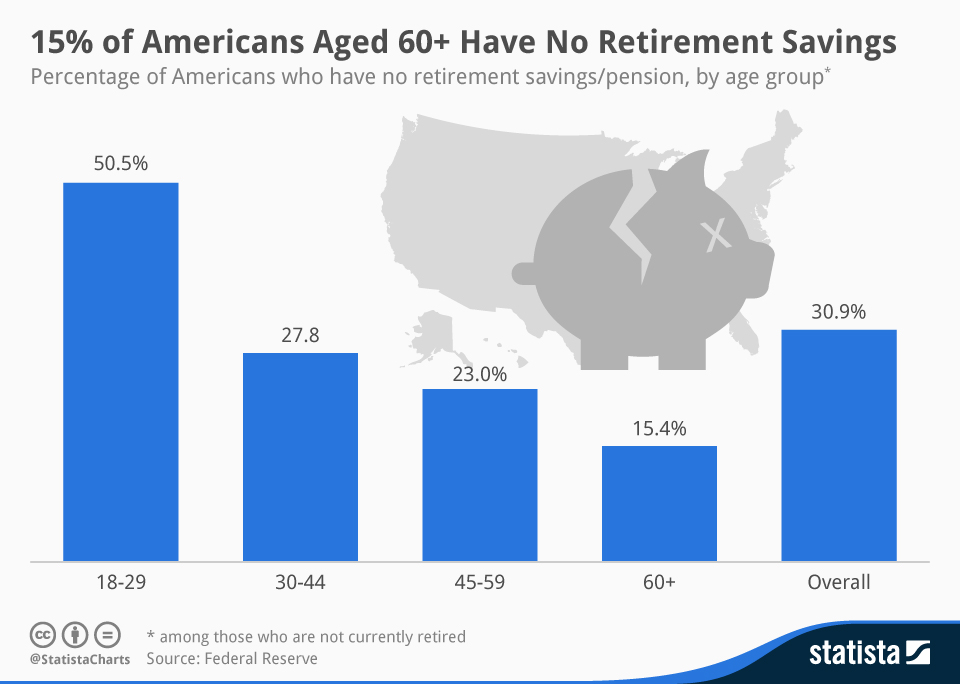

Every working person dreams of retiring with a huge surplus of money that can sustain their lifestyle during retirement. But for some unlucky individuals who haven’t planned what to do after their 60s and have no retirement savings, it can be quite challenging. But don’t panic, since retirement is still some years away and there are several other steps you can take to overcome this. In this blog, let’s look at what can be done if you are 60 years old and have no retirement savings.

No Retirement Savings? Look Into Your Financial Condition

The first thing you must do when you’re 60 and have no retirement savings is to look into your financial condition. Start by taking a look into your assets, income sources, and any debts that you may have.

Take a close look at your current expenses for the month to see where your money is going and how much you might need to survive. Look into areas where you can cut back your expenses, such as going out or eating out frequently.

Also, look into your income sources. Check whether you have any income sources that will remain stable even after your retirement, such as Social security, dividend income, debt interests, part-time work, etc. Social security is a big part of your post-retirement income so make sure to check how much you are eligible for on the Social Security Administration’s website.

Delay Retirement and Keep Working

Now this one seems counterproductive, but if you’re 60 with no retirement savings, it seems reasonable to delay your retirement so that you have more years to save up and plan for your retirement again.

If possible, try to delay your retirement up until 67. This gives you 7 more years to plan your retirement and the benefit is that you can get more income through your Social Security. This is because Social Security payments grow by about 8% annually for each year you delay beyond the full retirement age up until 70.

If you are not able to continue your work full-time, consider part-time work or freelance consulting based on your expertise to reduce your workload but still earn money.

Aggressively Save and Invest

Now even if you are 60, you still have time to aggressively save and invest to build yourself a good financial cushion. The trick is to make the most of your income by cutting down on your expenses and using that money to invest in retirement accounts to maximize your returns.

If your employer offers a 401(k) or a similar retirement plan, contribute as much as possible. In 2024, the contribution limit for 401(k)s is $23,000, with an additional $7,500 catch-up contribution allowed for those over 50.

If you don’t have access to a 401(k), open an IRA and try to contribute as much as $7,000 annually. You can even consider a Roth IRA if you expect to pay heavy taxes in the future.

Cut Costs and Downsize

Now if you are unable to increase or sustain your income, try cutting costs and downsizing. As mentioned before, look at your expenses and cut back on any unwanted expenses. If you live in a big house in an expensive area, try downsizing to a smaller house in a relatively cheaper area. Even though the moving costs might be high, you can save a lot more in the long run during your retirement.

Alternatively, you can also try applying for reverse mortgages if you have a lot of equity in your home. This way you can earn some additional money through regular payments.

Also, try clearing off your debt as much as possible. This will ease your burden on your savings, giving you more money to spend elsewhere.

Tap into Social Security and Medicare Wisely

Social Security and Medicare are your main assets if you are 60 and have no retirement savings. As mentioned earlier, delaying Social Security until age 70 can increase your monthly benefits by up to 32% compared to claiming at age 62. Before claiming, check your benefits statement to see how much you’ll receive at various ages and plan accordingly

Also, healthcare is a big expense when it comes to your retirement. So sign up for Medicare to help cover your medical expenses when it comes out of the blue.

No Retirement Savings? It’s Never Too Late To Save For Retirement

When you are 60 and have no retirement savings, it may seem overwhelming, but stop complaining about lost time and start building your savings from the years you have left from your retirement. Try working harder, delaying your payment, and downsizing, and you are on your way to financial independence even if you are late. Remember, it’s never too late to take control of your financial future.

- Sources:

- https://finblog.com/top-2-reasons-why-americans-struggle-with-retirement-savings/

- https://finblog.com/what-is-the-full-retirement-age-in-the-usa/

- https://www.usa.gov/agencies/social-security-administration

- https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000