Nasdaq has filed to let investors trade tokenized versions of stocks and ETFs on its main market—keeping the same rulebook, rights, and order book as today’s shares, but settling on-chain. If approved, this would be the first time a U.S. national exchange natively integrates tokenized securities into the existing market structure rather than building a parallel crypto venue.

What Nasdaq is actually proposing

- Same stock, new rails. Orders still route through Nasdaq’s current systems; participants can elect regular or tokenized settlement. Trades stay under the national market system, surveillance, and best-execution rules. Holders of tokenized shares retain identical rights (CUSIP, voting, dividends). DTCC would handle the token leg when selected. First live trades depend on DTCC readiness, with early guidance pointing to 2026.

- Why now. Tokenization promises faster settlement, lower frictions, and programmable corporate actions (think automated proxy voting, on-chain dividends), while maintaining existing safeguards. Nasdaq’s leadership is leaning into “innovation without compromising resiliency.”

The proof point: Galaxy Digital’s live tokenized stock

We already have a preview. Galaxy Digital became the first Nasdaq-listed company to let shareholders convert registered equity into on-chain tokens on Solana, with Superstate as transfer agent. These on-chain shares are the legal stock (not a synthetic), transferable 24/7 among KYC’d wallets. That’s the model Nasdaq wants to scale.

Not all “tokenized stocks” are equal

In parallel, Ondo Global Markets launched 100+ tokenized U.S. stocks and ETFs for non-U.S. investors on Ethereum—these are wrapped exposures fully backed at U.S. broker-dealers, but they’re not the issuer’s native share. Nasdaq’s plan is different: it keeps everything inside the U.S. market structure and lets DTCC tokenize the same security after trade. Expect both models to coexist.

Who wins (and what moves) if this clears?

Equities & market plumbing

- Exchanges and brokers: A green light accelerates the on-chain back office—shorter settlement cycles and cleaner corporate action workflows—without changing the front-end trading experience. Beneficiaries include market operators, transfer agents, and clearing infrastructure set up for token legs. Timing still hinges on DTCC’s production readiness.

- Issuers: Expect more “Galaxy-style” native tokenizations for cap-table flexibility (24/7 transfers, programmability) while preserving shareholder rights. Early adopters likely: tech, fintech, crypto-native firms comfortable with wallet-based registries.

Crypto markets (this is where it gets interesting)

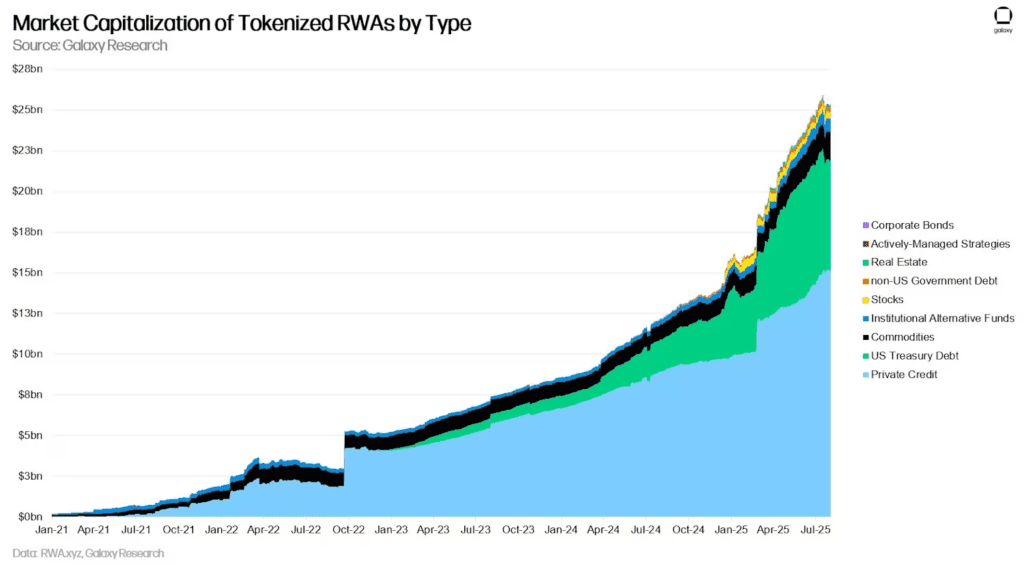

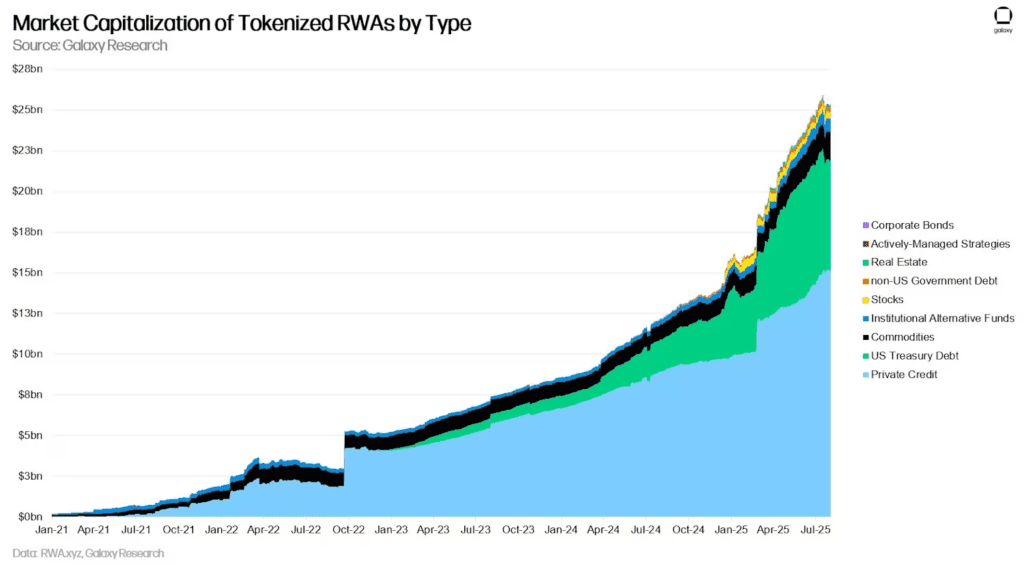

- Smart-contract platforms: Real equity flows on-chain are a narrative tailwind. Today’s live implementations highlight Solana (SOL) via Galaxy and Ethereum (ETH) via Ondo. If Nasdaq/DTCC go live, watch for pilot rails on ETH/L2 or permissioned chains that interoperate with public networks; either path tends to lift ETH, SOL on “RWA/tokenization” momentum.

- RWA tokens & infra: ONDO (RWA issuer) sits at the center of wrapped equities; oracle, custody, and compliance middleware also stand to benefit as volumes migrate. The more trades (or corporate actions) that need on-chain attestations, the stronger the bid for RWA infrastructure tokens.

- Exchange ecosystems: A broader race is underway: Coinbase, Gemini, Kraken, Robinhood, all exploring tokenised assets and even L2 stacks to host them. That arms race can buoy exchange tokens and ETH-aligned L2S on the expectation of new flows.

What could wobble

Liquidity myths: Tokenizing doesn’t magically create secondary liquidity; depth depends on market venues, participants, and regulatory permissions (e.g., no AMMs for registered shares—yet). Galaxy explicitly notes liquidity may be limited until compliant venues mature.

Regulatory pacing: SEC approval and DTCC implementation are gating items. Barron’s and industry trackers hint at 2026 as a realistic go-live, not “this quarter.” Policy shifts could speed up/slow down timelines.

What to watch next (practical checklist)

- SEC’s response to Nasdaq’s rule filing and any pilot parameters (issuers, instruments, volume caps).

- DTCC milestones on token-settlement plumbing. A formal testing calendar would be a strong signal.

- Issuer pipeline: Who follows Galaxy with native tokenised shares, which chains/agents they choose.

- Wrapped equity growth: Ondo’s list expansion and volumes; how quickly non-U.S. access scales.

How this tie to your earlier question on crypto ETFs

In our piece — “The Big Question: Are Crypto ETFs About to Explode?” — we explored what Crypto ETFs are and how they work, and the SEC regulators.

Tokenised equities are the mirror image: bringing traditional assets on-chain under existing protections. Together, ETF adoption off-chain and tokenisation on-chain are converging on the same outcome: crypto rails becoming part of market infrastructure.

Your article:

If approved, Nasdaq’s plan legitimizes the “on-chain back office” for mainstream equities while keeping the front door (order books, protections) unchanged.

For crypto, it’s another structural bid under ETH, SOL, and RWA tokens (e.g., ONDO) as real financial assets migrate on-chain.

Timing matters: momentum is real, but the throttle is regulatory and plumbing, think 2026 for broad rollout, with more Galaxy-style experiments in the meantime.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility