Trump keeps declaring inflation “over,” but polls show it’s his biggest economic liability — and Thursday’s CPI report could decide the Fed’s next move.

President Donald Trump is doubling down on his message that inflation is a problem of the past, even as Americans tell pollsters it’s their number one economic concern. In a radio interview this week, Trump declared: “We have no inflation. Prices are down on just about everything.” He went further on social media, posting: “Just out: No Inflation!!!” after producer prices unexpectedly dipped in August.

But the data and the polls tell a more complicated story.

Polls: Inflation is Trump’s Weak Spot

A Yahoo News/YouGov survey gave Trump a rock-bottom 28% approval on handling the cost of living, mirroring other polls showing widespread frustration with high prices. A CBS poll found just 36% support for Trump’s handling of inflation, and 65% of respondents believe his policies are raising grocery costs. RealClearPolitics shows his average inflation approval at 38.8%, far below his overall rating of 45.2%. The only issue where he fares worse is Russia/Ukraine.

Tariffs are central to that discontent. In the CBS poll, 62% opposed Trump’s new duties on imports, with four in ten saying tariffs have already forced them to buy fewer goods.

Markets React: Oracle Sparks AI Rally, Investors Wait on CPI

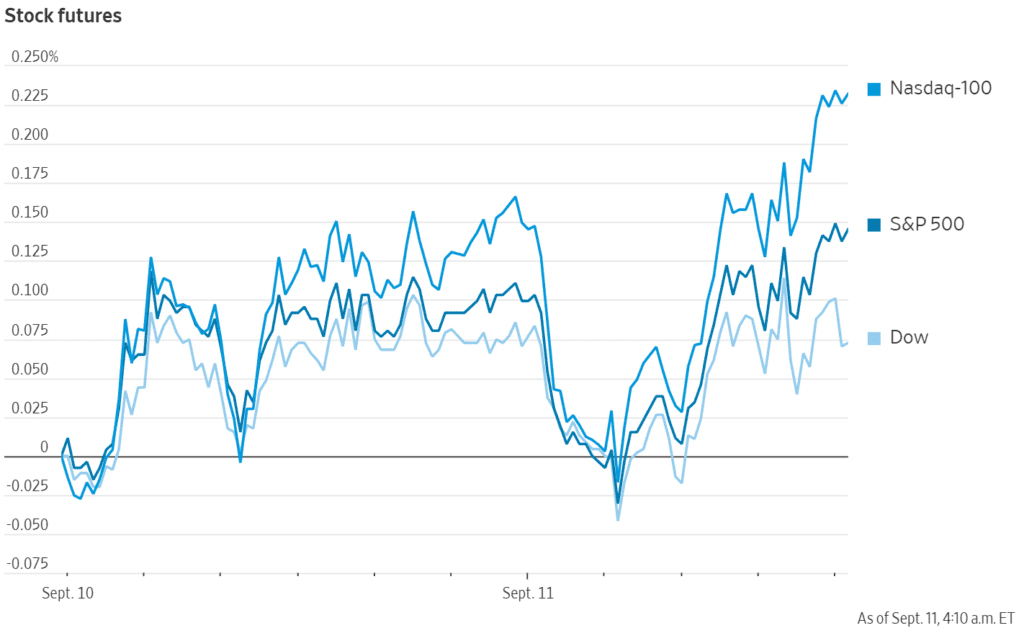

Stocks held steady in early Thursday trade. S&P 500 futures inched higher after back-to-back record closes, with Oracle’s 36% surge on AI cloud optimism driving gains in Asia and boosting tech sentiment globally. Treasuries softened slightly, with the 10-year yield near 4.05%, while the dollar firmed ahead of the inflation release.

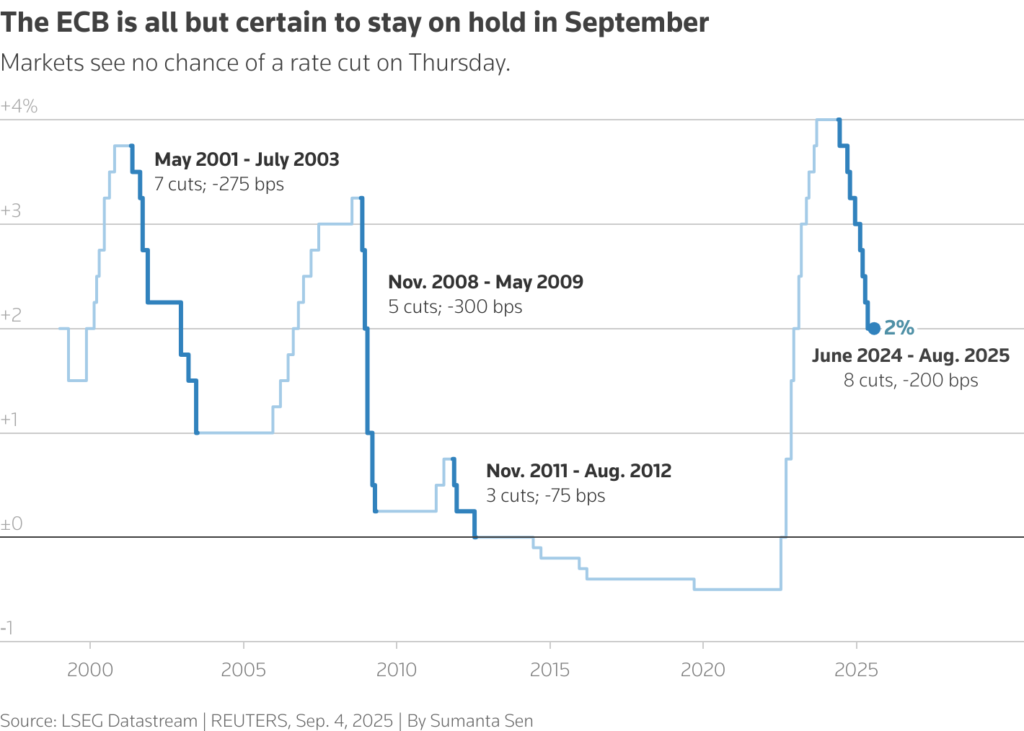

AI fever did not stretch to European stocks which looked set for a muted open ahead of an interest rate decision from the European Central Bank. EUROSTOXX 50 futures inched up a 0.1%; German futures even less.

The ECB, which halved its policy rate to 2% in the year to June, is widely expected to hold steady, leaving the focus on whether it keeps the door ajar for further policy easing. Markets imply about a 60% chance of a move by early next year.

Today’s main risk event is the US Consumer Price Index (CPI) release. Economists expect headline CPI to rise 2.9% year-over-year in August, the fastest pace since January, while the core rate likely held steady at 3.1%, according to a Reuters poll.

Yesterday’s softer-than-expected Producer Price Index (PPI) has raised hopes for an in-line CPI print — or at least nothing hotter than 3%. With the labor market showing cracks, investors are betting it would take a truly shocking upside surprise to derail a quarter-point Fed rate cut next week, which markets already see as fully priced in.

For all of 2025, futures are pricing about 67 basis points of easing — roughly two to three cuts in total. A tame CPI could even fuel wagers on a 50 basis-point cut next week, likely pressuring the dollar and pulling Treasury yields lower. But a stronger-than-expected report would complicate the Fed’s path, forcing traders to trim expectations for a third cut this year.

Key developments that could influence markets on Thursday (est):

- IEA Monthly Report (4:00 AM)

- OPEC Monthly Report (7:00 AM)

- ECB policy decision

- US CPI for August (8:30 AM)

- US Initial Jobless Claims (8:30 AM)

- 30-Year US Treasury Bond Auction (1:00 PM)

- Fed’s Balance Sheet (4:30 PM)

Earnings to Watch:

Pre-market: Kroger ($KR), Lovesac ($LOVE), Cheetah Mobile ($CMCM)

After-hours: Adobe ($ADBE), Rent the Runway ($RENT)

So, inflation has become Trump’s defining political vulnerability. Since taking office, his approval on the issue has fallen by more than 30 percentage points, the steepest drop of any policy area. His strategy has been to pressure the Fed into cutting rates while reframing the 2% inflation target as too rigid — a message echoed by allies who argue that the Fed under Jerome Powell has mishandled price stability.

But with Americans still feeling the pinch at supermarkets and gas stations, Trump’s “no inflation” mantra is colliding with lived reality. The next CPI report could either give him breathing room — or deepen the perception that the economy is slipping away from the White House.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

France’s Government Collapses — What Moved in Markets and What’s Next

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility