US stocks fell sharply on January 20 after President Donald Trump threatened new tariffs on several European countries over his push to take control of Greenland.

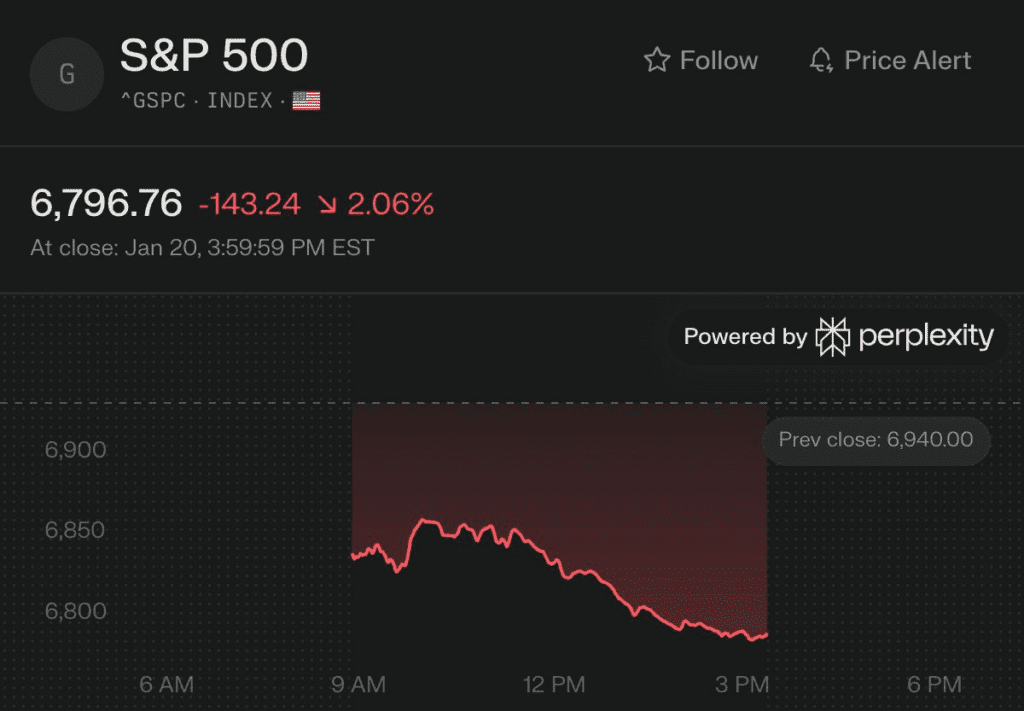

The S&P 500 dropped 2.1 percent, its worst day in three months. The Nasdaq fell 2.4 percent, while the Dow Jones lost nearly 871 points.

Investors rushed to sell after Trump said he would impose new tariffs starting February 1, with rates rising to 25 percent by June, on goods from Denmark, France, Germany, the UK and several other European nations. These countries have opposed Trump’s plan to acquire Greenland.

Trump also warned he could place a 200 percent tariff on French wine and champagne, adding more tension to global trade.

Money Moves to Safe Havens

The market selloff spread beyond stocks:

- The 10 year Treasury yield jumped to 4.29 percent

- The US dollar weakened

- Gold surged to a record above $4,700 per ounce as investors looked for safety

Analysts said markets were reacting to fears of a new trade war and rising political risk.

Economy Still Looks Strong

Despite the sharp drop, economists said the US economy remains healthy. Recent data shows cooling inflation and steady growth, and many still expect the Federal Reserve to cut interest rates later this year.

More inflation data will be released on January 22, and investors hope it will confirm that price pressures are easing.

For now, markets remain nervous as Trump’s tariff threats raise fears of another major trade conflict with Europe.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

What’s Ahead for Stocks and Gold in 2026? What Markets and Experts Are Watching

Stocks Look Bullish Entering 2026 — But What Could Go Wrong?

FOMO vs. Bubble Angst Signals More Stock Volatility in 2026

Gold Breaks $4,400 as Silver, Copper and Platinum Hit Record Highs: What Comes Next

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Want to Know Where the Market Is Going? Don’t Trust This, or Any, Forecast.