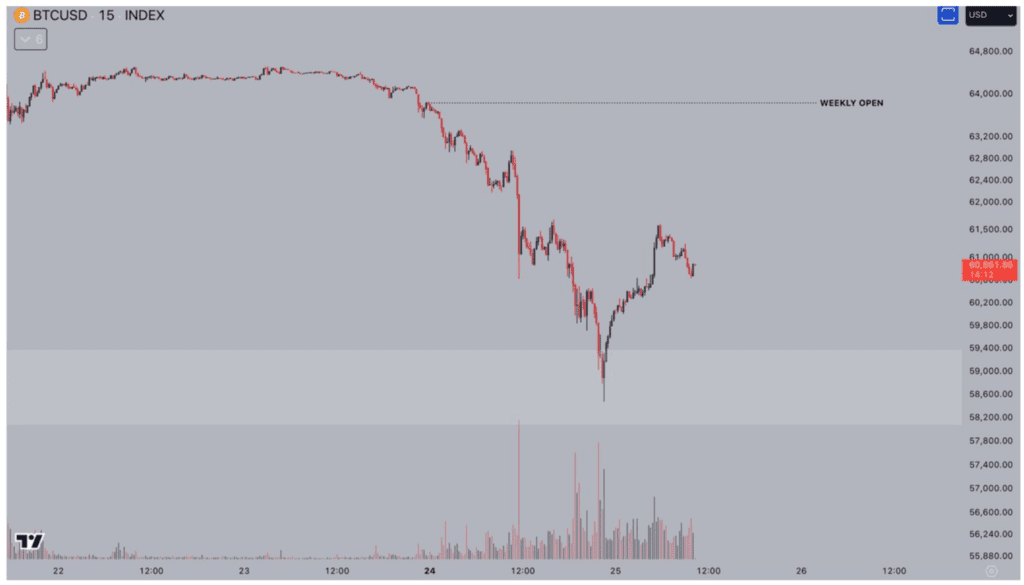

Bitcoin price briefly fell to a six-week low on June 24, before buyers pushed it back above $62,000 within 24 hours. Technical traders remain uncertain about whether the downtrend is over.

Market Analysis

Popular trader Jelle observed a return of buyer interest around the $60,000 support zone. Jelle suggested that if Bitcoin can establish a lower timeframe higher low, the price could reach $63,500 by the end of the week.

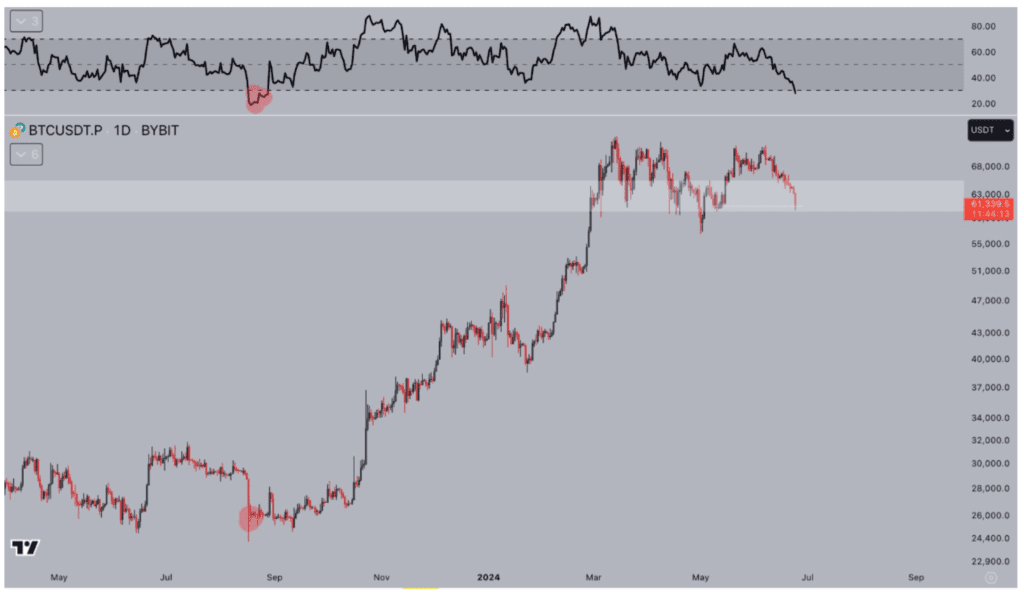

Jelle highlighted the oversold conditions following Bitcoin’s drop to $58,400 on June 14, comparing the current market action to when Bitcoin traded around $26,000 in August 2023. Despite different circumstances in 2024, the RSI (Relative Strength Index) indicates a potential rebound.

“Bitcoin’s daily RSI has not been this low in nearly a year,” Jelle noted, suggesting the possibility of a sustained recovery from the oversold zone.

Investor Sentiment

Author Robert Kiyosaki of “Rich Dad, Poor Dad” saw the recent dip as a buying opportunity, advising those scared by crashes to sell and keep their jobs. The drop below $60,000 was partly due to selling pressure from the defunct Mt. Gox exchange, which plans to repay creditors in July with Bitcoin and Bitcoin Cash worth over $9 billion.

Technical Outlook

Data from Cointelegraph Markets Pro and TradingView showed Bitcoin attempting to recover the $62,000 level. The critical support zone between $60,000 and $64,000 remains crucial for avoiding deeper corrections.

Analyst Aksel Kibar pointed to a bullish setup, emphasizing the importance of the $60,000 support provided by the ascending parallel channel’s upper boundary. A significant breach could shift the outlook to bearish.

Bitcoin’s price recovery above $62,000 has provided temporary relief, but traders and analysts continue to monitor key support levels closely. The potential for a rebound remains, but caution is advised as market conditions evolve.