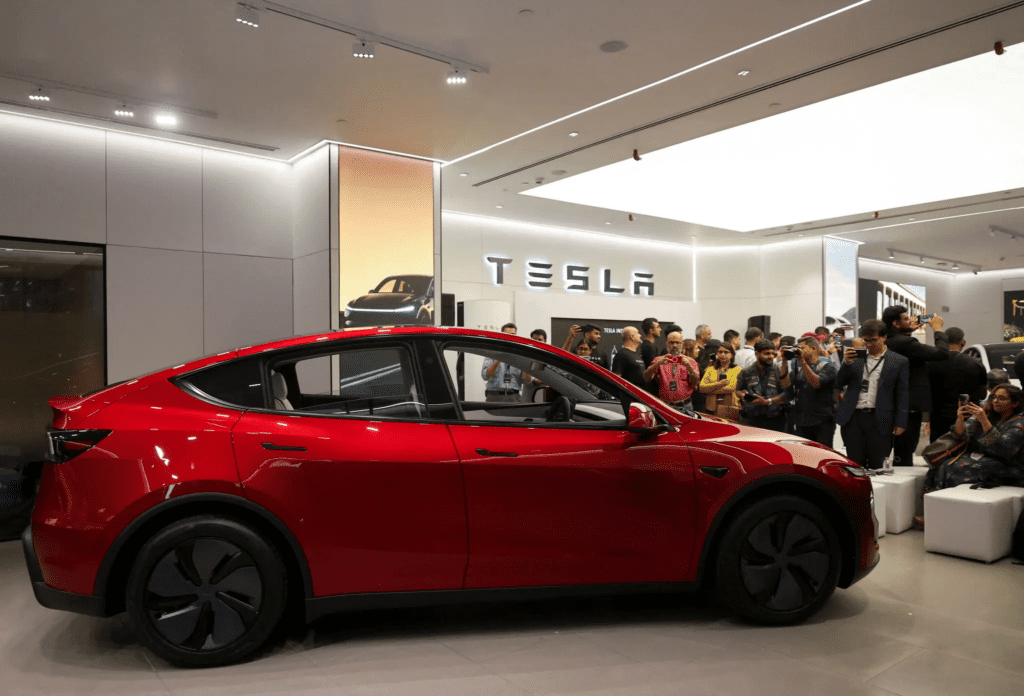

Bold move, but risky timing: Tesla unveiled more affordable versions of its flagship Model Y and Model 3 on Tuesday — a long-awaited attempt to reignite sales amid rising competition, waning demand, and the loss of federal EV tax credits.

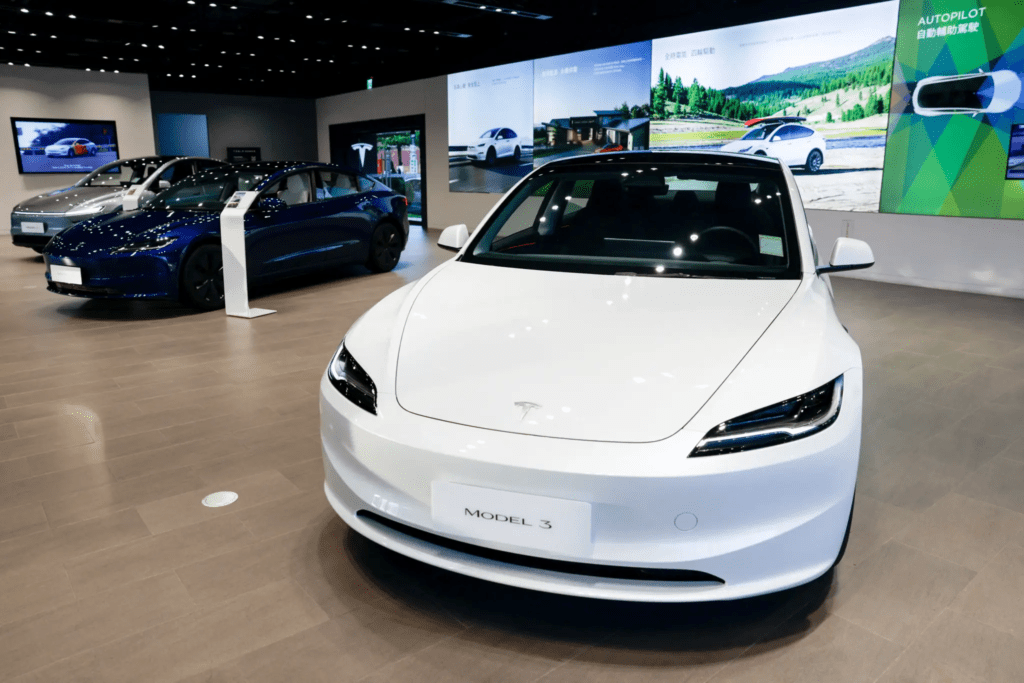

Tesla Rolls Out “Standard” Models Below $40K

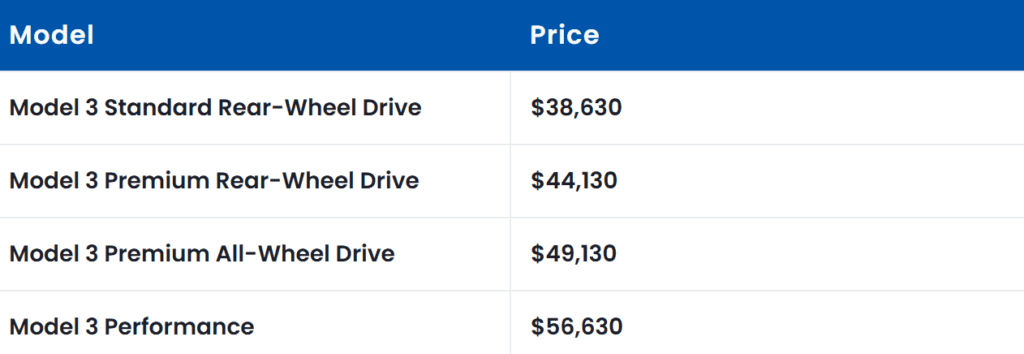

Tesla introduced stripped-down versions of its bestsellers:

Both feature 321 miles of range and fewer premium add-ons — including no rear touchscreen, no Autosteer driver-assist, and fabric interiors. Deliveries are slated between December 2025 and January 2026, according to Tesla’s US website.

The cheaper trims aim to counter the end of the $7,500 federal EV tax credit, which expired in late September, denting affordability and demand.

“These models are about accessibility,” Elon Musk said earlier this year. “People want Teslas — they just don’t have enough in their bank accounts to buy one.”

Why It Matters

Tesla’s sales have slumped over the past year, pressured by anti-Musk boycotts, fierce competition from BYD, Hyundai, and Ford, and a loss of pricing leverage. The cheaper cars may reignite volume — but they could also cannibalize higher-margin models, a concern already voiced by Wall Street analysts.

Tesla shares fell 4% Tuesday to $441.08, erasing Monday’s gains after the teaser campaign that had fueled speculation of a new launch.

What’s Different

The “Standard” trims cut costs by removing several features:

- No LED light bar (Model Y)

- No panoramic roof or rear screen

- Manual side mirrors

- Fabric interiors (vegan leather optional for Model 3)

- Less powerful acceleration and smaller battery packs

Despite the downgrades, Tesla maintained range competitiveness — a strategic play to undercut rivals like Ford’s Mustang Mach-E and Hyundai’s Ioniq 5.

Context: Tesla’s Broader Struggle

The launch marks Tesla’s first major new product since the Cybertruck in 2019 and follows months of slowing deliveries and shrinking profits.

- Tesla delivered 497,099 vehicles in Q3, a record quarter — but margins continued to compress.

- The Model Y still leads global EV sales, accounting for 7.4% of the total market, per Autovista Group.

- Musk’s broader strategy has shifted toward AI, robotaxis, and humanoid robots, though investors remain wary of overreach.

Market Reaction & Analyst View

Wall Street’s reaction was mixed. Analysts welcomed the affordability play but warned of risks to profitability:

“It’s a smart short-term move to boost volume, but a risky long-term one,” said Wedbush analyst Dan Ives. “It could pressure Tesla’s margins and dilute the premium brand appeal.”

Tesla stock remains near record highs but has lost momentum since mid-summer.

Outlook: Cheaper, But Will It Be Enough?

Tesla’s cheaper lineup arrives at a pivotal time. Without the tax credit cushion, US EV demand could weaken further unless affordability broadens the buyer base.

Still, Tesla’s aggressive pricing may set a new industry standard — and help Musk hit the company’s 20 million vehicle target this decade, a milestone tied to his proposed $1 trillion pay plan.

Tesla is betting affordability will drive growth, not dilute it. But as one analyst put it — “Musk just turned the EV race into a price war again — and this time, he’s the one chasing.”