US stocks moved higher on Wednesday, pushing the S&P 500 above 7,000 for the first time ever, as investors leaned into AI optimism ahead of the Federal Reserve’s policy decision and a wave of major tech earnings.

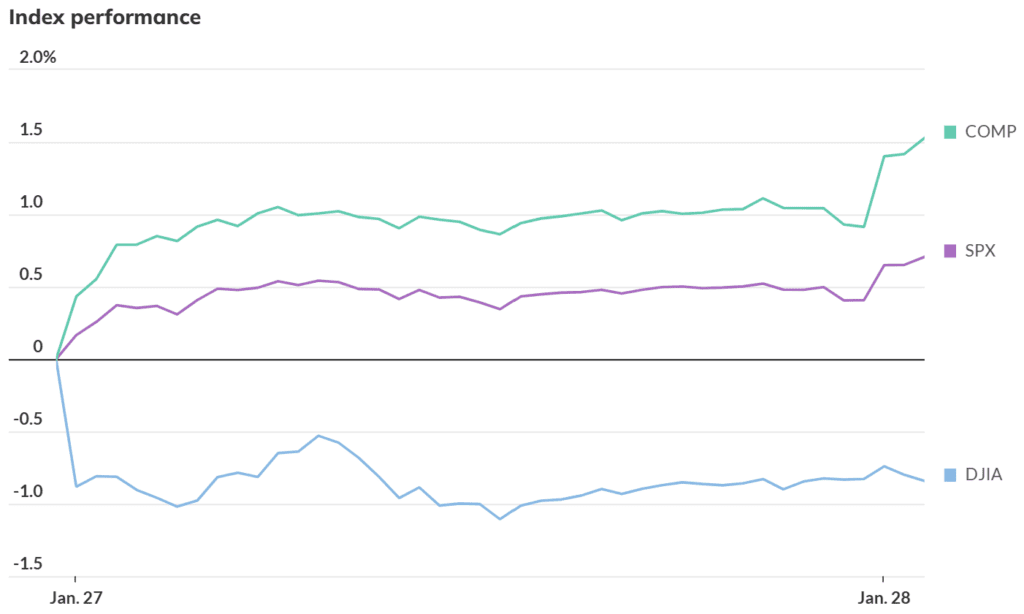

The benchmark index rose about 0.3% at the open, building on a record close. The Nasdaq climbed roughly 0.6%, while the Dow Jones Industrial Average hovered near flat.

Tech stocks led the move after ASML posted a surprise jump in orders for chipmaking equipment, reinforcing confidence that demand tied to artificial intelligence and data center expansion remains strong. Shares of Nvidia and TSMC followed higher, adding to the sector’s momentum.

Attention is now turning to earnings from Microsoft, Meta, and Tesla, due after the market close, with Apple reporting on Thursday. Investors are watching closely to see whether heavy AI spending is starting to translate into durable growth.

Markets are also bracing for the Federal Reserve’s rate decision, with policymakers expected to leave rates unchanged. Any hints from Chair Jerome Powell about the path toward future cuts will be closely watched.

A softer US dollar and easing bond yields have added support, helping keep risk appetite intact.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

What’s Ahead for Stocks and Gold in 2026? What Markets and Experts Are Watching

Stocks Look Bullish Entering 2026 — But What Could Go Wrong?

FOMO vs. Bubble Angst Signals More Stock Volatility in 2026

Gold Breaks $4,400 as Silver, Copper and Platinum Hit Record Highs: What Comes Next

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Want to Know Where the Market Is Going? Don’t Trust This, or Any, Forecast.