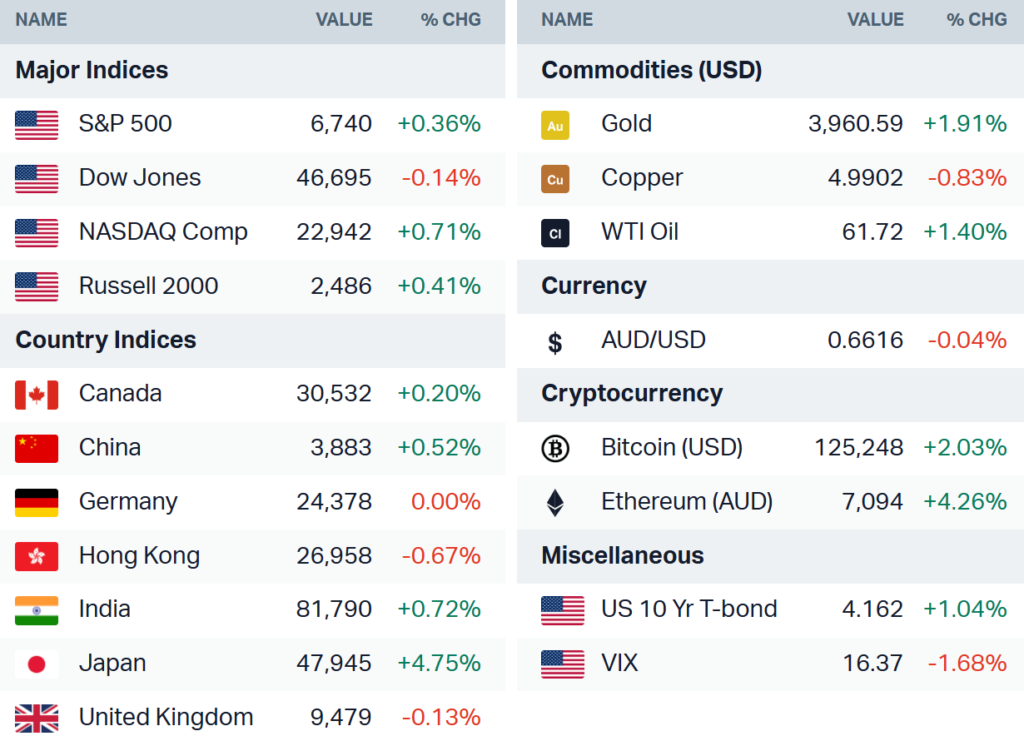

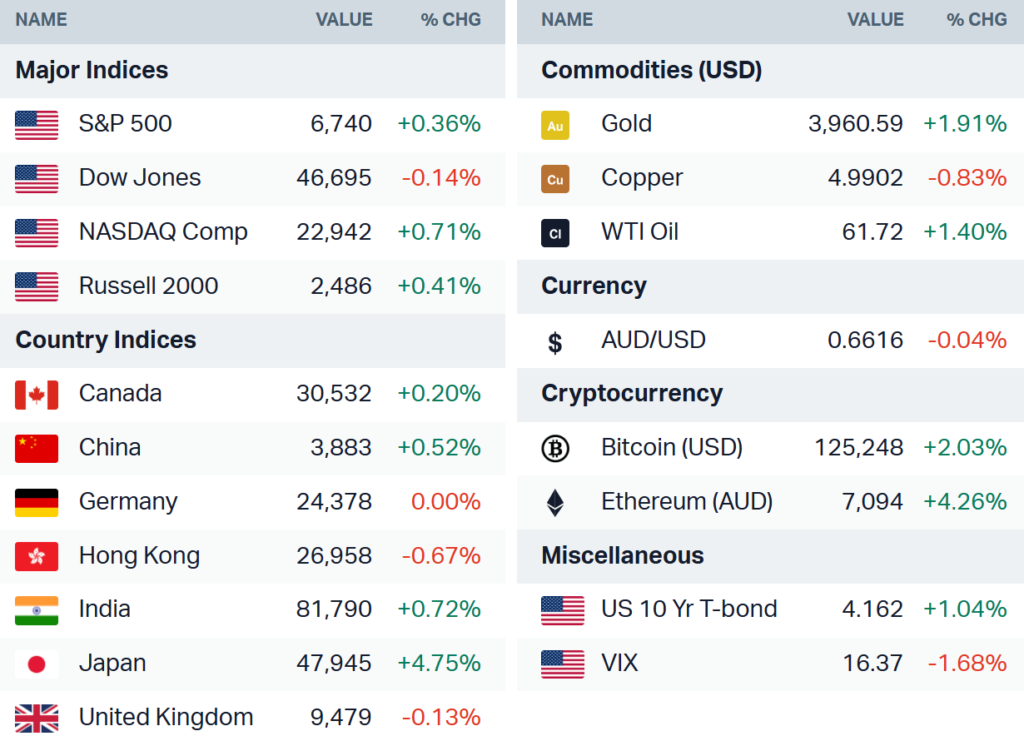

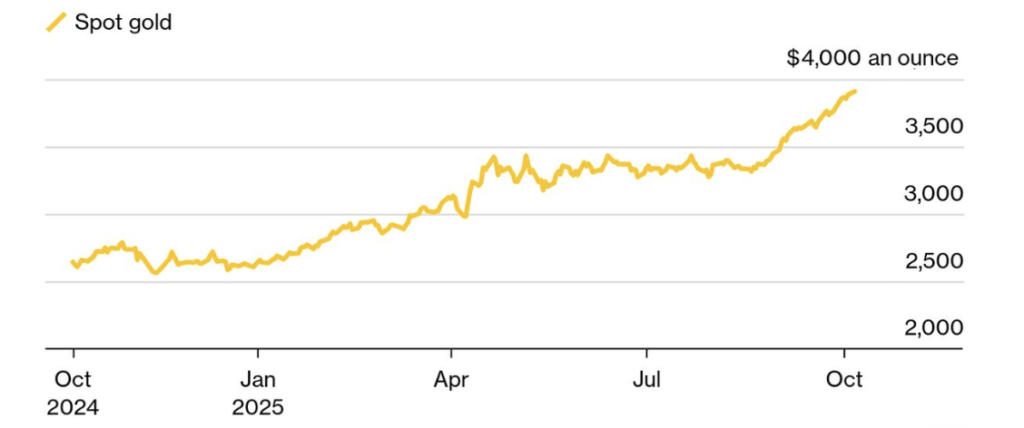

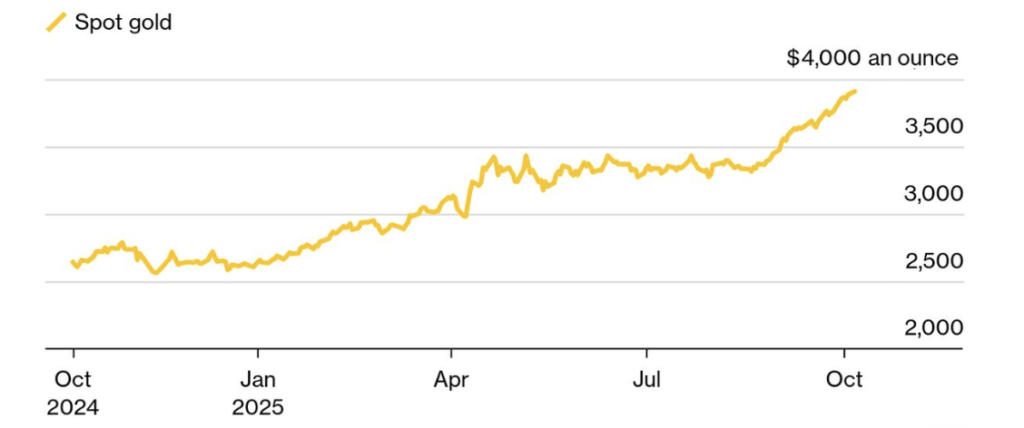

Global equities extended their record-setting rally Monday, powered by AI optimism and strong risk sentiment despite political headwinds in the US, France, and Japan. Gold hovered near the $4,000/oz mark as investors hedged against fiscal and geopolitical uncertainty.

Political shocks in France and ongoing jitters from the US government shutdown tempered risk appetite, keeping US and European futures flat this morning.

Europe: French political turmoil pressures euro

European equities were subdued as France’s political crisis deepened following PM Sébastien Lecornu’s resignation. (France in Chaos as PM Lecornu Resigns After Just 27 Days — Markets React Sharply)

Euro weakened to $1.17, while bond spreads hit nine-month highs. Stoxx 600 closed flat, dragged by French banks and luxury names. BNP Paribas and Société Générale fell over 3%, LVMH and Hermès slipped more than 2%.

US & Futures: Record highs and rising AI bets

S&P 500 gained 0.4% for its seventh straight record close, while the Nasdaq 100 jumped 0.8%. The Dow edged lower amid rotation out of industrials.

- AMD soared 24% after unveiling its multi-year OpenAI deal, potentially generating tens of billions in revenue.

- Nvidia dipped slightly, but the semiconductor index climbed nearly 3%.

- Micron and Boeing rose, while Apple slipped amid French privacy scrutiny.

The 10-year Treasury yield rose to 4.16%, the US dollar strengthened 0.3%, and gold rallied to $3,960, closing in on the $4,000 milestone.

AI trade: AMD’s OpenAI win reverberates

AMD surged (Asia takeaway: semiconductor complex bid) after agreeing to supply 6GW of GPUs to OpenAI starting 2H26, with an option for OpenAI to take up to ~10% of AMD via warrants tied to milestones and share-price targets. Deal seen delivering “tens of billions” in revenue to AMD; adds to OpenAI’s chip-sourcing spree and keeps AI-infrastructure capex in overdrive. (More about: OpenAI Hands AMD a Big Win in AI Chip Race — What It Means for Nvidia)

Nvidia dipped modestly but broader chips rallied.

Asia: Tech leads, Japan’s policy pivot powers gains

MSCI Asia Pacific +0.3% to a new peak, led by chips after AMD’s blockbuster multi-year AI deal with OpenAI. Nikkei hit another record as ruling-party winner Sanae Takaichi — seen favoring fiscal stimulus and loose policy — boosted bets on Abenomics-style support.

Yen stayed weak beyond ¥150/$, JGBs slipped (yields up) amid fiscal worries; a ¥536.8bn 30-year JGB auction cleared smoothly, easing immediate funding angst. Hong Kong/China shut for holiday.

Havens bid: Gold near milestone, crypto firm

Gold +0.4% in Asia, printing fresh records around $3,970–3,980/oz, within sight of $4,000, supported by:

- Political risks (France, Japan shift),

- US shutdown data blackout and dovish-leaning rate-cut odds,

- Persistent central-bank and ETF inflows.

Brent crude +1.7% to $65.60/bbl, supported by OPEC+’s restrained output move.

Bitcoin hit $126,000, and Ether jumped 5%, as traders bet on institutional inflows.

Macro & policy: Shutdown shadow, central banks steady

US shutdown (Day 7): Senate again rejected rival stopgaps; data delays (jobs, trade, claims) muddy the Fed’s near-term read even as FOMC minutes and UMich sentiment remain on deck.

More about: US Government Shutdown Enters Week Two as Senate Rejects Dueling Funding Bills

ECB officials flagged balanced inflation risks; no imminent policy shift.

Japan’s incoming leadership implies more fiscal, later BOJ normalization — a mix that weakens yen, steepens JGBs, and props equities.

What to watch next

- Gold $4,000 test: a clean break could extend flows into miners; dips likely bought while policy and political risks simmer.

- AI leadership rotation: AMD outperformance vs. Nvidia headlines; second-order winners across memory, packaging, power, and data-center REITs.

- France risk premium: OAT-Bund spread as barometer for euro and EU banks.

- US shutdown duration: rate-cut odds vs. data blackout dynamics; watch Fed speakers and minutes tone.

AI euphoria keeps risk wheels turning in Asia and tech, but politics (France, Japan), a firm USD, and the US shutdown are steering fresh money into gold and select defensives. Near term, momentum favors chips and havens in tandem—an unusual but telling mix in a headline-driven market.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.