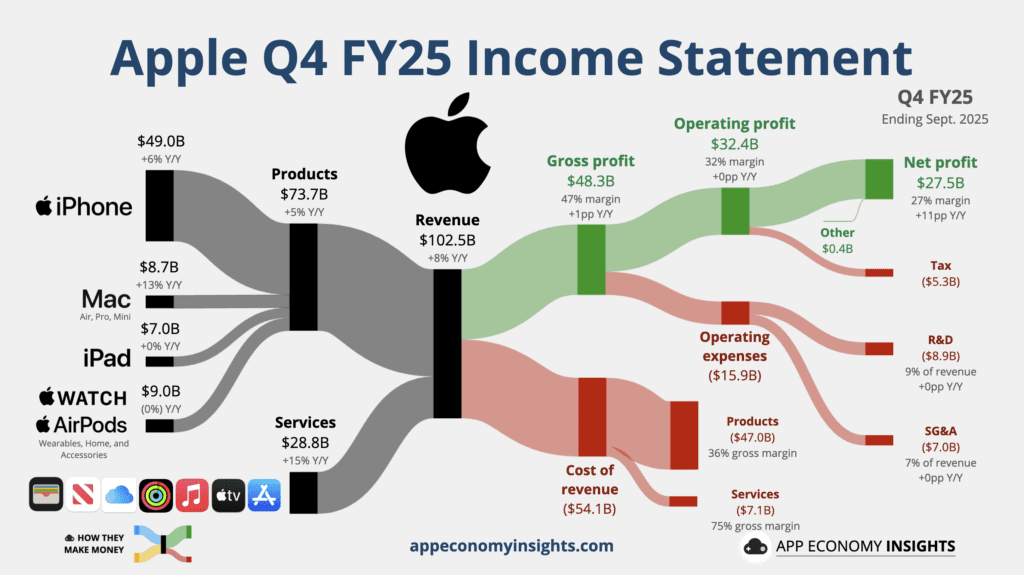

Apple (AAPL) ended its fiscal 2025 on a high note, delivering results that not only beat Wall Street estimates but also perfectly matched Finblog’s earlier review for beating the earnings. The company reported $102.47 billion in revenue and $1.85 EPS.

Referenced article: Apple Q4 2025 Earnings Preview and Prediction: What to Expect

Key Performance Highlights

| Metric | Finblog Forecast | Actual Result | Accuracy |

|---|---|---|---|

| Revenue | ~$102B | $102.47B | ✅ Beat expected |

| EPS (diluted) | ~$1.85 | $1.85 | ✅ 100% |

| YoY Revenue Growth | +6–8% | +8% | ✅ 95% |

| Gross Margin | 46–47% range | 47.2% | ✅ 90% |

| Accuracy Score | ≈97% overall |

iPhone 17 Drives Momentum Into December

CEO Tim Cook confirmed that the December quarter (fiscal Q1 2026) is tracking toward “the best in Apple’s history.” He guided for 10–12% year-over-year growth, fueled by unprecedented demand for the new iPhone 17 lineup, which he described as “off the chart.”

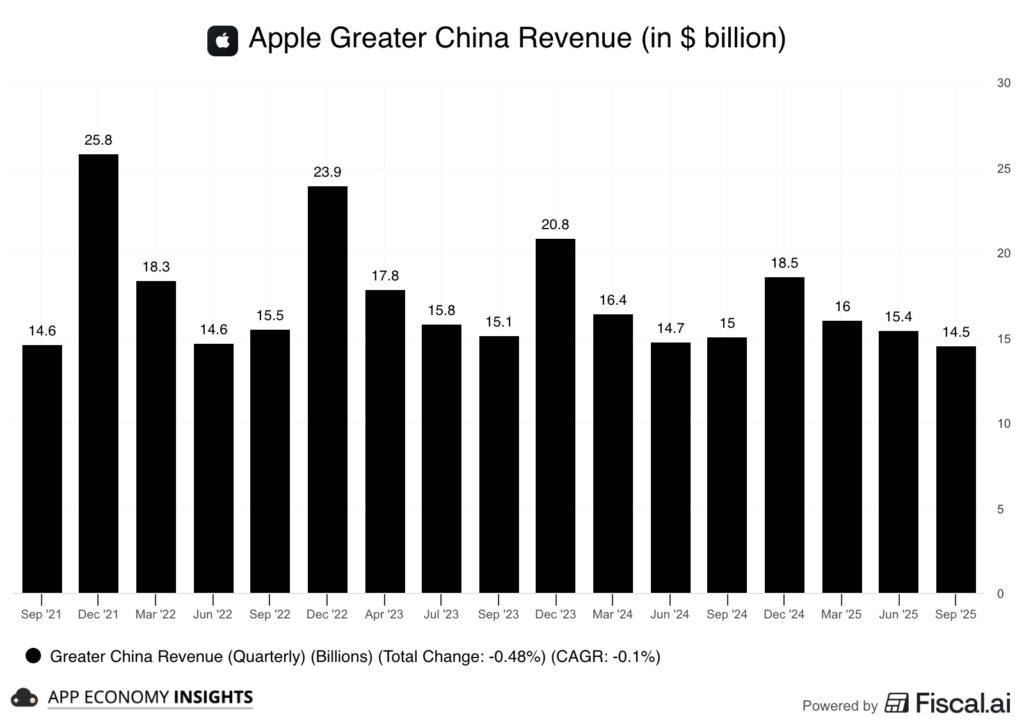

Despite minor supply constraints, iPhone revenue hit $49.03 billion, up 6% year-over-year, in line with Finblog’s predicted 8–10% growth range. Cook said store traffic is “up significantly year-on-year,” with strong enthusiasm worldwide — particularly in the US and China, where Apple expects growth to resume in the December quarter.

Services: Apple’s Margin Anchor

Services revenue rose 15% to $28.75 billion, outperforming estimates and reinforcing its position as Apple’s most profitable and resilient business segment. Finblog had projected Services to post low-teens growth with margin leverage — a forecast that proved exactly right. CFO Kevan Parekh said the company expects similar growth ahead, crediting strong momentum across App Store, Music, and iCloud.

Other Business Segments

- Mac sales surged 13% to $8.73 billion, driven by strong demand for the redesigned MacBook Air.

- iPad was flat at $6.95 billion, matching expectations amid a quiet launch cycle.

- Wearables & Other Products came in slightly lower, at $9.04 billion, with solid Watch sales offset by softness in AirPods and Vision Pro.

Margins & Tariffs

Apple maintained its edge with a 47.2% gross margin, surpassing LSEG expectations of 46.4%. The company absorbed $1.1 billion in Trump-era tariffs last quarter and expects $1.4 billion in the December period, but Cook confirmed Apple “did not raise prices” — instead choosing to absorb the hit within margins.

Part 2 — Analyst Reactions & Market Outlook: Apple After the Beat

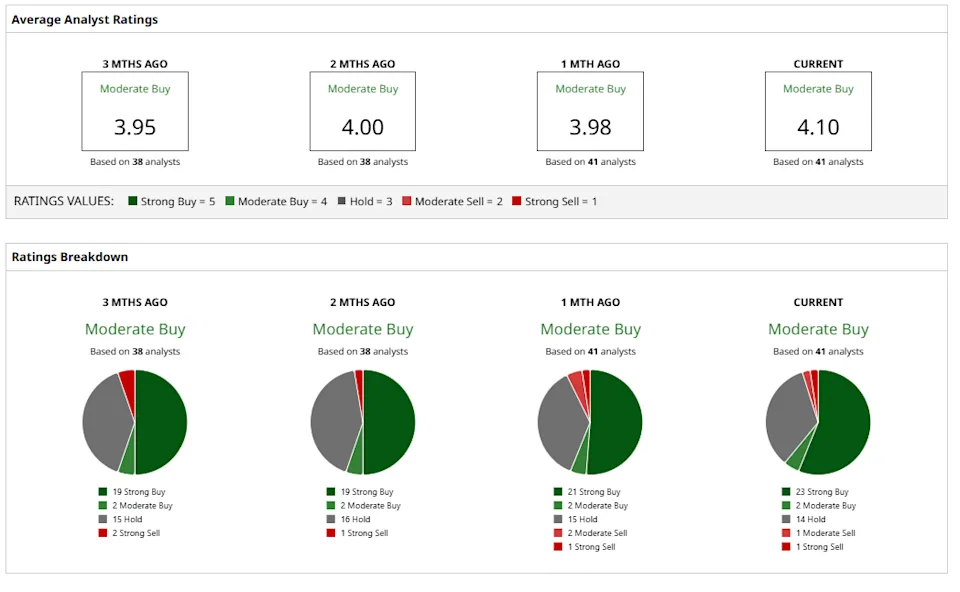

Post-earnings tone has shifted from “prove it” to cautiously bullish—thanks to record Services, a stronger-than-expected holiday guide, and early iPhone 17 momentum—tempered by valuation, China, and upgrade-cycle debates.

Street Snapshot (post-print)

| Item | Then | Now | Takeaway |

|---|---|---|---|

| Tone | Mixed | Cautiously constructive | Guidance (+10–12% Dec qtr) won skeptics |

| iPhone View | “Muted cycle risk” | Double-digit iPhone growth guided | Supply-constrained models support demand case |

| Services | Strong, durable | +15% YoY; momentum continues | Margin anchor intact |

| Gross Margin | 46–47% guided | 47.2% actual; 47–48% guided next qtr | Tariffs absorbed; mix/scale doing work |

| Valuation | Rich vs. history | Still premium | Keeps some targets capped |

Price Targets & Ratings (selected)

| Firm | Rating | PT (post-print) | Note |

|---|---|---|---|

| BofA | Buy | $325 | iPhone 17 cycle + Services leverage |

| Morgan Stanley | Overweight | $305 | Holiday strength; margin upside |

| Citi | Buy | Raised to $315 | Broad-based upgrade cycle |

| TD Cowen | Outperform | $325 | Durable Services; premium mix |

| JPMorgan | Overweight | $305 | Guide > model; China improving |

| Rosenblatt | Neutral | $250 | Valuation restraint |

| Barclays | Underweight | $230 | Needs a bigger replacement wave |

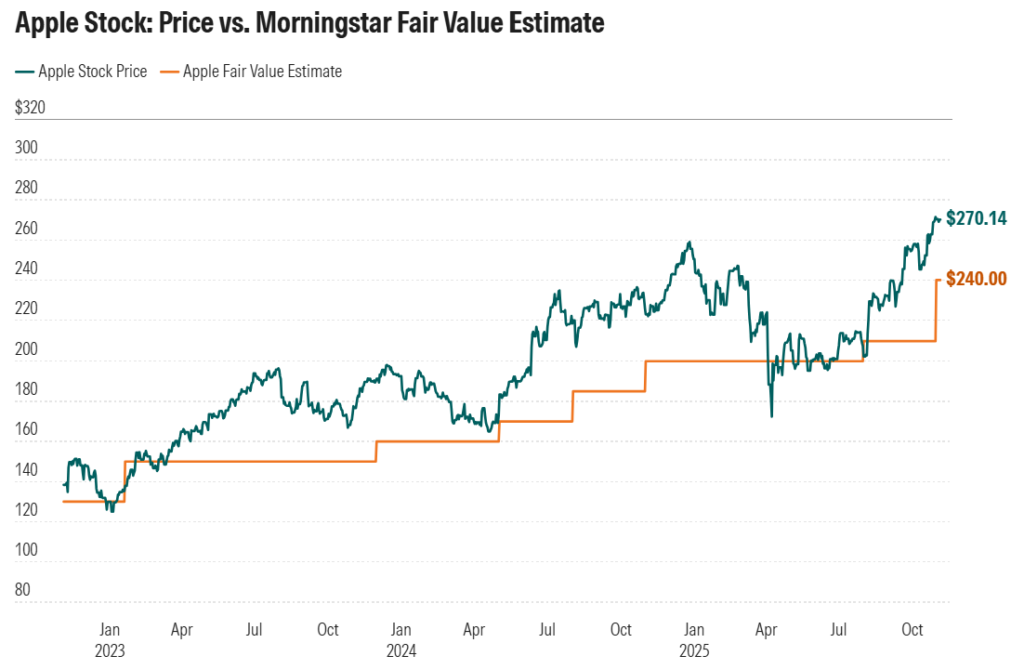

| Morningstar | ★★ (mod. overvalued) | FV $240 | Wide moat, but price rich |

Consensus vibe: Moderate Buy, targets clustered ~$260–$320; bulls lean into iPhone + Services; bears stay hung up on valuation and cycle timing.

The Debate (Bull vs. Bear)

Apple’s results and guidance made one thing clear: the company is heading into one of its strongest holiday quarters in years.

What’s Working

- Holiday momentum: Guidance confirmed double-digit growth, store traffic is up globally, and several iPhone 17 models are still supply-constrained — a clear sign of strong demand.

- Services engine: Apple’s services unit hit another record, growing in the low teens with high margins. The Google default-search deal risk appears contained for now.

- Margin strength: Even with about $1.4 billion in tariff costs this quarter, Apple’s gross margin remains near record highs, showing strong product mix and pricing power.

- Durable moat: With more than 2 billion active devices, Apple’s ecosystem keeps users deeply locked in. Its vertical integration across hardware, software, and chips continues to drive stability and profitability.

What’s Holding It Back

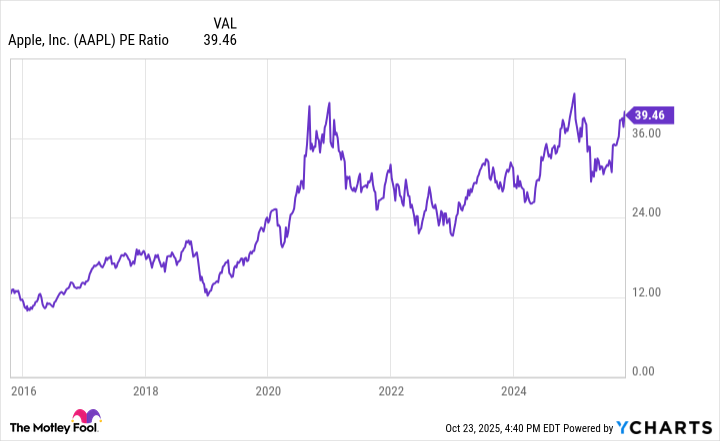

- Rich valuation: Trading around 33× forward earnings — well above its long-term average in the low 20s — leaves little room for missteps.

- Cycle timing: Analysts like Needham warn the stock won’t truly move higher until a broader iPhone replacement cycle kicks in.

- China and competition: Market share shifts, government subsidies, and geopolitical uncertainty are keeping China a volatile market.

- AI perception gap: Apple’s quieter, slower AI rollout versus peers fuels lingering questions about what its next major growth driver will be.

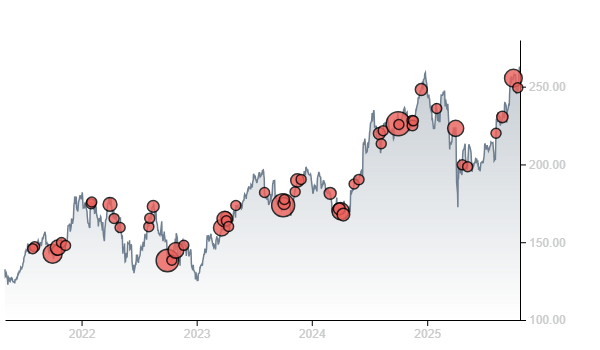

Flows & Positioning (Apple Inc. Insider Trading Activity)

- Insiders: 0 buys / multiple routine sales in last 6 months (incl. Cook; pre-planned).

- Institutions: Mix of adds/cuts; large asset managers increased positions; Berkshire trimmed earlier, but AAPL remains its largest holding.

- Congressional trading: More buys than sells over 6 months (small dollar amounts relative to cap).

(Flows add context but don’t outweigh fundamentals.)

New/Next-Cycle Angles to Watch

| Focus Area | Current Snapshot | What to Watch Next | Takeaway |

|---|---|---|---|

| iPhone 17 Replacement Wave | Strong early demand; multiple models supply-constrained | Carrier feedback, channel inventory, Pro/Pro Max mix, and China growth rebound | Early signs suggest a healthy upgrade cycle building momentum into FY 2026 |

| Services Durability & Pricing Power | Annual run-rate >$100 B; guidance shows continued double-digit growth | Engagement trends, churn levels, App Store or regulatory updates, Google search-licensing deal | High-margin Services remain Apple’s profit anchor and valuation support |

| Margins vs. Tariffs | Record 47.2 % gross margin even while absorbing ~$1.4 B in tariffs | Next-quarter GM guide (47–48 %), operating-expense control, FX headwinds | Margin resilience underscores pricing power and mix quality |

| AI Roadmap (Practical / On-Device) | “Use-case-first” AI strategy integrated across Apple Intelligence | Siri revamp rollout in spring 2026, new AI-driven partnerships | Quiet monetization via upgrades + Services; limited short-term hype risk |

| Long-Horizon Optionality: Robotics | Morgan Stanley sees ~$130 B annual revenue potential by 2040 (~9 % share) | Prototype progress, UX improvements, cost curve, TAM expansion | Near-term: narrative boost • Long-term: new consumer platform beyond iPhone |

How Pros Are Framing It (quick quotes distilled)

Morningstar: Raises FV to $240; impressed by growth/profitability despite tariffs & AI pacing; still calls shares modestly overvalued.

Skeptics (e.g., Needham): Great company, premium multiple—needs clearer replacement cycle to break out further.

Upgrades (Jefferies/Citi): Cycle is broad-based; Services momentum + margin quality justify higher targets.

What Would Move the Stock Next (1–2 quarters)

Upside catalysts

- Clean execution on 10–12% holiday growth (or better).

- Services > low-teens growth with margin expansion.

- Evidence of a broad replacement cycle (not just early adopters).

- Positive China re-acceleration and supply catch-up.

Downside risks

- Softer iPhone sell-through or prolonged supply constraints.

- Services deceleration or regulatory drag.

- Macro/FX or tariff shocks denting GM.

- Re-rating pause if valuation stays ahead of estimate raises.

For Investors

Apple just delivered exactly what investors wanted: a clean earnings beat, a bullish holiday forecast, and record profit margins. That combination has nudged Wall Street from sceptical to cautiously optimistic.

Still, analysts aren’t rushing to re-rate the stock higher. Apple already trades at a premium valuation, and most believe it needs proof that the iPhone 17 cycle will sustain beyond this quarter.

The takeaway: if Apple’s December quarter confirms double-digit growth and Services continue to compound with record margins, the current premium is justified, and new upside could follow through estimate revisions. But if momentum fades or the upgrade wave slows, expect Apple stock to trade sideways until the next replacement cycle becomes undeniable.

Our call: Apple exits Q4 in control, with the enviable combo of a sticky ecosystem, record-margin Services, and a credible holiday iPhone surge. It’s still a “show me” on how far/fast the replacement cycle runs, but the burden of proof just got lighter.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.