Shares of Fair Isaac Corp (NYSE: FICO) surged as much as 26% on Thursday after the company unveiled a new licensing program that allows mortgage lenders and resellers to purchase FICO credit scores directly—cutting out the traditional middlemen, Experian, Equifax, and TransUnion.

Why It Matters: The FICO score, created by Fair Isaac, is used by nearly 90% of US lenders to assess borrower creditworthiness. Until now, lenders had to buy these scores through the major credit bureaus, which added steep markups. Analysts at Raymond James said this move will end the “100% markup” lenders currently pay, delivering both price transparency and cost savings to the mortgage industry.

Federal Housing Finance Agency (FHFA) Director Bill Pulte applauded the move, calling it a “creative solution” for American consumers. Pulte has previously criticized FICO’s pricing model and encouraged wider adoption of rival scoring systems like VantageScore.

Market Reaction

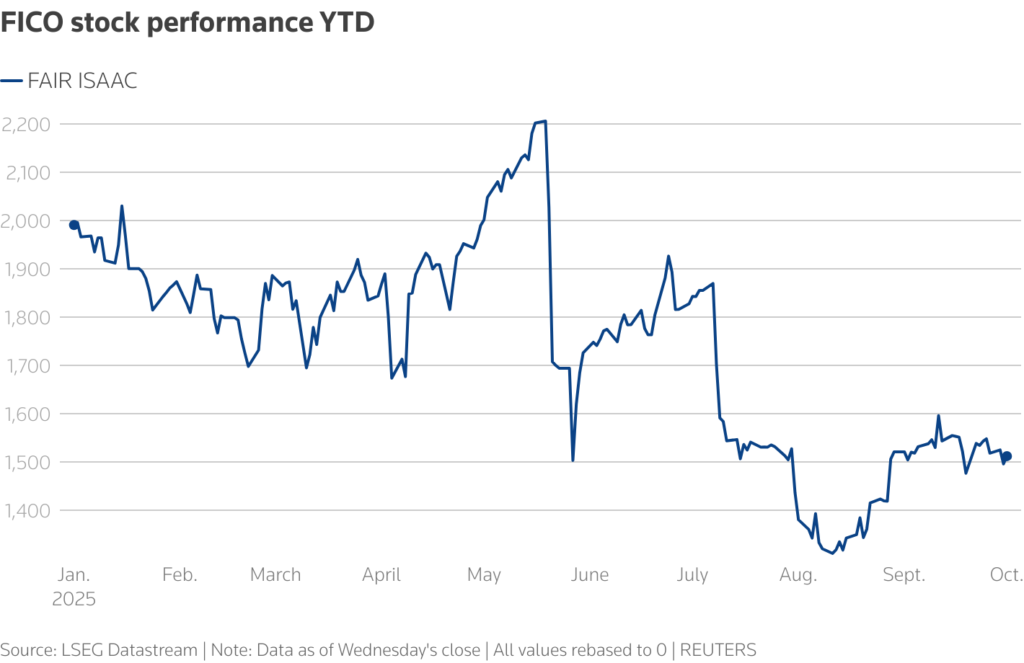

- FICO (FICO): +26% intraday, erasing its year-to-date losses.

- Equifax (EFX): –7%, hitting a five-month low.

- TransUnion (TRU): –11%, its sharpest single-day drop this year.

- Experian (EXPN.L): –4.8% in London.

Citigroup analysts said the new model is “negative for Experian and Equifax”, as it eliminates one of their most lucrative revenue streams. Jefferies warned that bureau earnings could fall 10–15% on average.

How the New Model Works

Under the FICO Mortgage Direct License Program, tri-merge resellers—who combine credit data from all three bureaus—can now calculate and distribute FICO scores directly to lenders without paying the bureaus’ additional fees.

- For lenders: Immediate cost savings and pricing transparency.

- For FICO: Higher margins by capturing revenue previously pocketed by the bureaus.

- For consumers: Potential for lower mortgage costs if savings are passed on.

CEO Will Lansing said the change “eliminates unnecessary mark-ups and puts pricing model choice in the hands of those who use FICO scores to drive mortgage decisions.”

Industry Shift & Competitive Pressure

The move comes at a time of intensifying competition in the credit scoring market. Earlier this year, the FHFA authorized VantageScore 4.0, developed by the three major credit bureaus, for use in Fannie Mae and Freddie Mac mortgages. That decision was seen as a challenge to FICO’s dominance.

Now, by cutting out the middlemen, FICO is flipping the script—weakening the very bureaus that built VantageScore. Analysts say this shift could mark the beginning of a more transparent, price-competitive era in mortgage lending.

FICO’s direct licensing program represents one of the biggest shake-ups in the credit scoring business in decades. It threatens the revenue model of Equifax, Experian, and TransUnion, while positioning FICO as not just the creator but also the distributor of America’s most widely used credit score.

If the gains hold, FICO stock will fully recover its 2025 losses, while the credit bureaus face tough questions about how to replace lost revenue and defend their market role.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s $100,000 H-1B Visa Fee: What It Means for Tech, Talent, and Markets

Fed Divide Widens as Policymakers Clash Over Pace of Rate Cut