President Donald Trump signed an executive order establishing a framework that will keep TikTok operating in the US under a new, American-controlled joint venture. Vice President JD Vance put a headline valuation around $14B for TikTok’s US business—far below many past estimates—while stressing final pricing will be set by the buyers and ByteDance.

Who owns what (as outlined so far):

US investor bloc (~45% combined): Oracle, Silver Lake, and MGX will be the lead investors.

ByteDance: <20% stake in the US JV to meet national-security requirements.

Other holders (~35%): A mix of existing ByteDance investors and new US/global investors.

Board control: 6 of 7 seats to Americans.

Trump also name-checked Larry Ellison, Rupert & Lachlan Murdoch, and Michael Dell as participants; additional names may surface as documents finalize.

Security & the algorithm:

Oracle remains the security and cloud provider (“top-to-bottom security”) for the US entity—auditing software updates, data flows, and the recommendation engine.

The US TikTok will use a copy of the algorithm, inspected in the US and retrained on US user data. Oracle’s role is to inspect and monitor, not rewrite the code.

US users are not expected to download a new app; the transition is meant to be seamless.

What still needs to happen:

China’s approval (export license for algorithm/IP) is still required. Trump says President Xi has signaled support; Beijing has been more cautious publicly.

Corporate plumbing: final ownership percentages, governance docs, and license terms need to be papered.

Hill reaction: Some in Congress may question whether any ByteDance equity or algorithm licensing truly satisfies the 2024 law’s intent. Expect oversight pressure.

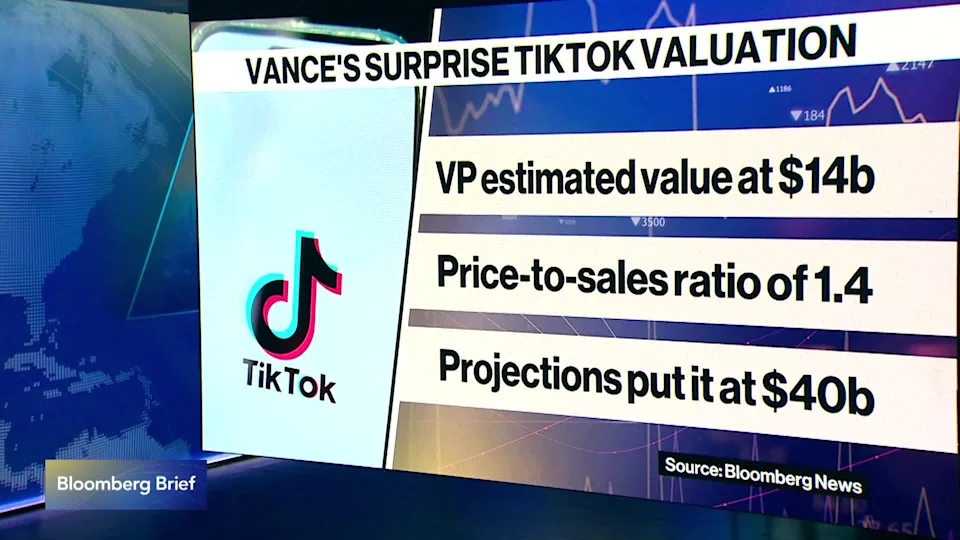

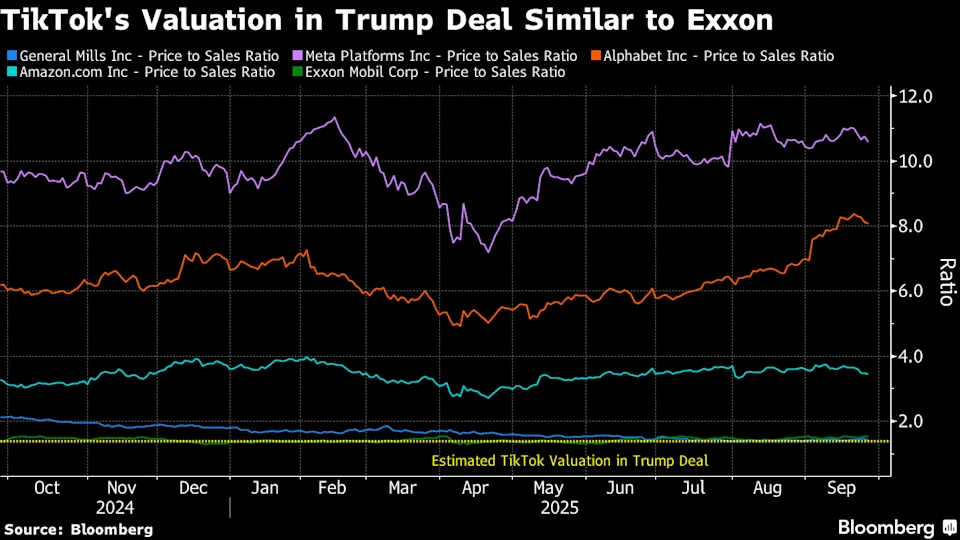

Why the $14B number raised eyebrows:

- TikTok US reportedly generates >$10B in annual revenue and has ~170M US users.

- A $14B tag implies ~1.4x sales—more like mature industrials than top-tier social platforms (Meta/YouTube trade closer to high-single to ~10x sales).

- ByteDance investors may push for a higher figure as terms firm up.

What it means for US users & creators:

The app should stay live in the US. Content access is intended to remain broad (global videos visible), but engineers must “wall off” US data while the algorithm is US-audited and retrained—a non-trivial technical lift.

Creators and small businesses avoid an immediate disruption, though some content or recommendation behaviour could evolve during the retrain period.

Winners & question marks:

Oracle (ORCL): Solidifies a multi-year cloud + security contract, plus potential board influence—a strategic win.

Silver Lake/MGX & co-investors: Access to a top-engagement asset at a possibly discounted entry price.

ByteDance: Keeps a minority foothold and licensing economics, but cedes control and faces political risk if approvals wobble.

Policy risk: If Congress decides the JV still leaves room for Chinese influence, expect hearings or additional guardrails.

Timing: The order extends non-enforcement of the ban deadline to allow the JV to close (target window ~120 days). Trump and Xi are expected to revisit the deal’s progress at upcoming bilateral touchpoints.

The White House has put a concrete ownership and security structure on the table: American-controlled board, Oracle-run security, ByteDance under 20%, algorithm cloned, inspected, and retrained in the US If Beijing signs off and Congress is satisfied, TikTok stays—and Oracle emerges as a key infrastructure gatekeeper. The $14B sticker is the wild card: if it holds, buyers get a bargain; if ByteDance pushes back, expect price/terms to move before the ink dries.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Stakes $5 Billion in Intel: A Strategic Revival for the Chipmaker

Trump Turns Washington Into America’s Biggest Activist Investor With Intel Deal

Trump’s 10% Stake in Intel: A “Great Deal” or Political Gamble?

Intel Secures $2 Billion Lifeline From SoftBank, Shares Jump