Stock Market ETF (VTI) or SPDR S&P 500 ETF (SPY) are great starting points. These funds require little monitoring, making them ideal for hands-off investors.

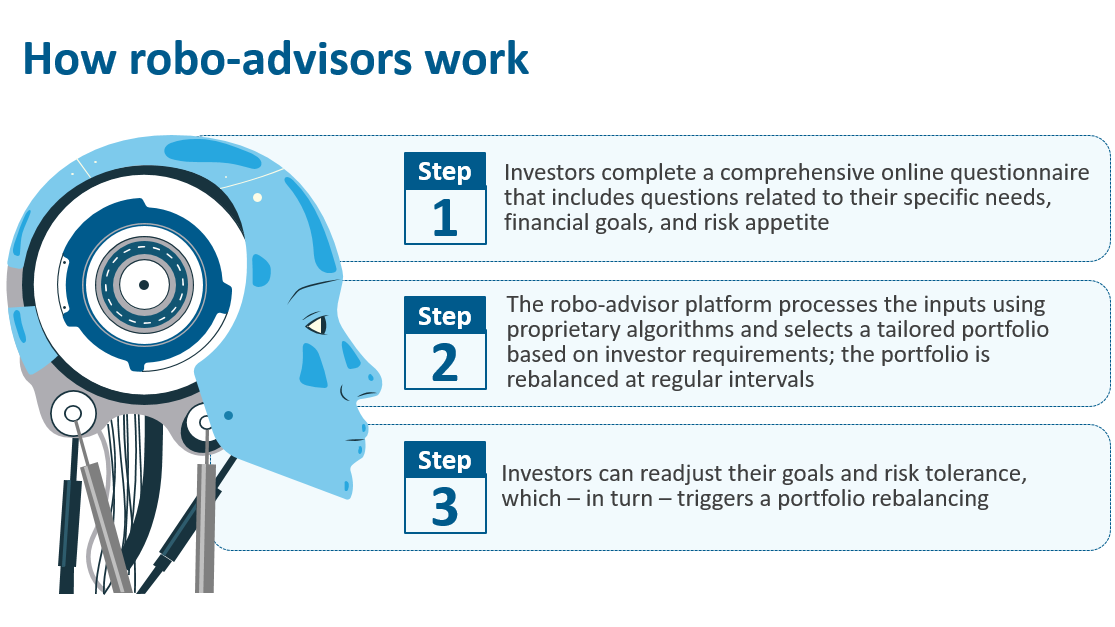

2. Robo-Advisors

Robo-advisors like Betterment and Wealthfront simplify investing by using algorithms to create and manage your portfolio. These platforms assess your risk tolerance and financial goals, automating the investment process.

Benefits include:

- Personalized Portfolios: Investments are tailored to your preferences, balancing stocks, bonds, and other assets.

- Tax Efficiency: Many robo-advisors offer tax-loss harvesting to minimize taxable income.

- Low Fees: Management fees are typically around 0.25%-0.50%, making them affordable for small investors.

If you’re new to investing, robo-advisors provide a stress-free way to get started with minimal knowledge.

3. Individual Stocks

For those willing to take on more risk, investing in individual stocks offers the potential for higher returns. Focus on companies with strong fundamentals, steady growth, and a history of good performance.

Tips for buying individual stocks:

- Research Thoroughly: Analyze financial statements, industry trends, and market conditions.

- Start with Blue-Chip Stocks: Companies like Apple (AAPL), Amazon (AMZN), or Microsoft (MSFT) are stable options for beginners.

- Fractional Shares: Use trusted platforms like Robinhood, E*TRADE, or Webull. Many of these allow commission-free trading, making it easier to maximize your $1,000 investment.

While individual stocks can be rewarding, they require more time and research compared to passive investment options like ETFs.

4. High-Yield Savings Accounts

For risk-averse investors, high-yield savings accounts offer a safe way to grow your money. These accounts typically provide higher interest rates than traditional savings accounts.

Top options include:

- Ally Bank: Offers competitive annual percentage yields (APYs) with no minimum balance.

- Marcus by Goldman Sachs: Provides one of the highest APYs in the market.

- Discover Bank: Known for its customer service and ease of access.

Although returns are lower compared to stocks or ETFs, high-yield savings accounts are FDIC-insured, ensuring the safety of your funds.

5. Cryptocurrencies

Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have become popular for their potential high returns. However, they come with significant risks due to price volatility.

Here’s how to invest in crypto responsibly:

- Start Small: Allocate no more than 5%-10% of your portfolio to cryptocurrencies.

- Reputable Exchanges: Sign up for platforms like Kraken, Binance, or Coinbase to start your crypto journey. With $1,000, you can easily buy fractional shares of Bitcoin or Ethereum.

- Diversify Within Crypto: Consider stablecoins like USDC alongside high-risk tokens.

Cryptocurrencies can deliver impressive gains but should be approached cautiously, especially by new investors.

6. Real Estate Crowdfunding

With just $1,000, you can invest in real estate through crowdfunding platforms like Fundrise and RealtyMogul. These platforms pool funds from multiple investors to purchase commercial or residential properties.

Benefits include:

- Passive Income: Earn dividends from rental returns or property appreciation.

- Low Barrier to Entry: Unlike traditional real estate, crowdfunding requires minimal upfront capital.

- Diversification: Spread your investments across multiple properties.

Real estate crowdfunding offers a way to benefit from property ownership without managing properties directly.

7. Start a Small Business or Side Hustle

Use your $1,000 as seed money to start a small business or monetize a skill.

- Freelancing: Offer services like graphic design, writing, or web development on platforms like Upwork.

- E-commerce: Set up an online store with Shopify or sell handmade items on Etsy.

- Digital Products: Create and sell online courses, e-books, or digital templates.

Investing in yourself through entrepreneurship can yield long-term financial and personal rewards.

Factors to Consider Before Investing

- Risk Tolerance

Understand your comfort level with risk. Safe options like savings accounts suit risk-averse investors, while stocks or crypto appeal to those with higher risk tolerance. - Time Horizon

The length of time you plan to keep your money invested determines your strategy. Long-term goals favor stocks and ETFs, while short-term goals align better with savings accounts or bonds. - Diversification

Avoid putting all your funds in one investment. Diversify across asset classes to mitigate risk and maximize returns.

Investment Strategies Based on Goals

| Goal | Recommended Investment |

|---|---|

| Emergency Fund | High-yield savings accounts |

| Retirement Savings | Robo-advisors or index funds |

| Wealth Accumulation | Individual stocks or ETFs |

| Passive Income | Real estate crowdfunding |

| High Risk-High Reward | Cryptocurrencies or speculative stocks |

Tips for Maximizing Your $1,000 Investment

- Start Early

Time in the market beats timing the market. The earlier you invest, the more compound interest can work in your favor. - Reinvest Your Returns

Use dividends or interest to buy more shares or assets. This accelerates portfolio growth. - Leverage Tax-Advantaged Accounts

Invest through accounts like IRAs or 401(k)s to benefit from tax savings. - Monitor Progress

Regularly review your investments to ensure they align with your goals. Adjust allocations as needed. - Avoid Emotional Decisions

Market volatility is normal. Stick to your strategy and avoid making decisions based on fear or greed.

Sources:

- Bankrate: Best Ways to Invest $1,000

- CNBC Select: Ways to Invest $1,000

- Stash: How to Invest $1,000

- The Motley Fool: How to Invest $1,000

- Investopedia: Investing $1,000

- Forbes: Growing Your Money

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.