US stocks tried to steady on Wednesday after a three day slide, but nerves around artificial intelligence valuations and a violent crypto selloff kept risk sentiment fragile.

The S&P 500 was up about 0.2% to 0.25%, while the Nasdaq Composite gained roughly 0.3% to 0.5%. The Dow Jones Industrial Average lagged, down about 0.2% as weakness in UnitedHealth and Boeing weighed on the index.

The move higher came after Monday’s drop pushed the S&P 500 and Nasdaq below their 50 day moving averages for the first time since April, a technical break that raised fears of further selling. The S&P is now about 4% off its October peak, but still up roughly 12% to 13% year to date.

Nvidia earnings: make or break for the AI trade

Attention is locked on Nvidia ahead of its quarterly results after the close, widely seen as a critical test of whether AI spending and earnings can justify sky high valuations.

Related: Nvidia Q3 FY2026 Earnings Preview and Prediction: What to expect?

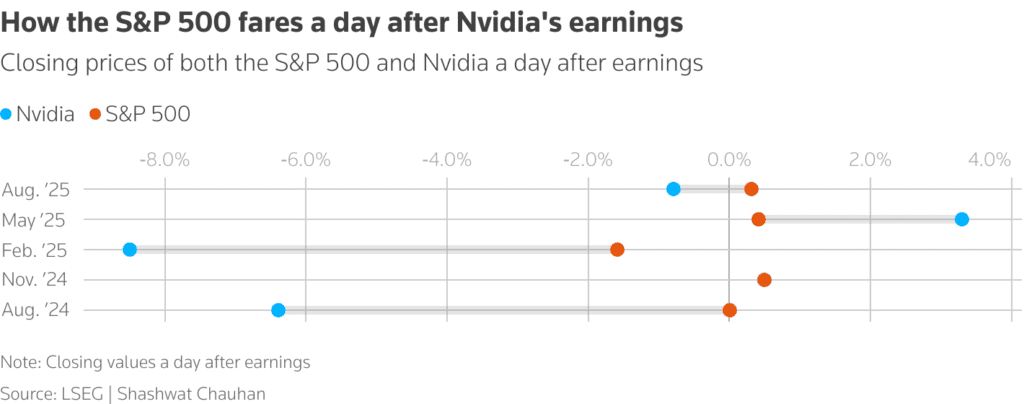

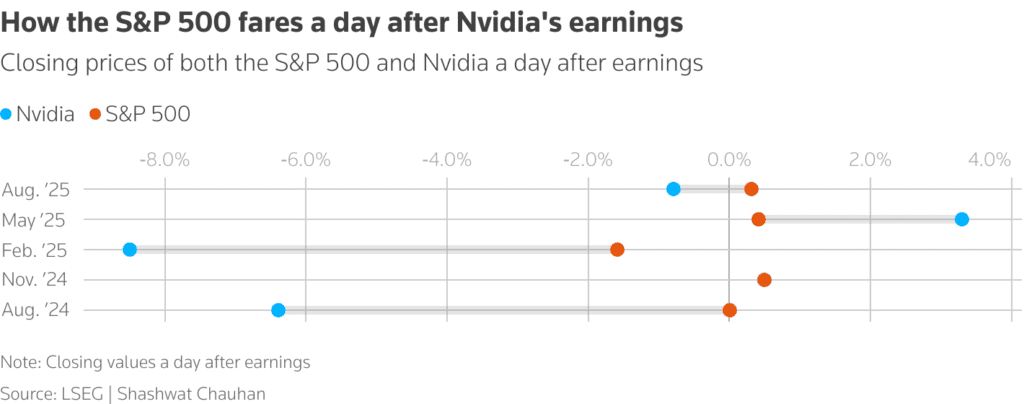

- Options are pricing an implied move of about 7% to 8% in either direction after the report.

- Nvidia shares were up roughly 1.5% to 2.1% on Wednesday midday after falling about 4% to 5% over the previous two sessions.

Analysts expect Nvidia to beat on both revenue and earnings for a 12th straight quarter, but the bar is unusually high. Investors want clear evidence that hyperscalers and AI startups are still ramping orders, not pausing to digest massive capex plans.

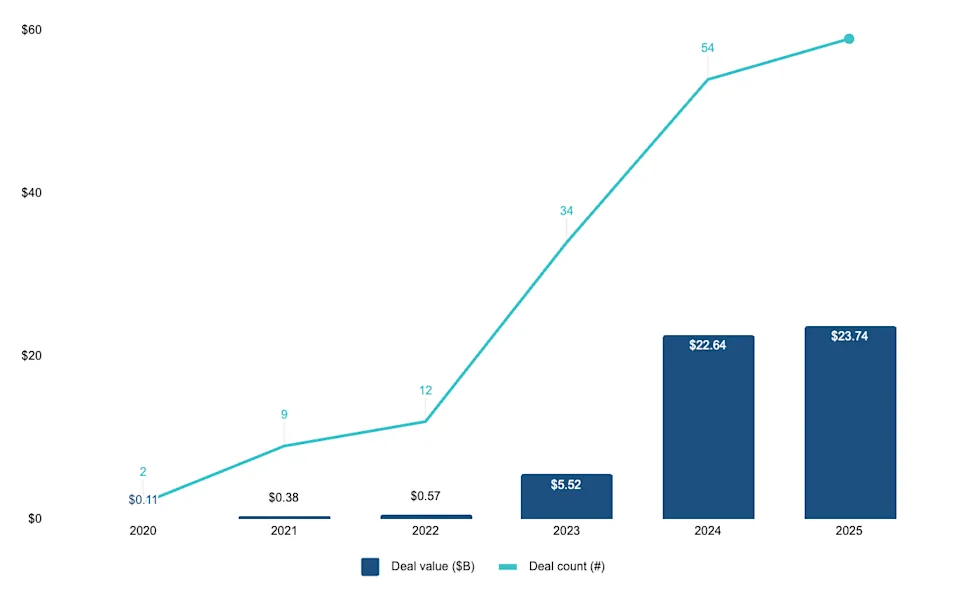

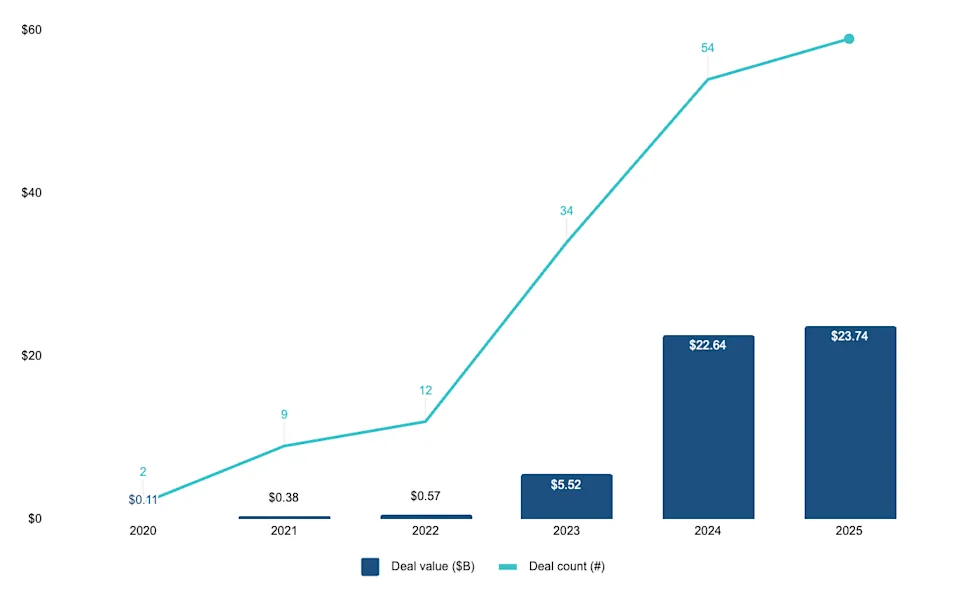

At the same time, Wall Street is probing Nvidia’s aggressive AI deal machine. PitchBook data show:

- 59 deals worth about 23.7 billion dollars in 2025 so far.

- Roughly 53 billion dollars across about 170 AI deals between 2020 and 2025.

Recent headline transactions include:

- Up to 10 billion dollars from Nvidia and 5 billion dollars from Microsoft into Anthropic, with Anthropic committing to buy roughly 30 billion dollars of Azure compute.

- About 6.6 billion dollars into OpenAI, alongside a wider commitment that could reach 100 billion dollars over time.

- Around 6 billion dollars into Elon Musk’s xAI.

The circular nature of some deals, where Nvidia invests in customers that in turn pledge very large compute purchases, has drawn criticism from some analysts as “murky” and potentially demand inflating. Others argue it is a rational way to lock in long term ecosystem dominance while competitors scramble to catch up.

For markets, the message is simple: if Nvidia’s guidance and customer commentary still point to strong, visible AI demand, the recent tech pullback may be seen as a shakeout. A softer tone on orders, power constraints or capex plans could revive bubble fears.

Alphabet leads mega cap bounce

Tech leadership was mixed, but Alphabet stood out. The stock jumped around 3% to 4%, hitting a fresh all time high as investors cheered ongoing progress in its next generation AI platform Gemini 3 and a new 4.3 billion dollar stake from Berkshire Hathaway.

The Alphabet rally helped pull the broader tech complex off the lows after several sessions of heavy selling in AI and software names.

Bitcoin leverage blow up deepens risk aversion

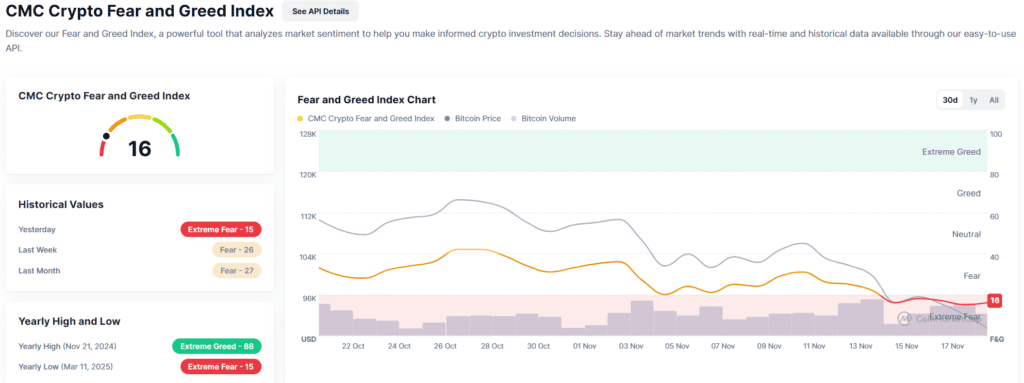

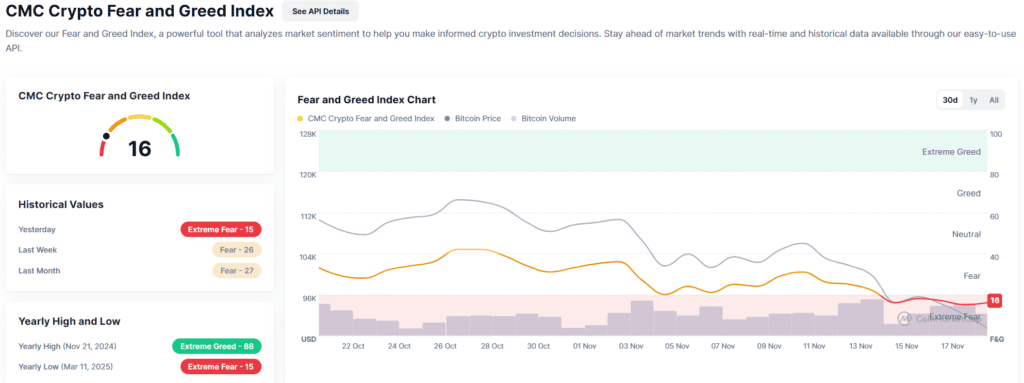

In the background, crypto remains a major stress point.

Bitcoin has fallen from record highs above 126,000 dollars in early October to briefly trade below 90,000 dollars, a drop of almost 30% that has erased all of its gains for 2025 and pushed sentiment into “extreme fear” territory.

The slide has:

- Triggered a “death cross” between the 50 day and 200 day moving averages.

- Knocked Bitcoin spot ETFs from strong inflows to nearly flat over the past two weeks.

- Left leveraged dip buyers deeply underwater while still paying funding costs.

Crypto exposed stocks such as Coinbase, Robinhood, miners and Strategy (formerly MicroStrategy) have sold off sharply, but so far the damage has been mostly contained to crypto, high beta tech and speculative AI plus crypto stories.

Traders worry that further forced selling in leveraged crypto positions and structured products could spill over into equities through margin calls and a broader hit to risk appetite, especially with volatility already elevated.

Macro backdrop: Fed minutes and jobs data still ahead

Beyond Nvidia, investors are watching the macro calendar closely:

- Fed October meeting minutes are due later Wednesday and will be scanned for clues on how divided policymakers are on further rate cuts.

- No October jobs report: The Bureau of Labor Statistics has confirmed it will not publish the October jobs report, forcing markets to rely on private-sector indicators and Thursday’s delayed September release instead. That leaves investors partially blind on the most important labor metric of the month, just as volatility spikes.

Markets have already pulled back expectations of a December rate cut from near certainty to roughly a coin flip. Stronger than expected jobs data would reinforce the case for patience at the Fed. Clear softening in employment and wages could revive the dovish narrative if risk markets are still under pressure.

Stocks are trying to stabilize after their worst stretch in a month, helped by an Alphabet driven tech rebound and modest dip buying. At the same time, Bitcoin’s crash, rising AI bubble chatter and questions about Nvidia’s circular AI investments are keeping nerves high.

The next 12 to 48 hours are critical. Nvidia’s earnings, the Fed minutes and the delayed jobs report will decide whether this is just a healthy correction in an expensive AI-driven market, or the start of a deeper reset in risk assets.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.