What is Crypto Trading?

Crypto trading refers to the process of buying, selling, or exchanging digital currencies like Bitcoin, Ethereum, and others through cryptocurrency exchanges. Unlike traditional stock trading, crypto trading operates 24/7 on decentralized platforms, offering traders flexibility and unique opportunities. Traders profit by speculating on price movements, using strategies that range from day trading to long-term investment.

Crypto trading allows individuals to engage in global markets with low barriers to entry, making it a popular choice for those seeking financial independence.

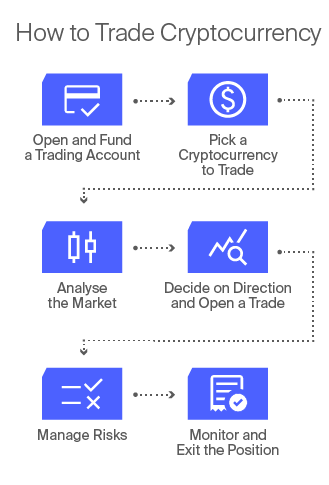

Steps to Start Trading Crypto

Starting your journey to trade in crypto requires a systematic approach. Here’s a step-by-step guide to get you started.

- Choose a Reliable Cryptocurrency Exchange

Begin by selecting a crypto exchange that matches your needs. Exchanges serve as platforms where buyers and sellers trade cryptocurrencies.

- Centralised Exchanges (CEXs) like Binance, Coinbase, and Kraken are beginner-friendly and offer tools for spot trading.

- Decentralized Exchanges (DEXs): These operate without intermediaries and are ideal for trading niche tokens. Examples include Uniswap (Ethereum-based tokens) and PancakeSwap (Binance Smart Chain tokens).

When choosing an exchange, consider factors like fees, liquidity, supported coins, and security features.

- Set Up a Secure Digital Wallet

A cryptocurrency wallet is essential for storing your assets securely. Depending on your trading style, you’ll choose between two main types:

- Hot Wallets: These are connected to the internet and suitable for active trading. Examples include MetaMask and Trust Wallet.

- Cold Wallets: These are offline and offer maximum security for long-term storage. Hardware wallets like Ledger Nano X and Trezor are popular choices.

Ensure you back up your wallet’s private keys or recovery phrase. Losing these details could mean losing access to your funds forever.

- Fund Your Trading Account

Once your wallet and exchange account are set up, deposit funds to start trading.

- Fiat Currency: Most exchanges allow deposits via credit cards, bank transfers, or PayPal.

- Cryptocurrency Transfers: If you already own crypto, transfer it to your exchange wallet. For example, you can transfer Bitcoin (BTC) from an external wallet to fund your trades.

Take note of deposit fees and processing times, which vary by platform.

- Learn Trading Basics and Market Types

Understanding the market and its tools is crucial for successful trading.

- Trading Pairs: Cryptocurrencies are traded in pairs, such as BTC/ETH or BTC/USD. You’re essentially exchanging one asset for another.

- Types of Orders:

- Develop a Trading Strategy

Before trading, outline a strategy based on your financial goals and risk tolerance. Here are common strategies:

- Place Your First Trade

Use the exchange interface to execute your first trade. Start small to minimize risk as you learn.

- On Centralized Exchanges: Use their straightforward buy/sell buttons to enter the market.

- On Decentralized Exchanges: Connect your wallet to the platform, select your trading pair, and confirm the transaction.

- Monitor and Manage Your Portfolio

Track your investments using portfolio management tools provided by exchanges or third-party apps like Blockfolio. Stay informed about market movements and adjust your strategy as needed.

- Withdraw Your Crypto to Your Wallet

For added security, transfer your cryptocurrency from the exchange to your personal wallet after trading. Exchanges are vulnerable to hacks, so storing funds in a secure wallet minimizes risks.

Tools and Resources for Crypto Trading

- Charting Platforms: Tools like TradingView help analyze price movements and set strategies.

- Portfolio Trackers: Apps like CoinMarketCap track portfolio performance across multiple platforms.

- News Aggregators: Stay updated with real-time news through platforms like CoinTelegraph or CryptoPanic.

- Automated Trading Bots: Bots like CryptoHopper or 3Commas can execute trades based on preset strategies.

Risks and Rewards of Trade in Crypto

- Volatility

Cryptocurrency prices can swing by 10% or more within a single day. While this offers profit opportunities, it also means traders face the risk of significant losses. - Lack of Regulation

The decentralized nature of crypto trading can expose traders to fraud, scams, or poorly executed trades. - Security Risks

Cybersecurity threats are prevalent, including phishing attacks and exchange hacks. Always use two-factor authentication and store funds in secure wallets. - FOMO and Emotional Decisions

The fear of missing out (FOMO) or panic selling during market downturns can lead to poor decision-making.

- High Profit Potential

Price volatility creates opportunities for traders to achieve significant short-term gains. For example, Bitcoin’s price surged over 100% during certain bull markets. - 24/7 Market Access

Crypto markets never close, enabling traders to operate on their own schedules. - Global Reach

Cryptocurrencies remove barriers to entry, allowing anyone with an internet connection to participate in trading. - Portfolio Diversification

Adding crypto assets to an investment portfolio can help hedge against traditional market risks.

Related articles:

- What are some benefits of using cryptocurrency as a method of payment?

- What is cryptocurrency mining? A Beginner’s Guide to Getting Started

- What is Cryptocurrency Solana (SOL) and How Does It Work?

- How to Buy Solana Meme Coins and Create Your Own on Solana

- How to Sell Bitcoin: A Step-by-Step Guide for Beginners

- How to Pay with Cryptocurrency: A Guide to Digital Payments

- What Are Meme Coins & How Do They Work?

- How to Buy Meme Coins: A Beginner’s Guide

- Which are Best FREE Crypto Exchanges & Apps in 2024

Sources:

- https://cointelegraph.com/learn/articles/how-to-trade-cryptocurrencies-the-ultimate-beginners-guide

- https://www.benzinga.com/money/how-to-trade-cryptocurrency

- https://management.org/how-to-trade-crypto