It is a shorter trading week on Wall Street because markets are closed on Monday for the Martin Luther King Jr. holiday, but investors still face a busy calendar with major political events, key inflation data, and important earnings reports.

The week begins with the World Economic Forum in Davos, where President Donald Trump is set to speak on Wednesday. His speech is expected to focus heavily on housing reform, including plans to limit large investors from buying homes and new steps to lower mortgage costs through Fannie Mae and Freddie Mac.

Inflation and Fed in the Spotlight

On Thursday, the US government will release the delayed PCE inflation data for October and November, the Federal Reserve’s preferred inflation measure. This comes after last week’s CPI report showed inflation continuing to cool.

Investors will be watching closely ahead of the Federal Reserve meeting next week, as policymakers remain divided on whether to continue cutting interest rates.

The Supreme Court will also hear arguments on Wednesday in the case involving Fed Governor Lisa Cook, whom Trump is trying to remove. The outcome could affect the future independence of the central bank.

Big Earnings Week for Tech and Airlines

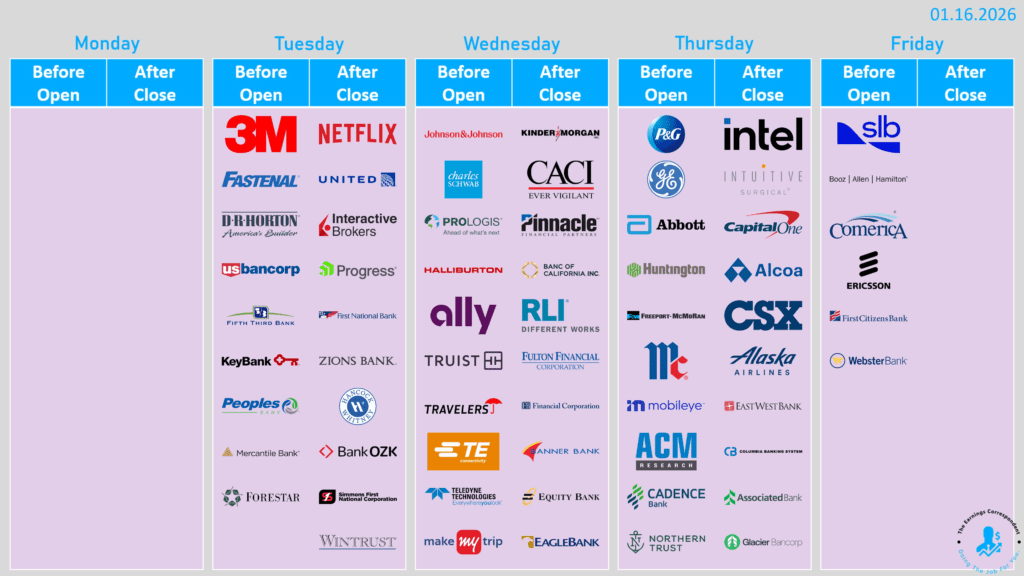

Several major companies report earnings this week, led by Netflix and Intel.

- Netflix reports on Tuesday, with investors watching for updates on its possible bid for Warner Bros Discovery and subscriber growth.

- Intel reports Thursday after its stock surged on optimism around its new AI chips and fresh government support.

Other big names reporting include United Airlines, Johnson & Johnson, GE Aerospace, Procter & Gamble, 3M, and several major banks.

Airline stocks will be closely watched after Delta warned about weaker profits last week, which sent the sector lower.

Key Dates to Watch

- Monday: Markets closed, Davos begins

- Wednesday: Trump speaks in Davos, Supreme Court hears Fed case

- Thursday: PCE inflation data, GDP final reading, Intel and GE earnings

- Friday: Consumer sentiment and PMI data, Davos ends

With politics, inflation, and major earnings all colliding in one week, markets could see sharp moves even with fewer trading days.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

What’s Ahead for Stocks and Gold in 2026? What Markets and Experts Are Watching

Stocks Look Bullish Entering 2026 — But What Could Go Wrong?

FOMO vs. Bubble Angst Signals More Stock Volatility in 2026

Gold Breaks $4,400 as Silver, Copper and Platinum Hit Record Highs: What Comes Next

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Want to Know Where the Market Is Going? Don’t Trust This, or Any, Forecast.