Tariff receipts hit all-time highs in August, but sticky inflation and weakening jobs data sharpen the stakes for next week’s Fed decision. Meanwhile, stocks hover at record levels and Bitcoin climbs above $115,000.

The US government collected $29.5 billion in tariff revenue in August, marking the first full month of President Trump’s “reciprocal” tariff regime and the highest monthly total on record, according to Treasury Department data released Thursday. That figure topped July’s $27.7 billion and June’s $26.6 billion, pushing fiscal-year-to-date tariff receipts to $165.2 billion with weeks left before the September 30 close.

Tariffs Fuel Treasury Inflows — But Also Inflation Concerns

The new revenue reflects duties of 10% to 50% imposed on a wide range of imports under Trump’s Aug. 7 executive order. Trump and Treasury Secretary Scott Bessent have touted the windfall, with Bessent posting that the administration is “fixing the financial shambles it inherited.”

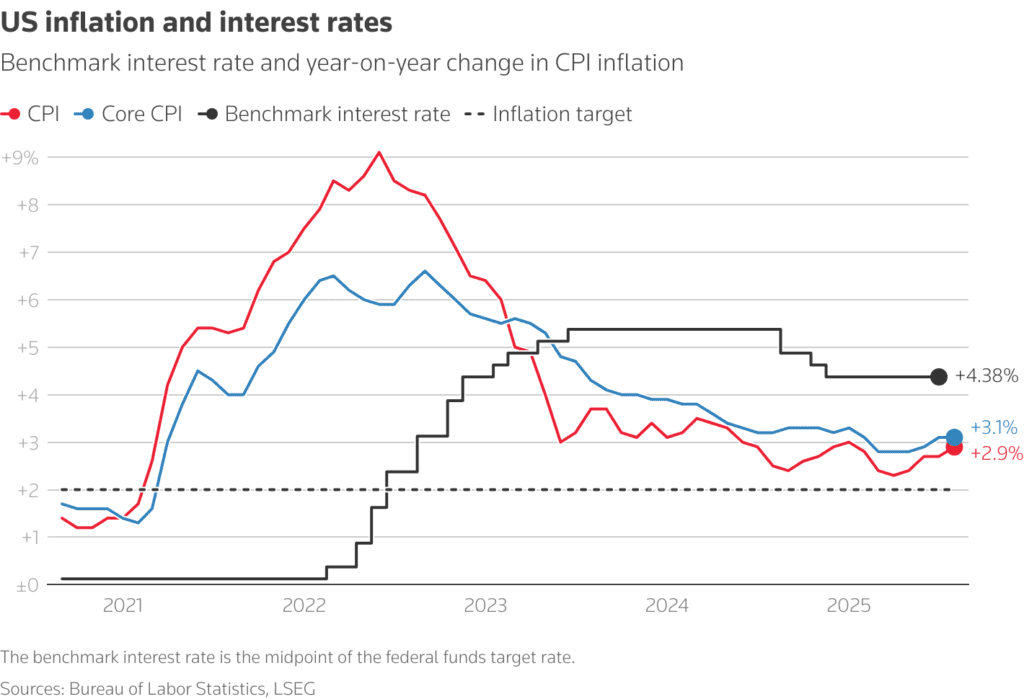

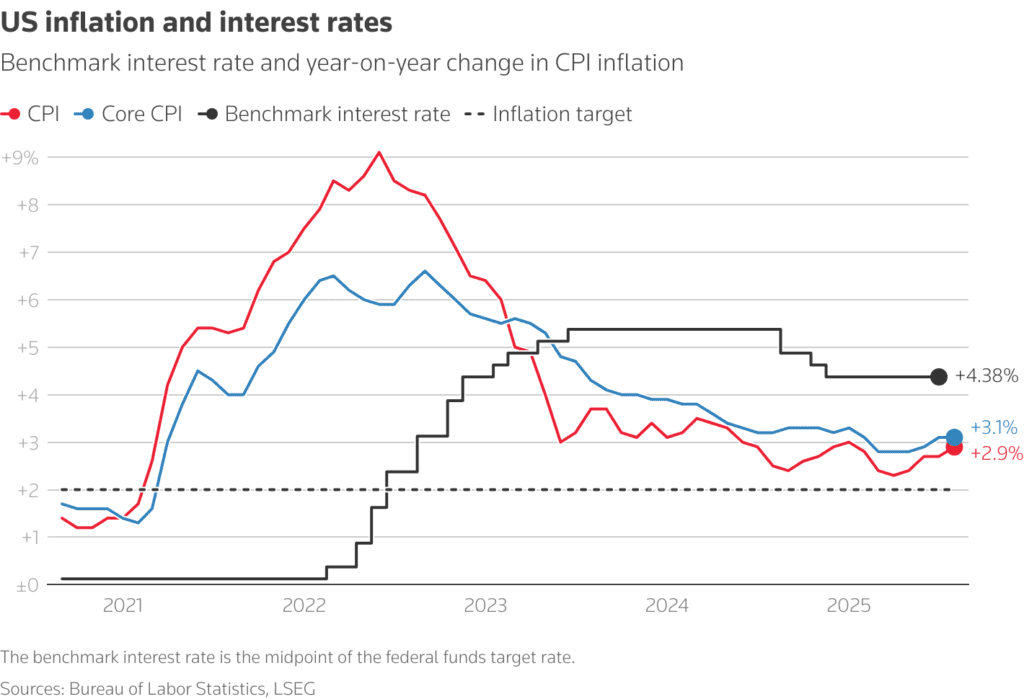

Yet the timing coincides with an August CPI report showing consumer prices up 2.9% year-on-year and 0.4% month-on-month, with food and apparel singled out by economists as areas where tariffs are directly lifting costs.

“Those are tariffs,” said Joe Brusuelas, chief economist at RSM, noting that companies are already passing part of the added costs onto consumers.

While tariffs boosted revenue, they remain a modest slice of overall government receipts, accounting for less than 10% of August’s $344 billion total intake. Spending still dwarfed inflows, reaching $689 billion and producing a monthly deficit of $345 billion.

Legal Risks Ahead

The durability of Trump’s tariff windfall is far from certain. Two federal courts have already deemed aspects of the “reciprocal” duties unlawful, and the Supreme Court is expected to rule later this year. If struck down, the administration may be forced to return roughly half of recent collections, potentially erasing much of the fiscal boost.

Sector-specific tariffs based on other legal authorities are not under challenge, but the blanket approach underpinning August’s surge remains in doubt.

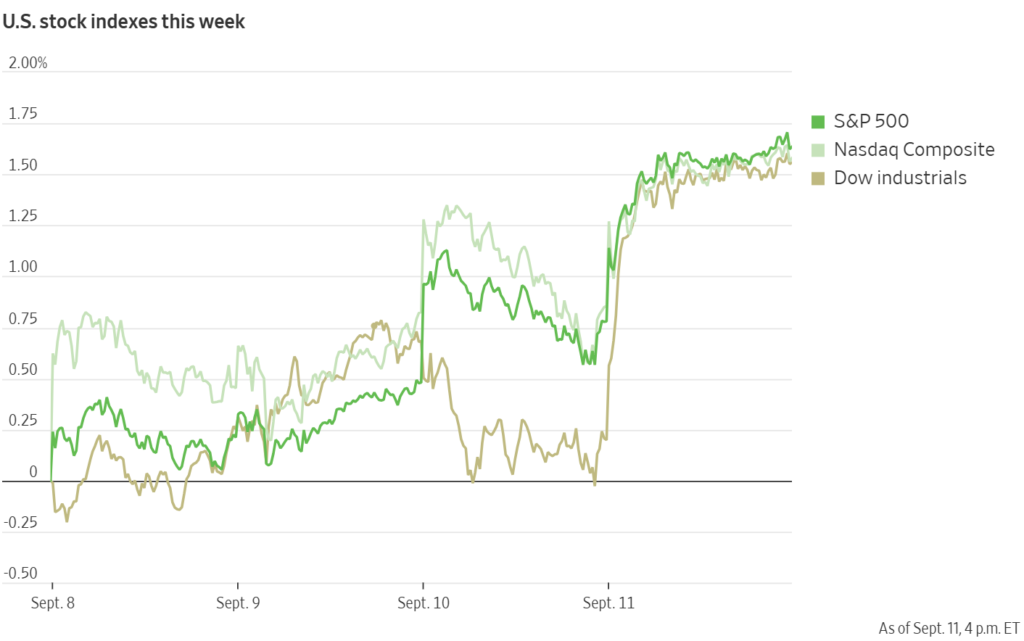

Markets Watch Fed, Not Tariffs

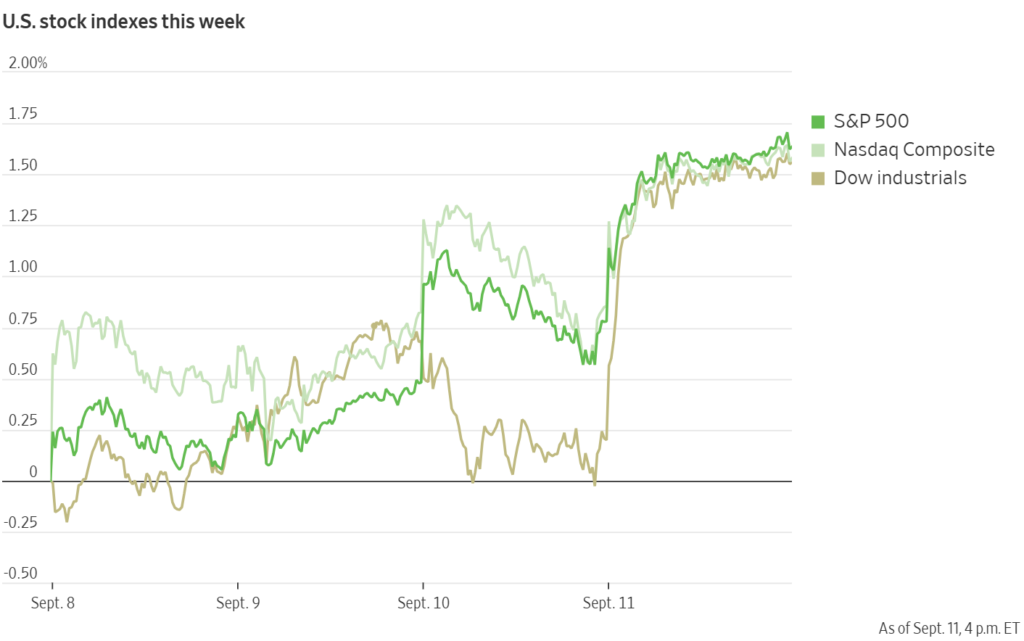

Equity markets took the tariff data in stride. Dow, S&P 500, and Nasdaq futures were little changed Friday morning, following fresh record closes the day before — the second time this week all three indexes notched new peaks. The Dow Jones Industrial Average crossed 46,000 for the first time, while the S&P 500 is now up 36% since its April bottom, adding $15 trillion in market cap in just five months.

- Treasuries: The 10-year yield (^TNX) fell near 4%, its lowest since spring, as investors locked in bets on easier monetary policy.

- Commodities: Gold surged to fresh all-time highs above $3,675 an ounce earlier this week. Silver rose 1% to $41.76, its strongest level in 14 years. Oil, however, slid around 2% amid supply concerns.

- Crypto: Bitcoin climbed above $115,000, extending a year-to-date rally that has drawn strength from the same liquidity trade propelling AI and tech stocks.

Currently, US stock futures inched lower as Wall Street took stock of the US economy from a lofty, record-setting perch ahead of the Federal Reserve’s highly anticipated decision on interest rates next week.

Dow Jones Industrial Average futures and S&P 500 futures both edged down roughly 0.1%. Contracts on the tech-heavy Nasdaq 100 (NQ=F) slipped just below the flat line.

Fed on Deck: Cuts All But Assured

The real driver for markets remains the Federal Reserve’s September meeting next week. After jobless claims spiked to a four-year high and monthly payroll growth was revised down sharply, traders now price in a more than 90% chance of a 25bp rate cut, with growing odds of multiple cuts before year-end.

Some economists argue the Fed could consider a 50bp move, though consensus still points to a quarter-point reduction. Futures markets are now pricing two to three cuts by December and as many as five by July 2026.

Globally, the ECB held rates steady at 2%, with President Christine Lagarde signaling its easing cycle is likely over. Japan’s central bank is edging toward unwinding stimulus, while Canada remains the only G10 peer expected to deliver significant cuts next year.

What to Watch Today:

- Speeches from Bank of Spain’s Jose Luis Escriva and ECB’s Olli Rehn

- UK July GDP and manufacturing output

- Final EU CPI readings

- US University of Michigan consumer sentiment (September, prelim.)

So, tariffs are giving Trump a new source of political and fiscal leverage, but they also risk deepening inflation pressures just as the Fed attempts to ease policy into a weakening economy. Investors, however, appear to be looking past the risks, pouring into tech, AI, and crypto plays in a liquidity-driven rally.

For now, markets remain buoyant, betting that lower interest rates will outweigh trade-policy uncertainty. But with inflation sticky, tariffs under legal fire, and job losses mounting, the balance could shift quickly in the months ahead.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Gold Surpasses Inflation-Adjusted Record High Set in 1980

CPI report shows prices climbing faster than July, What it means for Fed

France’s Government Collapses — What Moved in Markets and What’s Next

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility