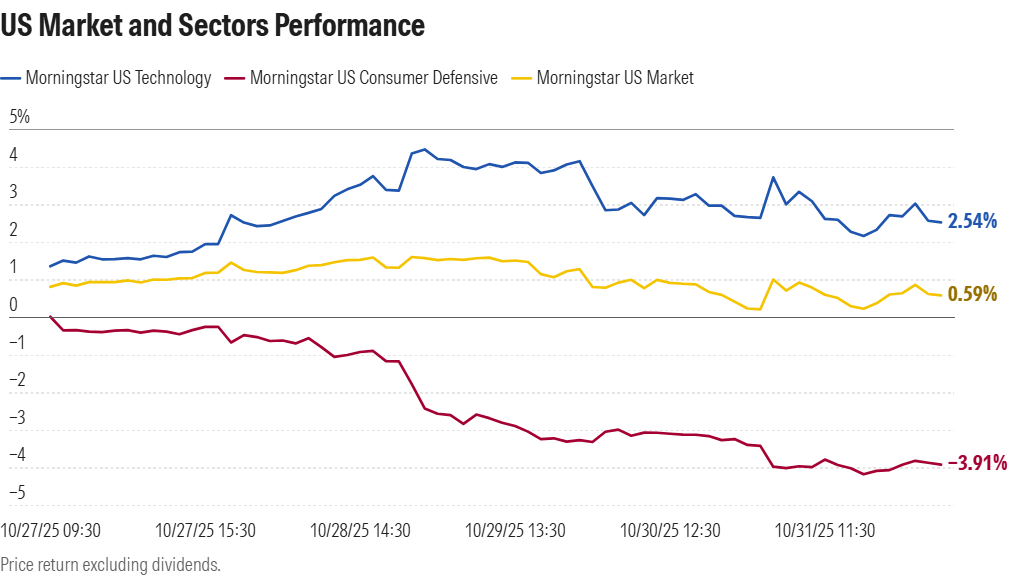

The Morningstar US Market Index advanced 0.59% for the week ending October 31, 2025, as strong performance in tech and cyclical names offset weakness in consumer defensives and property stocks.

Sector Breakdown

- Technology: +2.54% — led by strength in semiconductors and digital automation firms.

- Consumer Cyclicals: +2.12% — buoyed by retail and e-commerce gains.

- Consumer Defensives: –3.91% — weakest group amid margin pressure and soft sales forecasts.

- Real Estate: –3.48% — continued to slump as yields rose.

Large-caps gained 1.2%, while mid-caps fell 1.1% and small-caps slipped 1.51%.

By style, growth edged down 0.1%, blend fell 0.13%, and value declined 0.97%.

The S&P 500 added 0.71% and the Nasdaq Composite climbed 2.24%, reflecting resilience in AI-linked and hardware stocks.

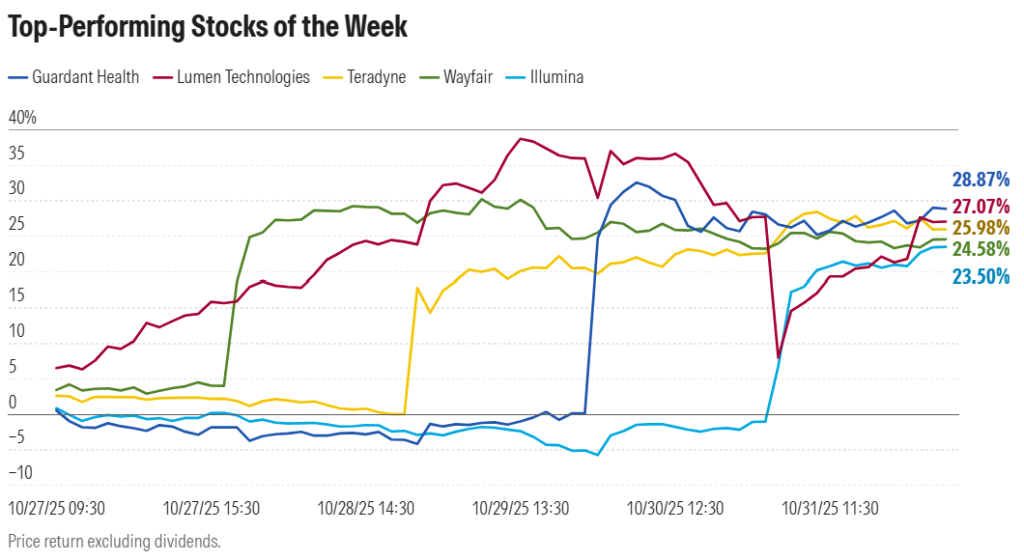

Top Movers

Winners

- Guardant Health (GH) +28.9% — now up 104% in three months as optimism grows around oncology diagnostics. Trades at a 55% premium to fair value.

- Lumen Technologies (LUMN) +27.1% — rally extends 132% in three months amid speculation over restructuring plans.

- Teradyne (TER) +26% — boosted by chip-testing demand and AI manufacturing tailwinds.

- Wayfair (W) +24.6% — surges after upbeat sales guidance; shares have gained 140% in the past year.

- Illumina (ILMN) +23.5% — rebounds from biotech lows as investors bet on restructuring success.

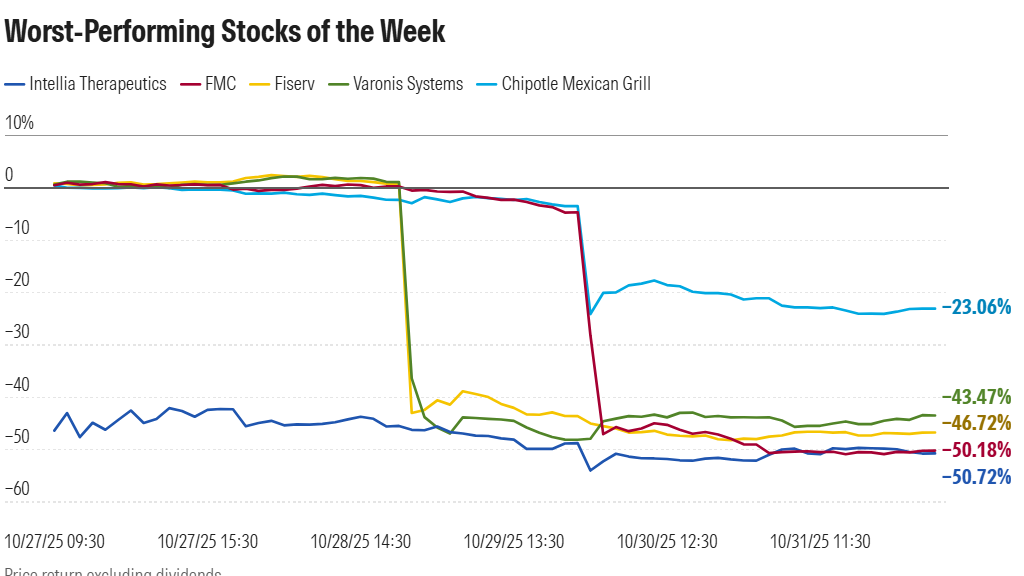

Losers

- Intellia Therapeutics (NTLA) –50.7% — steepest weekly drop; now trades 53% below fair value after clinical-trial setback.

- FMC Corp (FMC) –50.2% — weak ag-chem outlook drives shares to 75% discount to fair value.

- Fiserv (FI) –46.7% — hit by fintech sector downgrades.

- Varonis Systems (VRNS) –43.5% — cybersecurity names under pressure on slowing enterprise demand.

- Chipotle (CMG) –23.1% — extended slide amid concerns over input costs and consumer fatigue.

Macro Snapshot

- 10-year Treasury yield: rose to 4.11% (from 4.02%).

- 2-year Treasury yield: up to 3.60% (from 3.48%).

- WTI crude: fell 0.86% to $60.91 / bbl.

- Gold: down 2.82% to $3,996 / oz.

Markets head into November, historically one of the strongest months for equities, with optimism supported by tech momentum and expectations of seasonal tailwinds. Analysts, however, caution that rising yields and sector rotation could limit upside in defensives and income-sensitive names.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.