So, what happened to Oracle today?

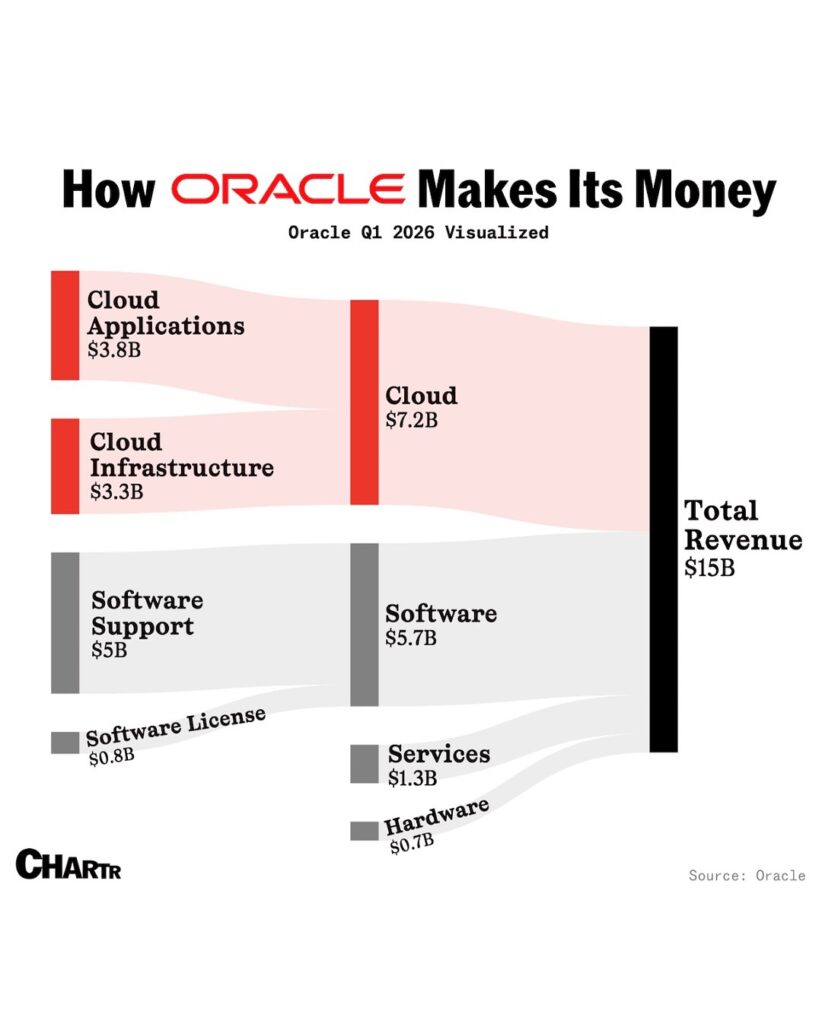

Let’s rewind a bit. Back in early September, Oracle’s earnings were a mixed bag, EPS of $1.47 missed by a penny, but revenue grew 12% year-over-year to $14.9B. Investors brushed off the small miss and piled into the stock anyway, because management doubled down on AI-driven cloud demand and boosted capex guidance. That hype helped push Oracle to fresh highs this month.

Fast forward to today, and things look shakier. The stock dropped almost 6%, and not just because of the broader market weakness. A big part of the move came after Rothschild Redburn slapped a Sell rating on the stock, with a $175 price target. That’s about 40% lower than where it trades right now. Pretty harsh.

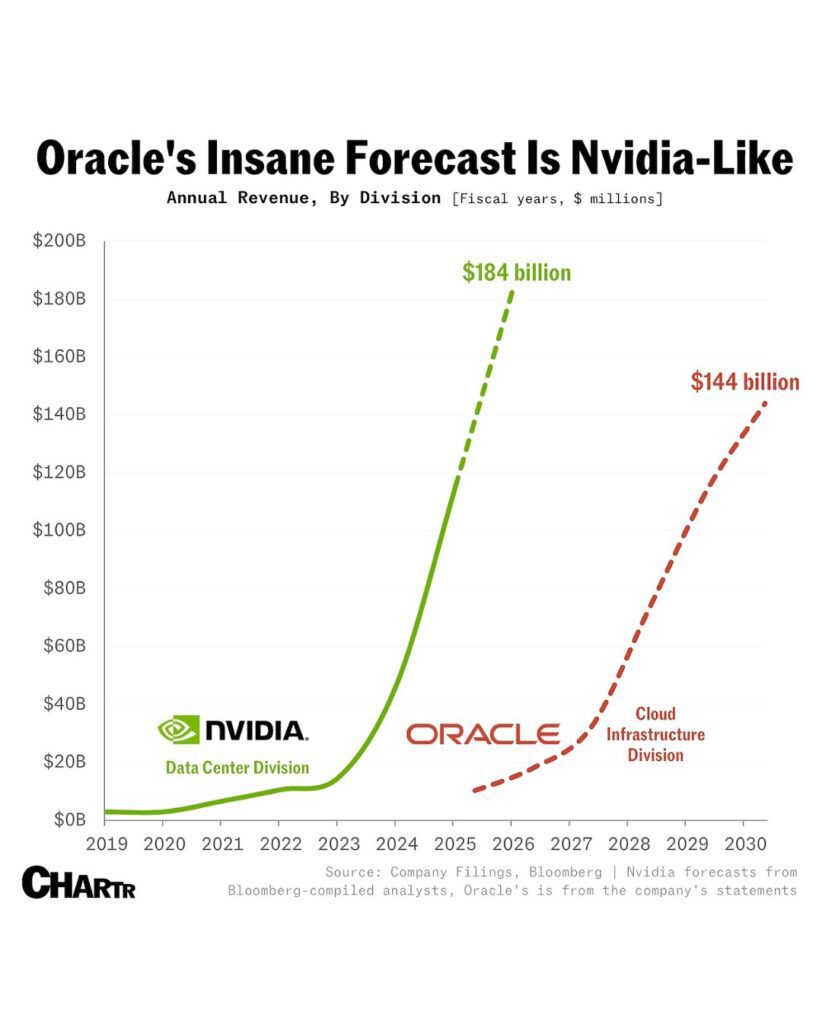

Their main argument? Oracle’s cloud revenues are being overvalued by investors. The analysts say a lot of these flashy AI contracts look more like financing deals than the high-margin, recurring cloud services Wall Street loves. In their words, the market is already pricing in a “blue-sky scenario” that probably won’t come true.

On top of that, the macro backdrop turned against Oracle. Stronger-than-expected GDP (3.8%) and jobless claims (218K) sent Treasury yields climbing toward 4.2%. Higher yields hurt expensive tech stocks first, and Oracle got caught in that downdraft alongside Nvidia. (More about: Markets Slide as Strong Data Lifts Yields, AI Stocks Sink)

Now, here’s where it gets interesting. Oracle still has major AI exposure and some big deals in the pipeline. Remember TikTok? Oracle already runs TikTok’s US cloud operations, and the partnership could be reaffirmed in upcoming announcements. That could be a credibility boost, showing Oracle isn’t just tagging along in AI, but actually running workloads for one of the world’s biggest apps. But… will it actually move the needle financially? That’s still debatable.

And don’t forget, Oracle is spending big to chase this growth. Capex is projected at $35B next year, with guidance it could top $60B by 2028. That’s a lot of money, and it means debt levels are climbing too. Bulls say it’s the price of securing AI’s future. Bears say it’s overreach that could backfire if the hype cools.

Bottom: Oracle’s story right now is being pulled in two directions. On one hand, the TikTok deal could become a major long-term win, giving Oracle a unique role in data security and AI-driven cloud demand. On the other hand, analysts like Rothschild Redburn are raising red flags, warning that the market is overvaluing Oracle’s cloud revenue. Add in stronger GDP and jobs data pushing Treasury yields higher, and you get the perfect storm for a sharp pullback in a high-valuation stock.

So while the TikTok partnership remains a potential catalyst, investors should expect volatility. Short-term moves don’t erase the bigger picture, but they remind us that markets never trade on one headline alone.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Stakes $5 Billion in Intel: A Strategic Revival for the Chipmaker

Trump Turns Washington Into America’s Biggest Activist Investor With Intel Deal

Trump’s 10% Stake in Intel: A “Great Deal” or Political Gamble?

Intel Secures $2 Billion Lifeline From SoftBank, Shares Jump