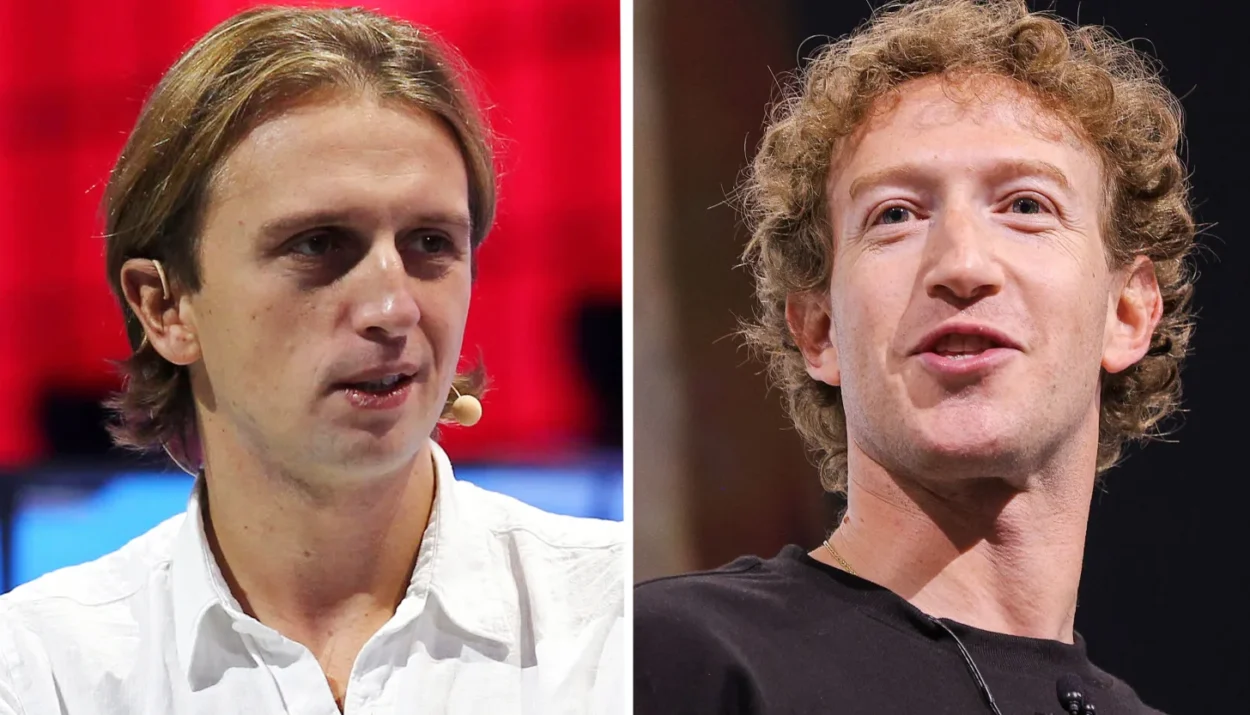

In a sharp rebuke, British fintech firm Revolut has criticized Meta, the parent company of Facebook, for its approach to tackling fraud, urging the U.S. tech giant to financially compensate victims of scams that originate on its platforms. This comes just a day after Meta announced a partnership with U.K. banks to help prevent fraud through data-sharing.

- Revolut’s criticism: Woody Malouf, Revolut’s head of financial crime, said Meta’s steps were insufficient, stating, “These platforms share no responsibility in reimbursing victims, and so they have no incentive to do anything about it.”

- Meta’s partnership: The collaboration between Meta, NatWest, and Metro Bank aims to share data to help protect customers, but Revolut argues it “falls woefully short” of what’s needed to combat fraud globally.

- Fraud origins: Revolut’s report highlighted that 62% of user-reported scams on its platform originated from Meta-owned platforms, with Facebook accounting for 39% of those cases.

- New U.K. regulations: Starting Oct. 7, banks and payment firms in the U.K. must compensate victims of authorized push payment (APP) fraud up to £85,000. Revolut calls for social media platforms to share this burden.

Revolut’s stance underscores the growing frustration within the financial sector regarding the role of social media in fraud schemes. As fraud continues to rise, the debate over accountability will likely intensify.