Applied Materials (NASDAQ: AMAT) reports its fiscal Q4 2025 earnings today after the bell, and expectations are riding a fine line between optimism around AI-driven chip demand and caution over China-related export headwinds.

The company has already warned that tighter US export controls may shave hundreds of millions off future sales, but investors are still betting on resilient demand for tools that power advanced semiconductors—especially high-bandwidth memory (HBM) and AI chips.

The stock is up ~40% year to date and trading near all-time highs. Now the question is: can AMAT back that rally with solid results and forward-looking confidence?

Street Forecast: Slight YoY decline, but guidance in focus

| Metric (Q4 FY2025) | Consensus Estimate | YoY Change |

|---|---|---|

| Revenue | ~$6.7 billion | –5% |

| Non-GAAP EPS | ~$2.11 | –9% |

Analyst expectations land right in the middle of AMAT’s own guidance range of $6.2–$7.2 billion in revenue and $1.91–$2.31 EPS. This quarter will likely be less about a surprise beat and more about commentary on what’s next for 2026.

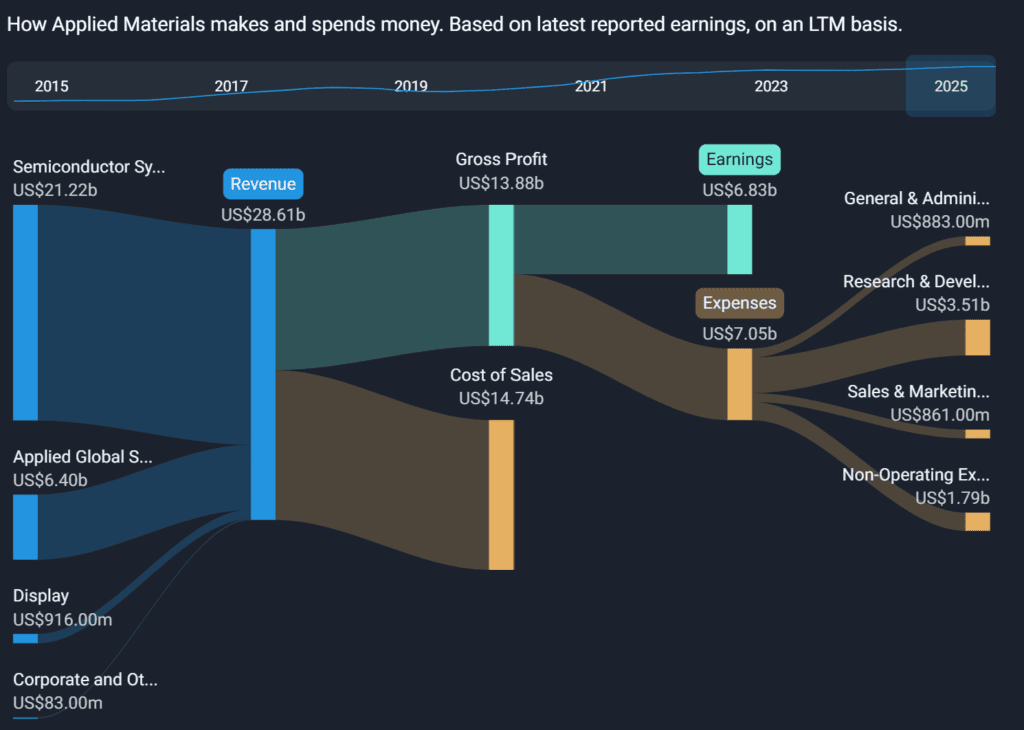

Semiconductor Systems: All Eyes on AI and Memory Spend

This is AMAT’s largest segment (~70% of sales), and it’s where the AI boom is most visible. Analysts expect ~$4.75 billion in Systems revenue, down 8% YoY.

While general chip demand has been lumpy, Applied’s exposure to DRAM, NAND, and HBM tools has been a bright spot. The company is benefiting from surging orders tied to AI training workloads, even as traditional logic and foundry customers manage capex cautiously.

Prediction: Systems revenue comes in at ~$4.8B, with strong AI-related orders offsetting softer traditional memory/tooling demand.

Global Services and Display: Stability Plus a Surprise Bump

The Applied Global Services unit (spare parts, maintenance) is expected to hold steady around $1.6 billion—flat YoY. This unit offers high-margin, recurring revenue and tends to be resilient in down cycles.

Interestingly, the Display and Adjacent segment is set for a surprising ~66% jump from last year, likely thanks to deferred orders finally shipping and signs of recovery in OLED and mobile display investments.

Prediction: Steady Services revenue, with a better-than-expected print from Display adding a positive surprise.

China and Trade Headwinds: $600M Drag Ahead?

Geopolitics is the wildcard. The Trump administration’s updated export controls—restricting shipments to Chinese chipmakers and expanding the entity list—hit AMAT directly. The company already said the new rules will cost it ~$110 million in Q4 revenue and could cut $600 million from fiscal 2026 sales.

China was nearly 35% of AMAT’s Q3 sales, so the loss of licenses and paused orders from Chinese fabs could weigh heavily if restrictions persist.

Investors will be watching for:

- Updates on any U.S. export license approvals

- Guidance on how much China sales are baked into 2026 plans

- Commentary on demand from domestic (U.S.) and Taiwan fabs

Prediction: No major resolution on China this quarter; management remains cautious and reiterates ~$600M FY26 impact.

The AI Semiconductor Supercycle: Still Intact?

AI infrastructure demand continues to drive tool orders across the chip supply chain. HBM3 memory, AI accelerators, and 3D packaging techniques are all ramping, and AMAT is uniquely positioned in areas like etching, deposition, and inspection for cutting-edge nodes.

Major foundries like TSMC and Samsung are running near full capacity for AI-related chips, and hyperscalers are plowing billions into custom silicon. This long-term thesis remains bullish.

Prediction: AMAT reinforces confidence in multi-year AI growth, with particular strength in memory and advanced logic tooling.

Investor Sentiment: Bullish but Watching Export Risks

Wall Street remains largely positive:

- Morgan Stanley, BofA, Barclays have price targets above $245 and rate the stock Overweight.

- Bulls point to strong pricing power, leading-edge exposure, and expanding gross margins.

- Bears worry about order lumpiness and China dependence. CFRA recently lowered its PT to $167, citing lingering export concerns.

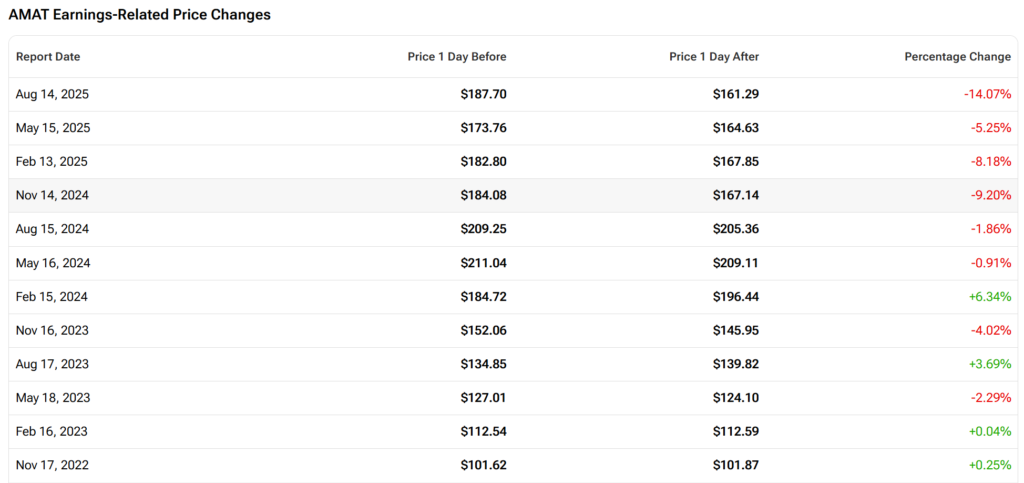

Options imply a post-earnings move of ~4%. The bar is not especially high—but guidance and tone will drive the stock’s direction.

Execution Strong, But Politics Still Cloud the Picture

Applied Materials is executing well operationally and has exposure to all the right tech trends—AI, HBM, 3D packaging, energy-efficient chips.

But investors know that no matter how strong the demand is, geopolitical friction can still derail growth. This quarter is likely to be inline with expectations, but commentary on 2026 China sales and AI order momentum will matter most.

Our call: AMAT delivers around $6.7B revenue and $2.11 EPS, as Wall Street estimated. No major upside surprise, but sentiment stays positive if management shows confidence in 2026 despite export pressure.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.