UK inflation fell sharply in November, strengthening expectations that the Bank of England will cut interest rates at its upcoming meeting.

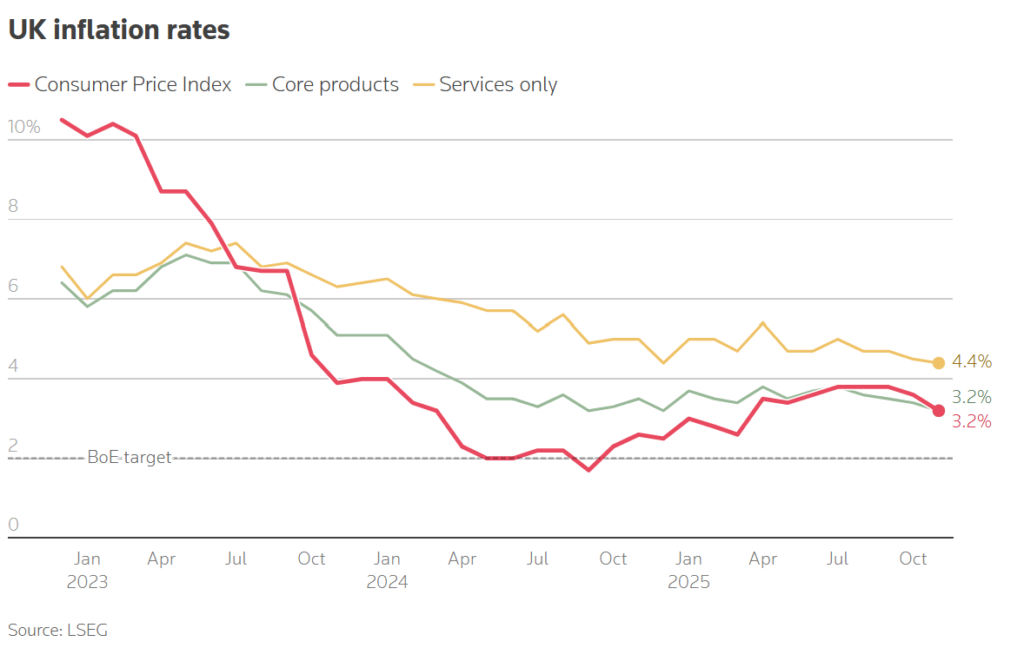

Official data showed consumer price inflation dropped to 3.2%, down from 3.6% in October, marking its lowest level since March. The reading came in below all economists forecasts and undershot the Bank of England’s own projections.

The decline was driven by lower food prices, softer tobacco costs, and Black Friday discounts, particularly on clothing. Items such as cakes, biscuits, cereals, and confectionery also saw notable price drops, according to the Office for National Statistics.

Markets reacted quickly. Sterling weakened, gilt yields fell, and traders priced in a near 100% chance of a quarter-point rate cut to 3.75%. Expectations for additional rate cuts in 2026 also increased.

Economists said the decision now looks clear. Rob Wood of Pantheon Macroeconomics said a rate cut is “beyond doubt” after inflation surprised on the downside, though he cautioned that some of the weakness may prove temporary, driven by volatile items and seasonal discounts.

Underlying inflation pressures also eased.

- Services inflation slowed to 4.4%, below expectations

- Core inflation dropped to 3.2%

- Food inflation fell to 4.2%, down from 4.9%

The Bank of England has been divided in recent meetings, but Governor Andrew Bailey had previously signaled he wanted to see further progress on inflation this year before backing a cut, a condition now met.

Looking ahead, government budget measures announced in late November are expected to reduce pressure on household energy bills from 2026, potentially pulling inflation lower in the short term. However, policymakers remain cautious, with wage growth still running above levels consistent with the 2% inflation target.

For now, the data has firmly tipped the balance toward a rate cut, reinforcing the view that the UK’s tightening cycle is ending and the easing phase is gaining momentum.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.