Gold prices jumped to new all-time highs on Wednesday as investors rushed into safe-haven assets amid rising global tensions linked to President Donald Trump’s push to take control of Greenland.

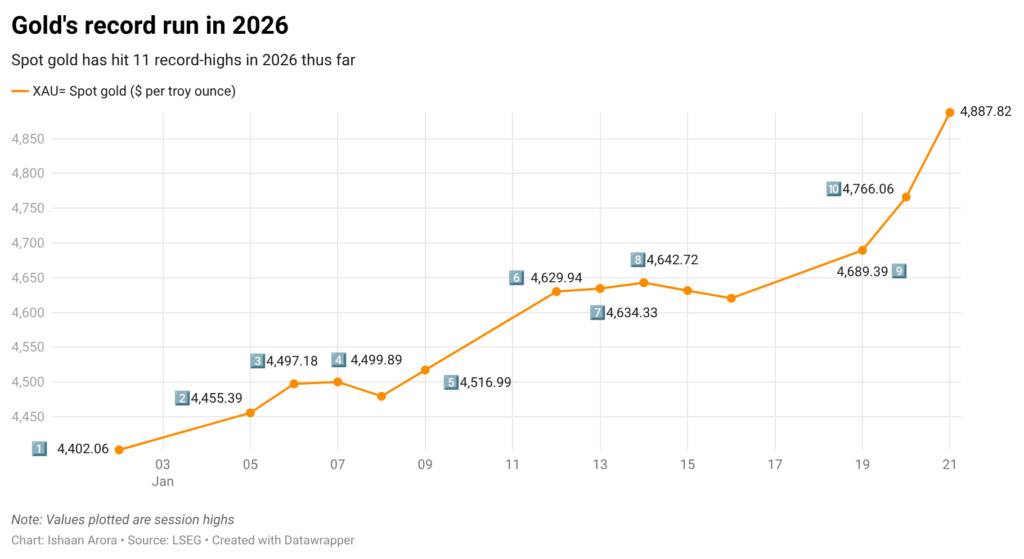

Spot gold climbed more than 2 percent to around $4,862 per ounce, after briefly hitting a record $4,887.82 earlier in the session. This marks the 11th record high for gold in 2026.

Analysts said fears over a widening dispute between the US and its NATO allies are fueling demand for gold ahead of Trump’s speech at the World Economic Forum in Davos.

Trump said this week he remains determined to gain control of Greenland and did not rule out using force. Danish Prime Minister Mette Frederiksen has firmly rejected the idea, adding to political uncertainty.

Dollar Falls, Metals Rise

The rally was supported by a weaker US dollar, which fell to a two-week low as investors sold US assets following tariff threats and geopolitical tensions. A softer dollar makes gold cheaper for buyers outside the US.

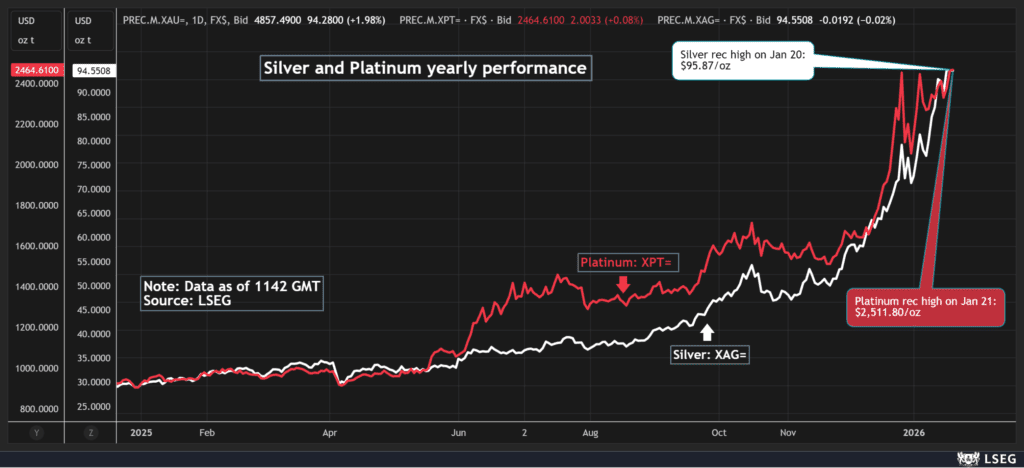

Other precious metals also climbed:

- Silver traded near $94.7, just below its record high

- Platinum hit a fresh record above $2,500 before easing slightly

- Palladium slipped modestly after earlier gains

More Risks Ahead

Markets are also watching a pending US Supreme Court decision on whether Trump can remove Federal Reserve Governor Lisa Cook, raising fresh concerns about central bank independence.

Some analysts now believe gold could soon reach $5,000 per ounce if political and inflation risks continue.

With geopolitical tensions rising and investors seeking protection, gold remains one of the strongest performers in global markets this year.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Markets This Week: Trump’s Davos Speech, Inflation Data, and Big Tech Earnings in Focus