Donald Trump’s state visit to UK is shaping up to be more than royal pageantry — it’s being framed as a turning point for the US–UK technology alliance, with billions in potential investment and three high-growth sectors at the centre: artificial intelligence, quantum computing, and cryptocurrency.

A State Visit with Business Weight

US President Donald Trump lands in the UK on September 16 for a rare second state visit, accompanied by top technology leaders. According to multiple reports, Nvidia CEO Jensen Huang and OpenAI CEO Sam Altman are expected to attend and announce multi-billion-dollar investments in the UK.

The centrepiece will be a “US–UK Technology Bridge” agreement, designed to deepen cooperation on frontier technologies while aligning regulatory frameworks. While artificial intelligence and quantum computing are confirmed as pillars of the deal, a coalition of more than a dozen industry associations is lobbying heavily to include blockchain and digital assets.

Related: Trump UK State Visit: What’s on the agenda, schedule, what to expect

Oracle, which already handles TikTok’s US data, will also maintain a cloud infrastructure agreement, underlining the fusion of tech and geopolitics running through the visit.

Artificial Intelligence: A $70B+ Bet

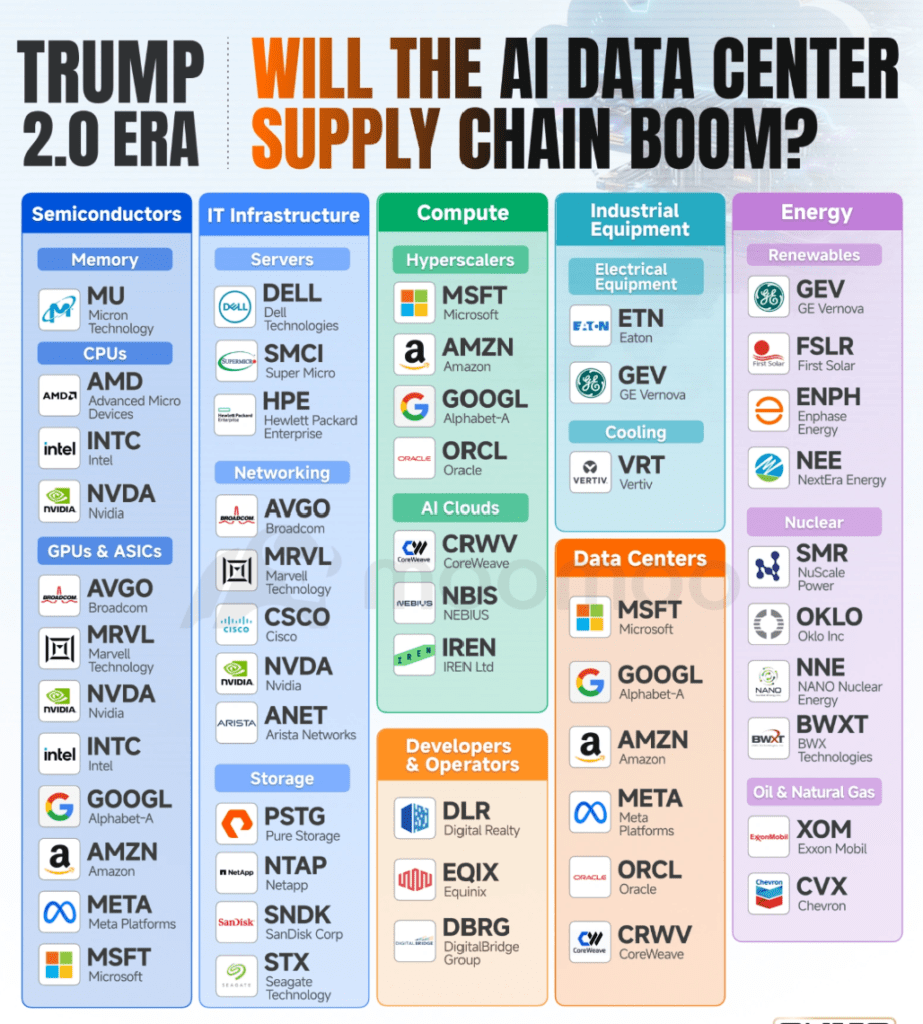

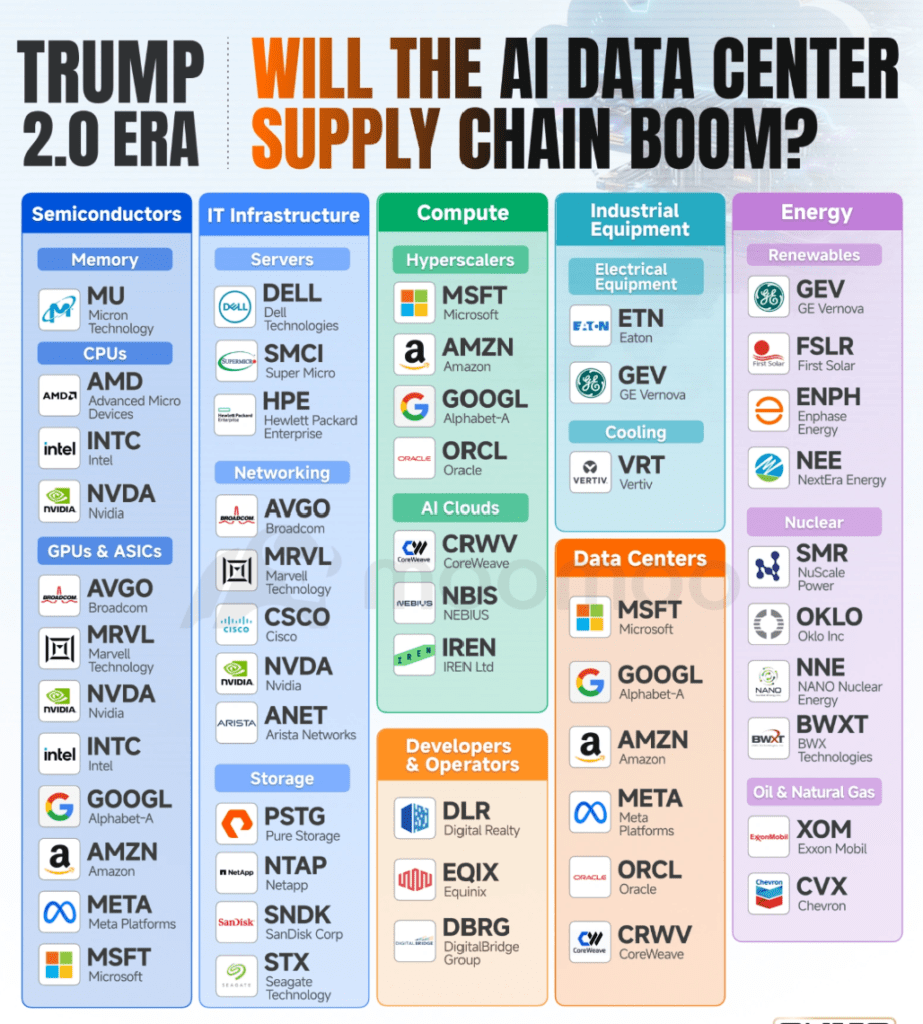

The AI sector is the immediate winner from the Trump–Starmer talks. Reports suggest the agreement will channel capital from Nvidia, OpenAI, CoreWeave, BlackRock, and Microsoft into UK infrastructure, including AI data centers, semiconductor supply chains, and cloud networks.

- Semiconductors: $NVDA, $AMD, $INTC, $AVGO, $MU

- Servers: $DELL, $SMCI, $HPE

- Networking: $CSCO, $ANET

- Data Centers: $MSFT, $GOOGL, $AMZN, $META, $ORCL, $CRWV

- Supporting Industries: $ETN, $GEV, $VRT

UK Prime Minister Keir Starmer hailed the agreements as a “strategic inflection point,” saying they would secure Britain’s role in the global AI race while expanding US firms’ overseas presence. Analysts note that Trump’s push dovetails with his domestic agenda: securing AI leadership and reducing reliance on Chinese supply chains.

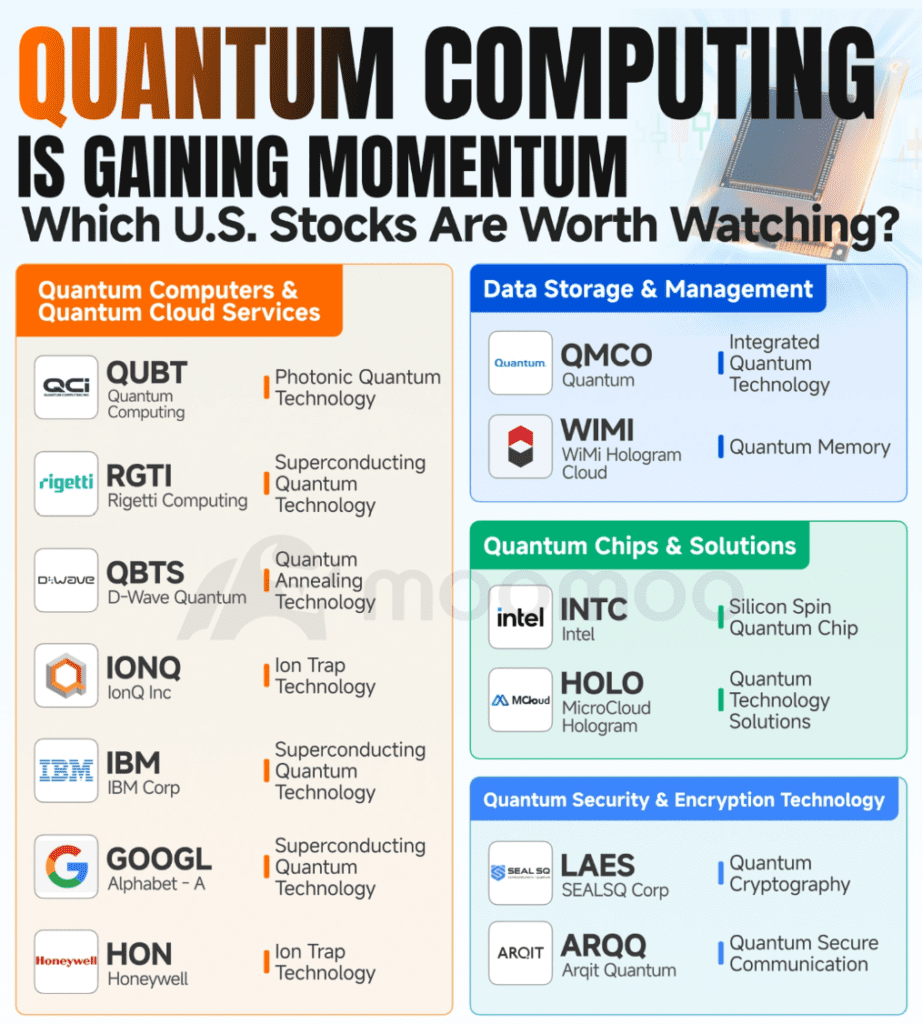

Quantum Computing: At an Inflection Point

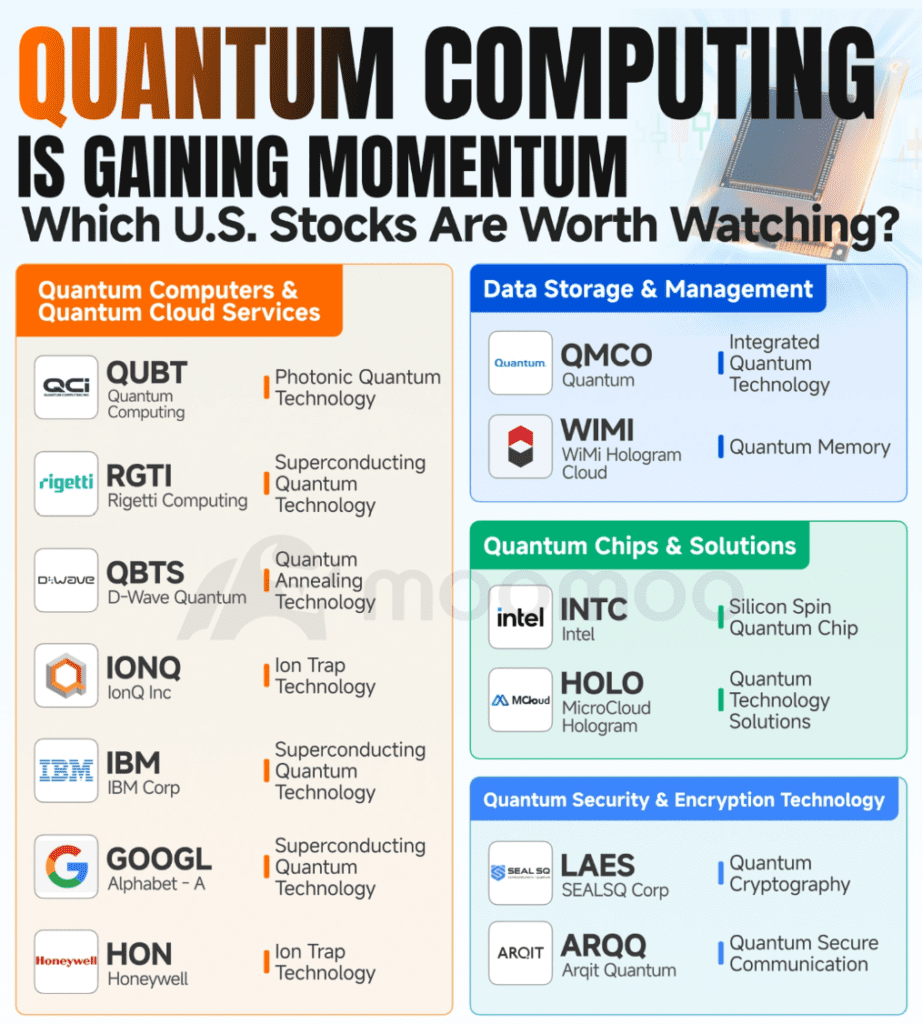

The second pillar of the deal focuses on quantum computing, where Britain already holds strong academic expertise. Just last week, the UK approved IonQ’s acquisition of Oxford Ionics, a deal structured to keep talent and core technologies within the country.

- Superconducting: $GOOG, $IBM, $RGTI

- Quantum Annealing: $QBTS

- Photonic Computing: $QUBT

- Ion Trap Tech: $IONQ, $HON

- Quantum Encryption & Cybersecurity: $ARQQ, $LAES

Jensen Huang has argued that quantum is reaching an “inflection point,” and experts believe commercial applications could arrive faster than previously expected. For Britain, hosting US–backed labs and ventures could help transform it into Europe’s quantum capital.

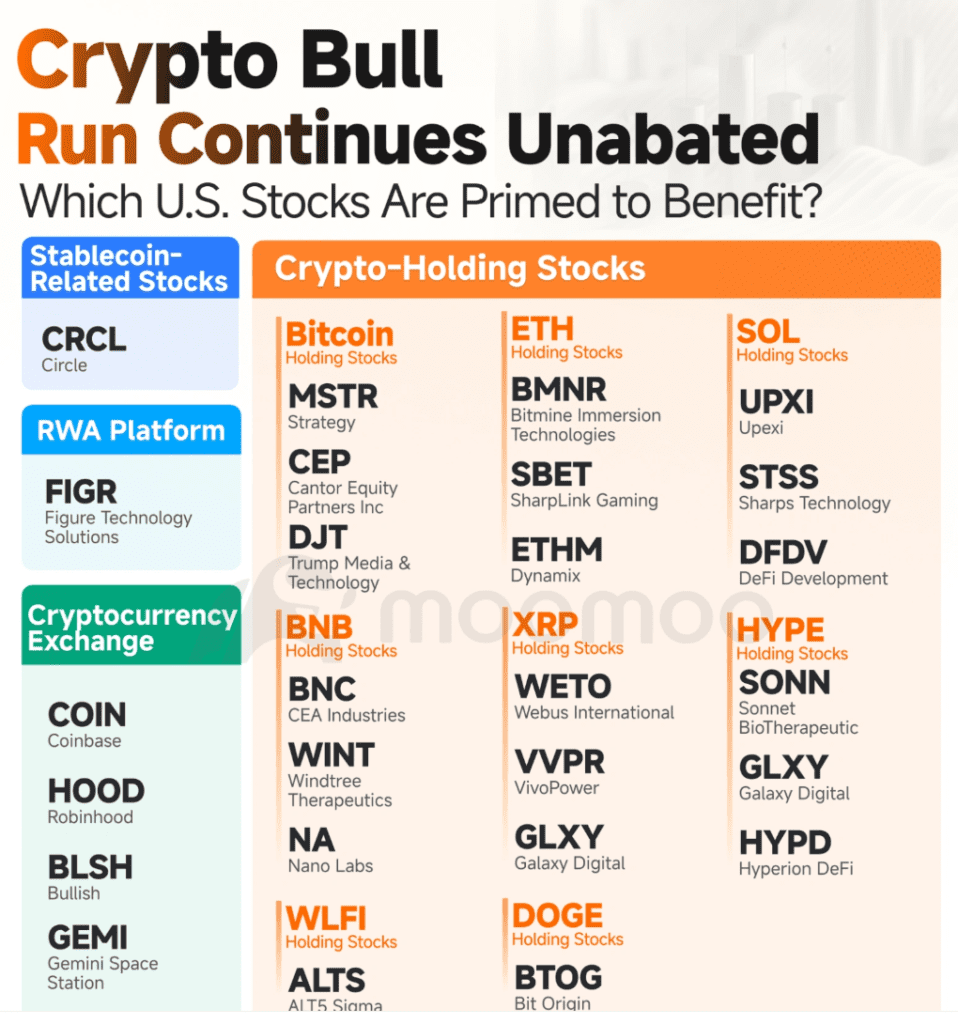

Crypto and Blockchain: The Missing Piece?

While not formally included in the early drafts, the digital asset industry is pushing hard for blockchain integration into the US–UK Technology Bridge.

A coalition of more than 10 industry groups has warned that excluding crypto would leave the UK behind in setting global financial standards, particularly on stablecoins, tokenization, and blockchain-based payments.

- Exchanges: $COIN, $HOOD, $BLSH, $GEMI

- Stablecoins: Circle ($CRCL)

- Bitcoin holders: $MSTR, $DJT, $CEP

- Ethereum/Solana ecosystem: $BMNR, $ETHM, $IONQ (quantum-secured crypto storage)

- DeFi & RWA platforms: $FIGR, $GLXY, $HYPD

This lobbying reflects a broader tension: London has ambitions to become a digital finance hub, but regulation has lagged behind. Trump has signaled openness to stablecoin adoption, and industry insiders believe crypto could be added in future rounds of the deal.

Energy and Infrastructure: The Nuclear Angle

Alongside tech, the visit will also deliver agreements on nuclear energy, including the joint development of Small Modular Reactors (SMRs) to power the growing AI and data center ecosystem. The plan includes a new nuclear plant at Hartlepool, framed by Starmer as the dawn of a “golden age of nuclear energy” for the UK.

Investor Takeaway

For investors, Trump’s UK visit is more than political theatre — it’s a catalyst for capital flows into high-growth industries:

- AI: benefiting chipmakers, hyperscalers, and data center operators.

- Quantum computing: bringing validation and capital to a sector approaching commercial viability.

- Cryptocurrency: lobbying pressure could open the door to digital assets in future deals, creating opportunities in exchanges and tokenization platforms.

If successful, the US–UK Technology Bridge could anchor a new transatlantic tech bloc, challenging both the EU’s regulatory dominance and China’s scaling ambitions.

As one senior UK official put it: “This isn’t just about trade. It’s about writing the rules of the future.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.