Walmart delivered another strong quarter, raising its outlook after beating Wall Street expectations and showing that Americans are still spending, even in a difficult economic environment.

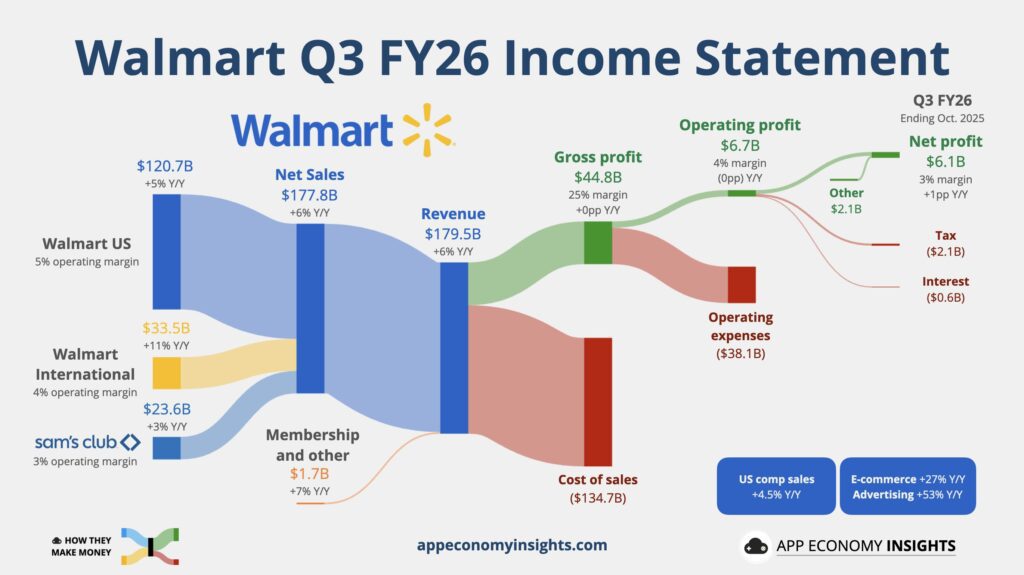

The retail giant reported $179.5 billion in revenue for the quarter ending Oct. 31, topping expectations of $177 billion and rising 6% year over year. The results were driven by strong e-commerce growth, steady demand in food and health categories, and Walmart’s continued success in attracting higher-income shoppers looking for value.

E-commerce Surges Again

Walmart U.S. sales rose 5.1% to $120.7 billion, while online sales jumped 28%, marking the company’s seventh straight quarter of more than 20% e-commerce growth.

Store traffic increased 1.8%, and customers spent 2.7% more per trip. Stronger private-label offerings and expanded assortments helped lift general merchandise sales, even as consumers across the country continue to pull back on discretionary purchases.

Higher-Income Consumers Keep Fueling Growth

Walmart continues to gain market share among wealthier households trading down from more expensive retailers. This trend has now persisted for several quarters and remains one of Walmart’s strongest growth drivers.

Sales were notably strong in grocery, health and wellness, and general merchandise, showing resilient spending across core categories.

Leadership Changes and a Boosted Outlook

The report comes one week after Walmart announced a leadership shuffle. Long-time CEO Doug McMillon will hand over global responsibilities to John Furner in February.

For fiscal 2026, Walmart now expects:

- Net sales growth: 4.8%–5.1% (up from 3.75%–4.75%)

- Adjusted operating income: up 4.8%–5.5%

- Adjusted EPS: $2.58–$2.63 (up from $2.52–$2.58)

Walmart Is Moving to Nasdaq

The company also announced it will transfer its stock listing from the New York Stock Exchange to the Nasdaq on Dec. 9, where it will continue to trade under the ticker WMT. Walmart said the move fits its long-term, tech-focused strategy as it leans further into automation and AI.

CFO John David Rainey said the shift reflects Walmart’s transformation into a “people-led, tech-powered” retailer, with automation and AI increasingly integrated into its logistics, store operations, and omnichannel offerings.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Stocks Steady as Nvidia Earnings Become Market’s Make-or-Break Moment