More than 40% of individuals miss valuable tax-saving opportunities simply because they lack a clear tax plan. Tax planning is more than a yearly scramble before filing season; it shapes how much you keep and how much you owe. Whether you are an entrepreneur or managing household finances, understanding the core principles of tax planning can help you minimize liability, stay compliant, and improve your financial well-being.

Table of Contents

- Tax Planning Defined And Core Principles

- Types Of Tax Planning Strategies Explained

- How Tax Planning Works In Practice

- Legal Requirements And Regulatory Framework

- Common Pitfalls And Errors To Avoid

- Maximizing Tax Savings: Pro Tips

Key Takeaways

| Point | Details |

|---|---|

| Effective Tax Planning | Involves strategies to minimize tax liabilities while ensuring compliance with tax laws. A thorough understanding of tax regulations is crucial for successful implementation. |

| Core Strategies | Key approaches include tax saving, avoidance, payment deferment, and credit optimization, all aimed at optimizing financial performance. |

| Common Pitfalls | Important to avoid mistakes like inaccurate record keeping and missed deductions, which can undermine tax efficiency. |

| Professional Guidance | Consulting with a qualified tax professional helps tailor strategies to individual financial circumstances, enhancing compliance and effectiveness. |

Tax Planning Defined and Core Principles

Tax planning is a strategic approach to managing your financial resources that aims to minimize tax liability while remaining fully compliant with legal requirements. According to tax.kenan.unc.edu, effective tax planning involves carefully designed strategies that help individuals and businesses optimize their financial performance through legal tax management techniques.

At its core, tax planning encompasses several key principles that guide financial decision-making. These principles include:

- Tax Conversion: Transforming income or assets into more tax-efficient forms

- Tax Shifting: Legally redistributing income to family members or entities with lower tax rates

- Tax Deferral: Strategically delaying tax payments to optimize current financial positioning

Successful tax planning requires a comprehensive understanding of current tax laws, potential deductions, and proactive financial management. By aligning tax strategies with broader financial goals, individuals can potentially reduce their overall tax burden while maintaining full legal compliance.

To develop an effective tax planning approach, consider working with a qualified tax professional who can provide personalized guidance tailored to your specific financial situation. Understanding tax implications of investing can further enhance your financial strategy and help you make more informed decisions about managing your tax liability.

Types of Tax Planning Strategies Explained

Tax planning strategies are sophisticated approaches designed to help individuals and businesses optimize their financial position while maintaining legal compliance. According to research from ijsrp.org, there are five primary tax planning strategies that can significantly impact financial management.

Five Core Tax Planning Approaches

The key tax planning strategies include:

Here’s a summary of the five key tax planning strategies:

| Strategy | Main Objective | Core Actions |

|---|---|---|

| Tax Saving | Reduce tax liability legally | Deductions Exemptions Allowances |

| Tax Avoidance | Minimize exposure within legal bounds | Financial structuring Timing transactions |

| Avoiding Tax Sanctions | Prevent penalties | Compliance Accurate reporting |

| Tax Payment Deferment | Optimize timing of tax payments | Delaying payments Deferral tactics |

| Tax Credit Optimization | Maximize available tax credits | Claim credits Optimize eligibility |

- Tax Saving: Proactively identifying legal methods to reduce overall tax liability

- Tax Avoidance: Structuring financial activities to minimize tax exposure within legal boundaries

- Avoiding Tax Sanctions: Ensuring compliance to prevent potential penalties

- Tax Payment Deferment: Strategically timing tax payments to optimize financial positioning

- Tax Credit Optimization: Maximizing available tax credits to reduce overall tax burden

Furthermore, escholarship.org provides deeper insights into three fundamental tax planning techniques: conversion, shifting, and deferral. These strategies involve transforming income, redistributing tax liability, and strategically timing tax payments to create maximum financial efficiency.

To enhance your tax planning approach, consider understanding tax-efficient investing as a complementary strategy. Professional guidance can help you navigate these complex strategies, ensuring you make informed decisions that align with your unique financial goals and legal requirements.

How Tax Planning Works in Practice

Tax planning transforms theoretical strategies into practical financial management techniques that can significantly impact an organization’s bottom line. According to research from dinastipub.org, tax planning directly influences financial performance by creating systematic approaches to minimize tax liabilities while maintaining legal compliance.

Key Practical Implementation Strategies

In practice, tax planning involves several critical steps:

- Comprehensive Financial Analysis: Thoroughly examining current financial structures

- Strategic Income Timing: Strategically scheduling income recognition

- Expense Management: Identifying and maximizing potential deductions

- Investment Portfolio Optimization: Selecting tax-efficient investment vehicles

- Retirement Account Utilization: Leveraging tax-advantaged retirement planning options

Research from journal.lembagakita.org highlights that successful tax planning goes beyond simple cost reduction. It requires a holistic approach that integrates tax strategies with broader financial goals, potentially improving overall economic performance for individuals and businesses.

To further refine your approach, understanding tax loss harvesting can provide additional insights into advanced tax planning techniques. Professional tax advisors can help you navigate these complex strategies, ensuring you maximize financial efficiency while remaining fully compliant with current tax regulations.

Legal Requirements and Regulatory Framework

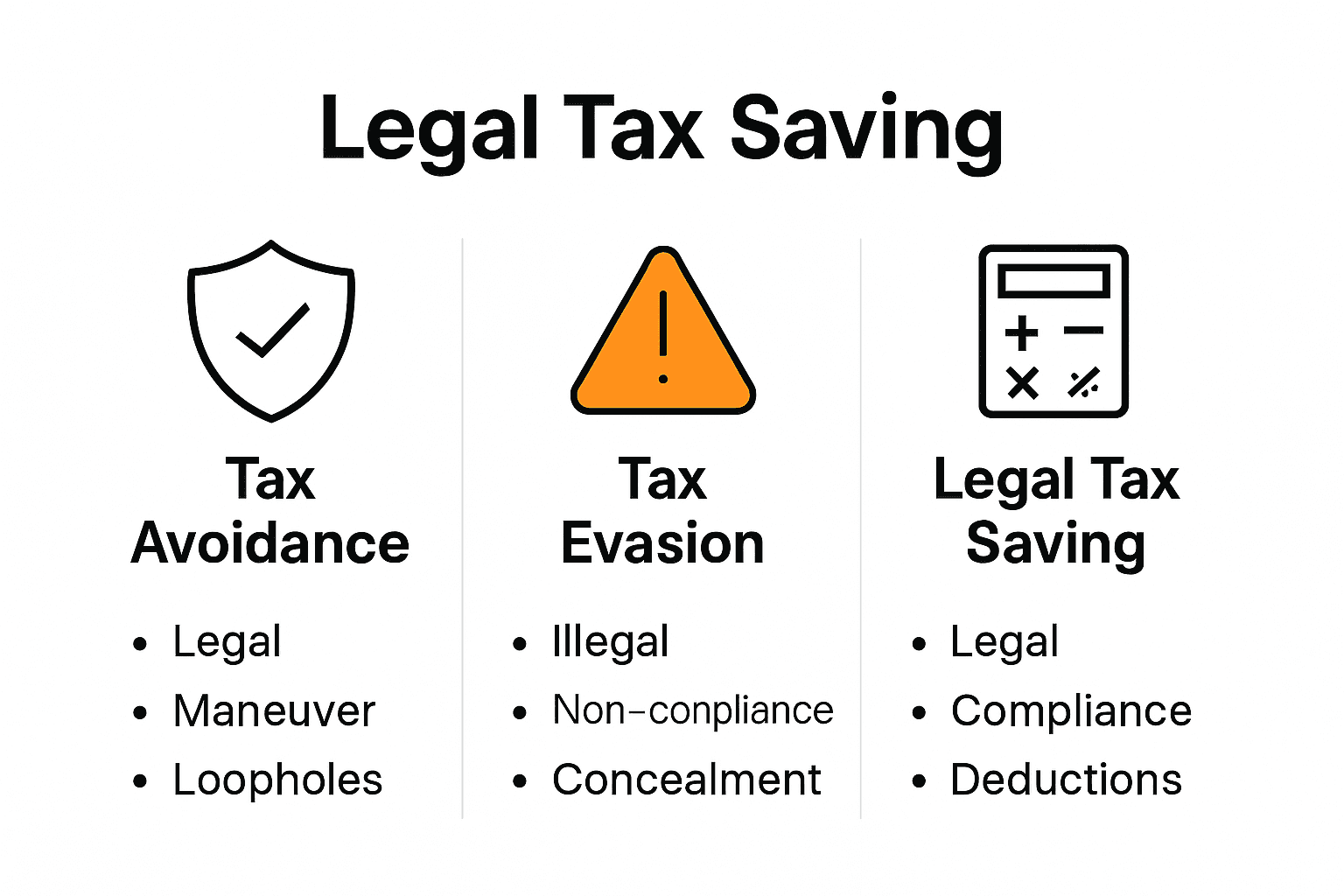

Navigating the complex landscape of tax planning requires a deep understanding of legal boundaries and regulatory frameworks. According to research from dinastipub.org, there is a critical distinction between legal tax avoidance and illegal tax evasion that every individual and business must understand.

Key Legal Considerations in Tax Planning

The fundamental legal principles of tax planning revolve around several crucial elements:

- Compliance: Strictly adhering to existing tax laws and regulations

- Transparency: Maintaining clear and accurate financial documentation

- Intentionality: Demonstrating legitimate business purposes for tax strategies

- Ethical Boundaries: Avoiding aggressive tactics that could be interpreted as tax evasion

- Documented Reasoning: Keeping detailed records that justify tax planning decisions

drpress.org emphasizes that enterprise income tax law provides a structured framework for tax planning, highlighting the importance of understanding the nuanced legal landscape. The key is to develop strategies that optimize financial outcomes while remaining firmly within legal boundaries.

To gain deeper insights into maintaining legal compliance, understanding the fundamentals of a financial plan can provide valuable context for responsible tax strategy development. Consulting with a qualified tax professional remains the most reliable approach to ensuring your tax planning meets all legal requirements and regulatory standards.

Common Pitfalls and Errors to Avoid

Tax planning requires precision and strategic thinking to avoid costly mistakes that could compromise your financial health. According to umatechnology.org, many individuals and businesses fall into predictable traps that can significantly impact their tax efficiency.

Critical Tax Planning Mistakes to Watch

The most common pitfalls in tax planning include:

- Inaccurate Record Keeping: Failing to track income and expenses meticulously

- Missed Deduction Opportunities: Overlooking potential tax credits and incentives

- Inappropriate Entity Structure: Selecting business structures that don’t optimize tax positioning

- Inadequate Retirement Planning: Underutilizing tax-advantaged retirement accounts

- Poor Timing of Financial Decisions: Mismanaging income recognition and expense allocation

accountinginsights.org emphasizes the importance of strategic approaches like bunching itemized deductions and maximizing contributions to tax-advantaged accounts. These techniques can help minimize tax liability and prevent common financial missteps that drain your resources.

To further protect yourself from potential errors, understanding tax loss harvesting can provide additional insights into sophisticated tax management strategies. Working with a qualified tax professional remains the most effective way to navigate complex tax landscapes and avoid potentially costly mistakes.

Maximizing Tax Savings: Pro Tips

Tax savings represent a critical opportunity for individuals and businesses to optimize their financial strategies. According to inaa.org, strategic tax planning can significantly reduce your overall tax burden through targeted approaches and proactive management.

Essential Tax Savings Strategies

Pro-level tax savings techniques include:

- Income Deferral: Strategically timing income recognition to minimize current tax liability

- Expense Acceleration: Front-loading deductible expenses to reduce taxable income

- Credit Optimization: Identifying and maximizing available tax credits

- Income Splitting: Redistributing income across family members or business entities

- Investment Tax Efficiency: Selecting tax-advantaged investment vehicles

umatechnology.org emphasizes the importance of comprehensive strategies like tax-loss harvesting and strategic asset allocation. These advanced techniques can help minimize tax exposure while maintaining robust financial growth.

To further enhance your tax savings approach, budgeting effectively can provide additional insights into managing your overall financial strategy. Consulting with a tax professional remains the most reliable method for developing a personalized, comprehensive tax savings plan tailored to your unique financial circumstances.

Take Control of Your Tax Planning Journey Today

Navigating tax planning can feel overwhelming with all the strategies like tax conversion, deferral, and credit optimization outlined in the article. You want to reduce your tax burden without crossing legal lines or missing critical opportunities. The struggle to balance compliance while maximizing savings is real and deserves expert attention.

At finblog.com, we understand the challenges you face managing complex tax rules and timing decisions to your best advantage. Our tailored financial insights and step-by-step guides help you avoid common pitfalls like missed deductions or poor income timing. Ready to move beyond theory and take practical steps toward smarter tax planning? Explore how to enhance your strategies with actionable advice on understanding tax-implications-of-investing and dive deeper into understanding tax-efficient-investing.

Don’t leave your tax savings to chance. Visit finblog.com now to access expert-led guidance that aligns with your unique financial goals and ensures full legal compliance. Start building your personalized plan and secure your financial future today.

Frequently Asked Questions

What is tax planning?

Tax planning is a strategic approach to managing financial resources that aims to minimize tax liabilities while ensuring compliance with legal requirements. It involves various strategies to optimize financial performance through legal tax management techniques.

What are the main types of tax planning strategies?

The five core tax planning strategies include tax saving, tax avoidance, avoiding tax sanctions, tax payment deferment, and tax credit optimization. Each strategy focuses on different aspects of managing tax liabilities while remaining within legal boundaries.

How can I optimize my tax savings?

You can optimize tax savings by employing strategies like income deferral, expense acceleration, credit optimization, income splitting, and selecting tax-efficient investments. These techniques help minimize your overall tax burden effectively.

What are common mistakes to avoid in tax planning?

Common pitfalls in tax planning include inaccurate record keeping, missed deduction opportunities, inappropriate entity structures, inadequate retirement planning, and poor timing of financial decisions. Avoiding these mistakes can significantly improve your tax efficiency.

Recommended

- Understanding Tax Efficient Investing: How It Works – Finblog

- Understanding the Tax Implications of Investing – Finblog

- Master Financial Planning for Freelancers in 2025 – Finblog

- Understanding Tax Loss Harvesting for Investors – Finblog

- 7 Key Steps in a Tax Planning Checklist for IRS Relief – Unique Solutions to IRS Tax Problems