Trade barriers, stockpiling, and protectionist policies are reshaping global commodity markets, fragmenting trade flows and pushing prices higher and more volatile across metals, energy, and raw materials.

Governments, traders, and even investors are increasingly hoarding key resources, transforming what used to be open global markets into regionalized pricing zones. Analysts say this shift is distorting supply signals and making it harder to determine the true value of commodities.

Copper Shows How Fragmentation Works

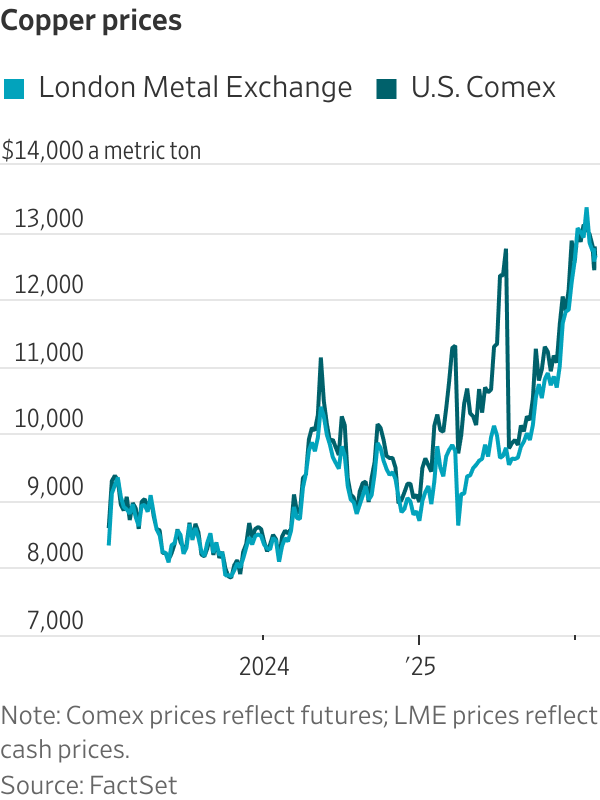

When tariff threats targeted copper, traders rushed to stockpile supplies inside the US. That drove US copper futures up to 30% higher than London prices at one point last summer.

Even after tariffs turned out to be milder than feared, US copper kept trading at a premium for months. Now the price gap has narrowed, but the earlier stockpiling created a global shortage outside the US, which is still supporting prices worldwide.

Analysts warn another policy decision on refined copper tariffs later this year could trigger fresh distortions.

Silver and Aluminum Show the Same Pattern

The same pattern has played out in other metals:

- Silver: Speculation about tariffs pulled inventory out of London markets, creating tight supplies and raising the risk of price squeezes.

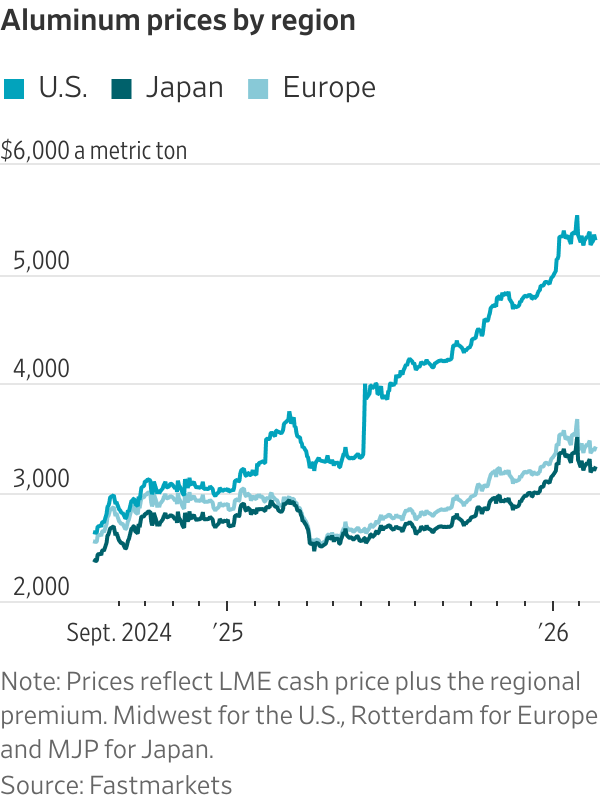

- Aluminum: After a 50% US tariff last year, American aluminum prices climbed to 57% above European levels, putting pressure on manufacturers.

Even rumors of policy shifts have been enough to move prices sharply.

Why This Is Happening Now

Economists link the global turn toward protectionism to a chain of shocks:

- Pandemic supply disruptions

- Energy shortages in major economies

- Food and fuel crises after geopolitical conflicts

Countries are now prioritizing resource security over free trade. Some are stockpiling far beyond immediate needs. China, for example, has been buying millions of tons more copper than it consumes annually while also building oil reserves. The US recently announced a $12 billion critical minerals stockpile.

More about: Why Are Oil Prices Rising If There’s Too Much Supply?

Investors Are Fueling the Trend

Uncertainty is pushing private investors to treat commodities as a form of insurance. That added demand is boosting rallies and amplifying volatility, especially in metals.

Commodity trading firms and vertically integrated miners are among the few clear winners, since volatile markets create arbitrage opportunities and higher trading profits. But for most industries, rising raw material costs mean tighter margins and more unpredictable pricing.

The era of smooth global commodity pricing is fading. As trade barriers rise and nations hoard strategic resources, markets are becoming fragmented, harder to read, and more volatile.

For businesses and investors alike, the new reality is simple: prices now move as much on politics as on supply and demand.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.