US markets tumbled on Thursday, erasing the early-week optimism that followed signs of a shutdown deal, as investors confronted a messy reopening of government, missing economic data, renewed rate-cut doubts, and a sharp rotation out of mega-cap tech.

‘It’s a great day’ – Trump signs bill to end longest shutdown in US history

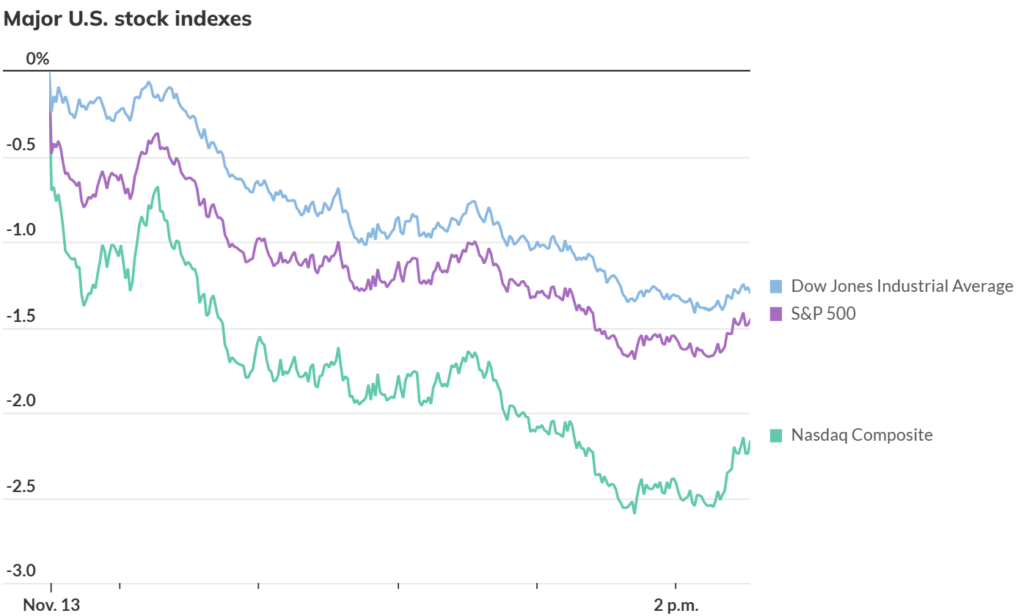

The S&P 500 slid 1.6%, the Nasdaq dropped 2.5%, and the Dow fell 650 points, breaking a four-day winning streak. The sell-off accelerated into the afternoon as heavyweight AI names, Nvidia, Tesla, Broadcom, and Alphabet, sank on valuation worries and rising uncertainty around monetary policy.

Shutdown Ends — But Key Data May Be Lost Forever

President Trump officially signed the funding bill Wednesday night, ending the 43-day shutdown, the longest in US history. But the reopening revealed a new problem: critical October economic reports may never be released.

- No unemployment rate for October, the first data cancellation of its kind in 77 years.

- October CPI and payrolls are also at risk of being permanently lost.

- White House officials warned the shutdown could shave 1–2 percentage points off Q4 growth.

Economists say GDP impact will be modest, but the missing data leaves the Federal Reserve flying blind just weeks before its December meeting.

With no inflation or labor reports to anchor expectations, markets sharply reduced the probability of a December rate cut from nearly 63% to under 50% in a single day.

Tech Cracks as Investors Rotate Out of AI

The end of the shutdown failed to calm markets. Instead, tech stocks — especially AI beneficiaries — saw their steepest declines in a month.

- Nvidia plunged 4.7%

- Tesla sank 7.6%

- Broadcom fell 5.4%

- Alphabet slipped while Disney dropped nearly 8% after mixed earnings

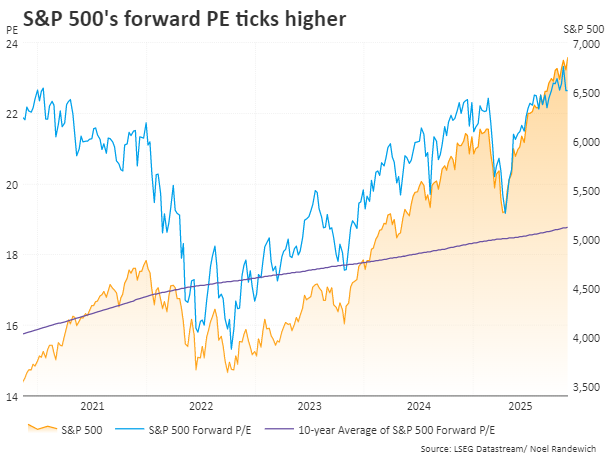

Analysts said the rotation — into healthcare, consumer staples, and energy — marks the first meaningful attempt by investors to move out of overcrowded, high-multiple AI trades.

The Nasdaq also broke below its 50-day moving average, a key technical level it had held since April.

“This is a healthy consolidation,” said Ron Albahary of Laird Norton. “AI capex will pay off long-term, but we’re still waiting for the real economic benefits.”

“Buy the Rumor, Sell the News” Hits the Market

Earlier in the week, optimism surged as Congress made progress on the shutdown bill. But Thursday’s drop mirrored a classic market reaction: the relief rally faded once the expected event — reopening — actually occurred.

Markets are now:

- pricing in fewer rate cuts,

- facing missing economic reports,

- and watching corporate layoffs continue to rise.

Consumer sentiment has fallen to its lowest since mid-2022.

Big Movers: Winners and Losers

Losers:

- Mega-cap tech, especially AI, Semiconductor names, Consumer discretionary

- Disney on earnings worries and a brewing distribution fight with YouTube TV

Winners: Healthcare, Energy, Value stocks,

Cisco jumped 5% after raising its full-year revenue outlook

The S&P Value Index is up 1.4% this week, while the Growth Index is down 0.7%, highlighting the dramatic shift.

What’s Next?

Markets will now watch:

- Whether October CPI, payrolls, or unemployment can be reconstructed

- Fed speakers, who remain divided on inflation vs. growth

- Nvidia earnings next week — considered a “sentiment reset” for the AI trade

- How quickly government agencies can restore modeling, forecasting, and publishing systems

With the shutdown finally over but data missing and rate-cut hopes fading, traders expect higher volatility in the coming weeks.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.