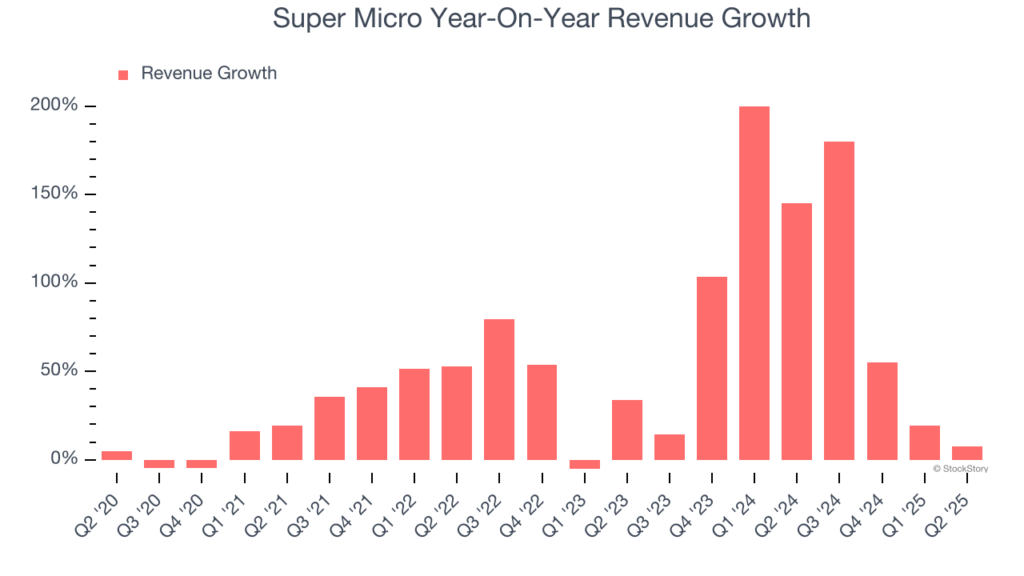

Super Micro Computer (SMCI) is set to report its Q1 2026 fiscal quarter earnings after the bell today, following a volatile stretch for one of the market’s most closely watched AI infrastructure stocks. After rising more than 70% year to date, Supermicro now faces the challenge of living up to sky-high expectations as it navigates supply chain bottlenecks, hyperscaler demand shifts, and tight margins in the AI server arms race.

SMCI pre-announced a sharp guide-down for Q1 revenue, now expected around $5.0B, significantly below its prior $6–7B range. While management attributed the shortfall to shipment timing, Wall Street will be scrutinising margins, order flow, and execution as competition from Dell and HPE intensifies.

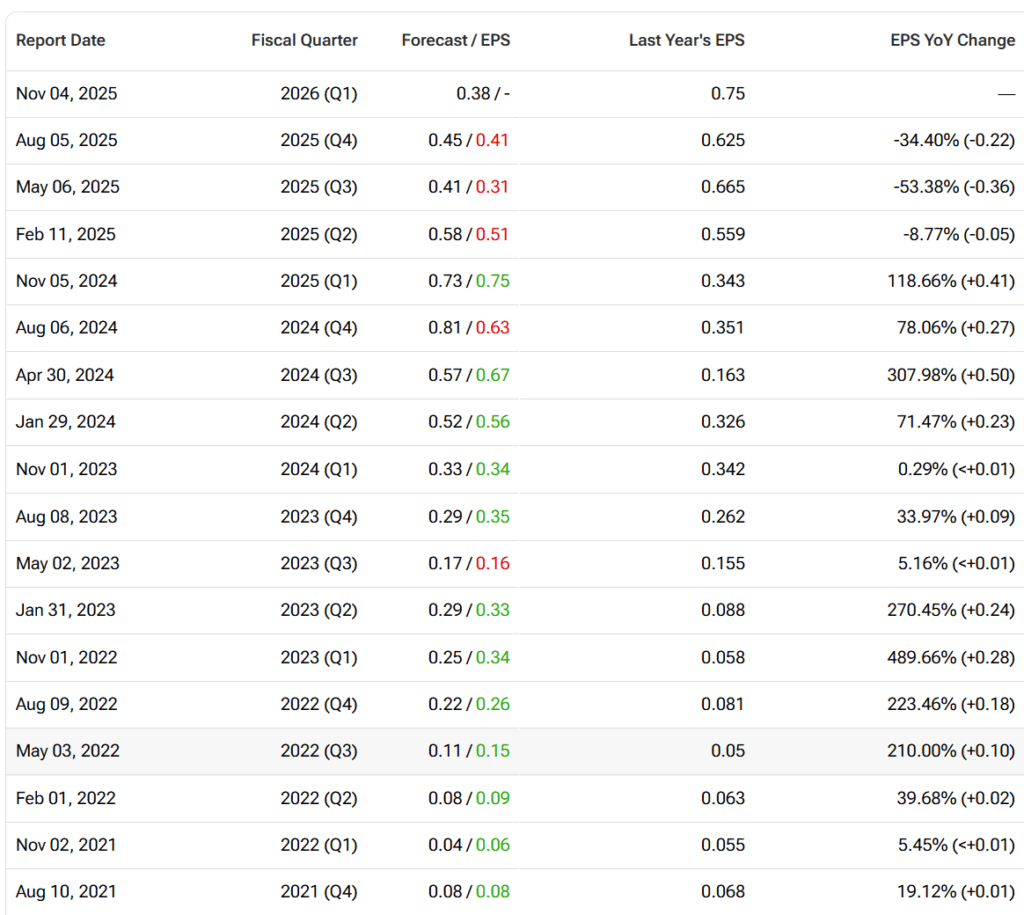

Street Forecast: Revenue Dip, Earnings Compressed

| Metric | Q3 2025 Consensus | Q3 2024 Actual (est.) | YoY Change |

|---|---|---|---|

| Revenue | ~$5.83 billion | ~$5.95 billion* | –2% |

| EPS (non-GAAP) | ~$0.37 | ~$0.74* | –50% |

| Gross Margin (non-GAAP) | ~9.5% | ~13.3%* | –3.8 pts |

*Prior-year estimates are reconstructed based on company filings. Q1 is shaping up as a “reset” quarter — reflecting shipment deferrals, backlog accumulation, and a shifting AI mix.

Prediction: SMCI misses consensus on revenue and EPS, but signals a stronger Q4 AI delivery surge. Stock reaction hinges on visibility into backlog conversion and margin stabilisation.

AI GPU Servers: The Growth Engine, But Delivery Slips

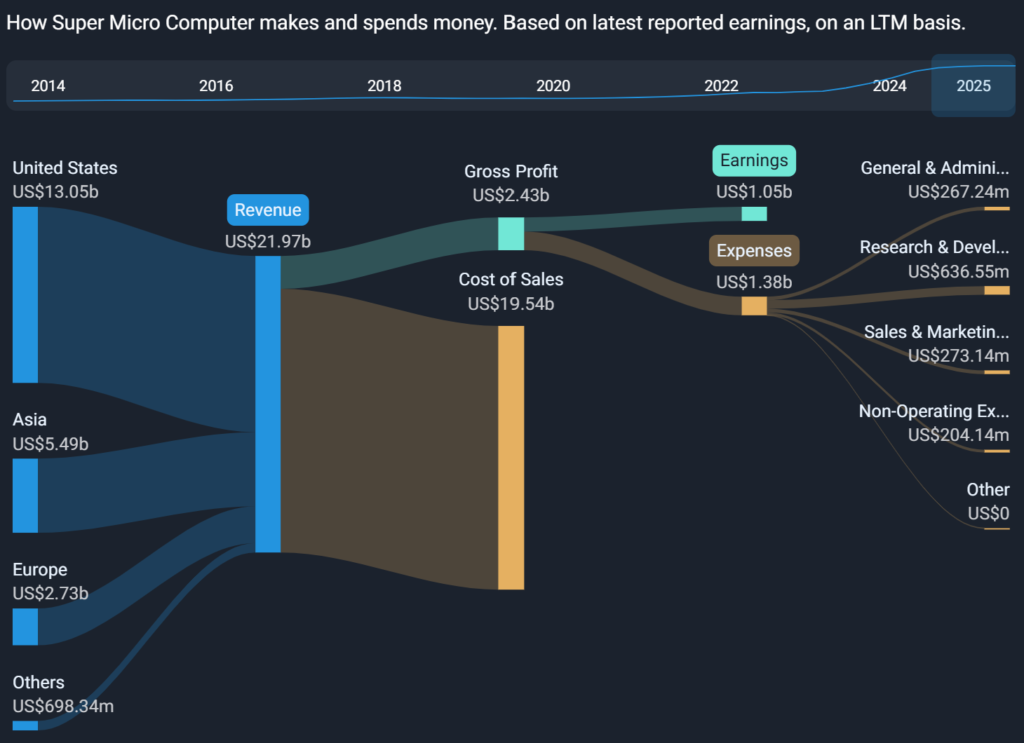

Supermicro’s dominant revenue source now comes from GPU-based AI systems powered by Nvidia’s H100/GB200 and AMD’s MI300 accelerators. Over 70% of revenue last quarter came from AI-optimized servers.

- SMCI recently launched 2OU 8-GPU and liquid-cooled rack-scale systems featuring Nvidia’s Blackwell and AMD’s MI350X chips.

- Management claims over $12 billion in AI design wins, many set to ship in Q4 — but supply chain tightness and customer install readiness delayed fulfillment.

Prediction: Q3 AI server revenue growth is flat or down sequentially. Q4 likely sees a big bounce — if backlog converts on schedule.

Hyperscaler Rack Systems: CoreWeave, xAI, Big Tech Drive Demand

Supermicro’s rack-scale deployments with hyperscalers and startups (e.g., CoreWeave, xAI, Microsoft, AWS) are a strategic focus. These modular “SuperClusters” include compute, networking, and liquid cooling.

- SMCI currently builds ~5,000 racks/month, with AI server density approaching 144 GPUs per rack.

- While the order pipeline remains strong, actual shipments were delayed in Q3 due to GPU allocation and site readiness.

Prediction: Moderate revenue from hyperscaler orders in Q3, but a sharp Q4 ramp expected — particularly in full-rack AI systems.

Storage, Edge, and Legacy Servers: Margin Support Amid Slowdown

While AI systems dominate headlines, Supermicro still generates revenue from:

- Traditional enterprise servers

- Storage systems and JBOD arrays

- 5G, edge, and embedded computing appliances

These segments are more margin-accretive but lower growth, helping offset the margin compression from AI GPU systems.

Prediction: Stable to slightly down YoY revenue contribution from legacy server business. Important ballast for margin stability.

Margins, Inventory, and Execution

Q2 GAAP gross margins fell to just 9.5% as AI rack costs rose and shipment deferrals lowered mix. In Q3, consensus sees a flat margin profile — with slight recovery depending on product mix.

- Inventory remains elevated at ~$4.7B, but CFO noted inventory days actually improved due to higher sales velocity.

- Capex and working capital investment remain high as SMCI pre-builds for future demand.

Prediction: Margins flat to modestly better (9.5–10%). Investors will focus on guidance and inventory trends for Q2.

Competitive Landscape: Can SMCI Stay Ahead of Dell and HPE?

SMCI remains one of Nvidia’s fastest-executing OEM partners, but rivals are catching up:

- Dell and HPE are aggressively pursuing AI server contracts with better financing terms and global scale.

- SMCI differentiates via fast time-to-market, in-house manufacturing, and rack-level integration with liquid cooling.

Still, as hyperscalers diversify vendors, SMCI may face pricing pressure and share dilution — particularly in large deals.

Prediction: SMCI retains key wins but margin tradeoffs continue. Competitive commentary will be key in earnings call Q&A.

Macro and Geopolitics: Tailwinds with Caveats

- Export controls on Nvidia and AMD chips to China affect the entire AI hardware sector — though SMCI is less exposed to China than peers.

- Demand for AI infrastructure remains strong across U.S. and allied markets, but shipment pacing, power availability, and data center construction can delay realization.

Prediction: No macro surprise this quarter. Investors will look for management reassurance that order delays are temporary.

Investor Sentiment: High Expectations, Volatility Ahead

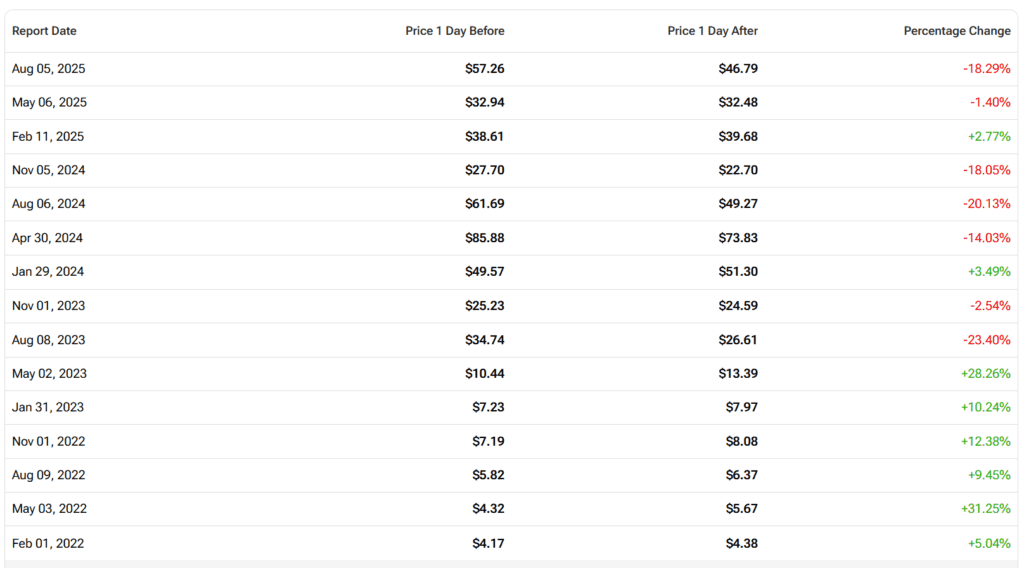

With the stock up ~70% YTD, expectations are elevated. Analyst consensus remains cautious:

- Average price target ~$44, implying ~15% downside from current levels.

- Street ratings: 4 Buys, 8 Holds, 3 Sells.

Options markets are pricing in a ~12% post-earnings move. A big beat or strong Q4 guide could trigger a rally, but a miss could spark a 10–15% decline.

Prediction: Sentiment vulnerable to execution hiccups. Stock reaction will follow margin trends and Q2 guidance.

Can Supermicro Deliver the AI Backlog?

SMCI has positioned itself as a core player in the AI infrastructure buildout — but high growth brings high expectations. This quarter will likely reflect growing pains rather than glory, with delayed revenue recognition and margin pressure. If management reaffirms Q4 strength and FY26 outlook, investors may look past a soft Q3.

Our Call: SMCI modestly misses Q1 expectations but outlines a strong Q2 AI ramp. Stock may trade down initially unless Q2 guidance is notably bullish.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.