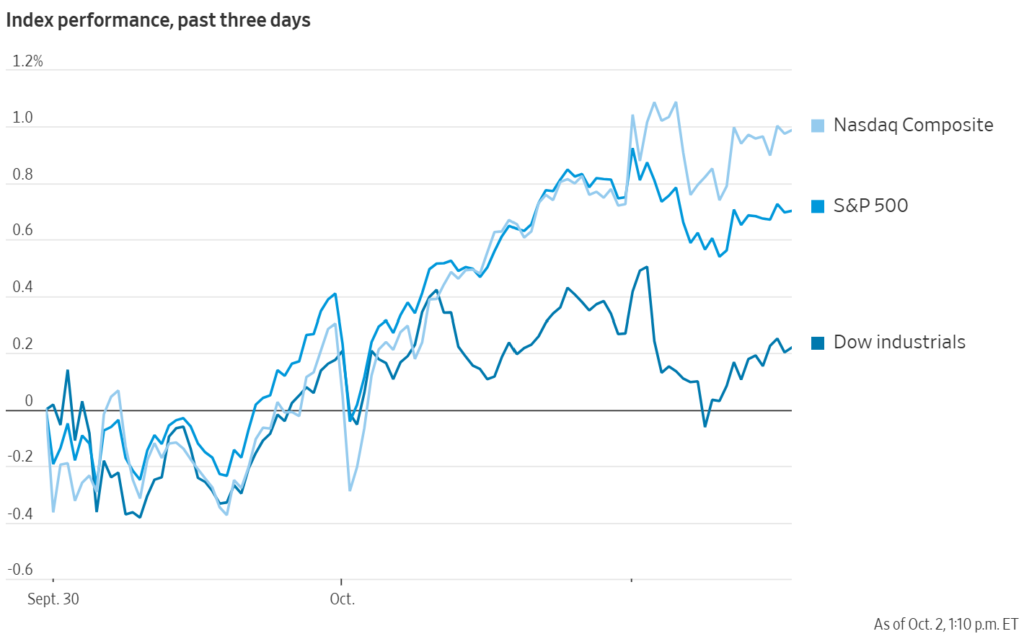

The US stock market opened Thursday in mixed territory, with the Nasdaq inching higher while the Dow and S&P 500 edged lower as the federal government shutdown entered its second day. The S&P 500 had closed at a record high just a day earlier.

What’s Driving Markets

- Shutdown jitters: With no end in sight, investors worry that key data — including Friday’s jobs report — may be delayed. Treasury Secretary Scott Bessent warned of a possible drag on growth.

- Tech & chip strength: Global chip stocks jumped after Samsung and SK Hynix inked a deal with OpenAI to support its “Stargate” AI infrastructure. Samsung stock rose ~4.7%, SK Hynix jumped ~12% in Seoul.

- Credit sector shakeup: Fair Isaac (FICO) shares surged after the company unveiled direct licensing of its mortgage scores, bypassing major credit bureaus. In contrast, TransUnion, Equifax, and Experian experienced a sharp decline.

Markets have largely shrugged off the shutdown so far. Historically, short-term federal lapses tend not to derail stocks unless they drag on or trigger layoffs. With Fed policymakers and rate-uncertainty already on edge, the absence of fresh economic data is complicating sentiment even more.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

OpenAI Surges to $500 Billion Valuation, Overtakes Musk’s SpaceX

Trump’s $100,000 H-1B Visa Fee: What It Means for Tech, Talent, and Markets

Fed Divide Widens as Policymakers Clash Over Pace of Rate Cut