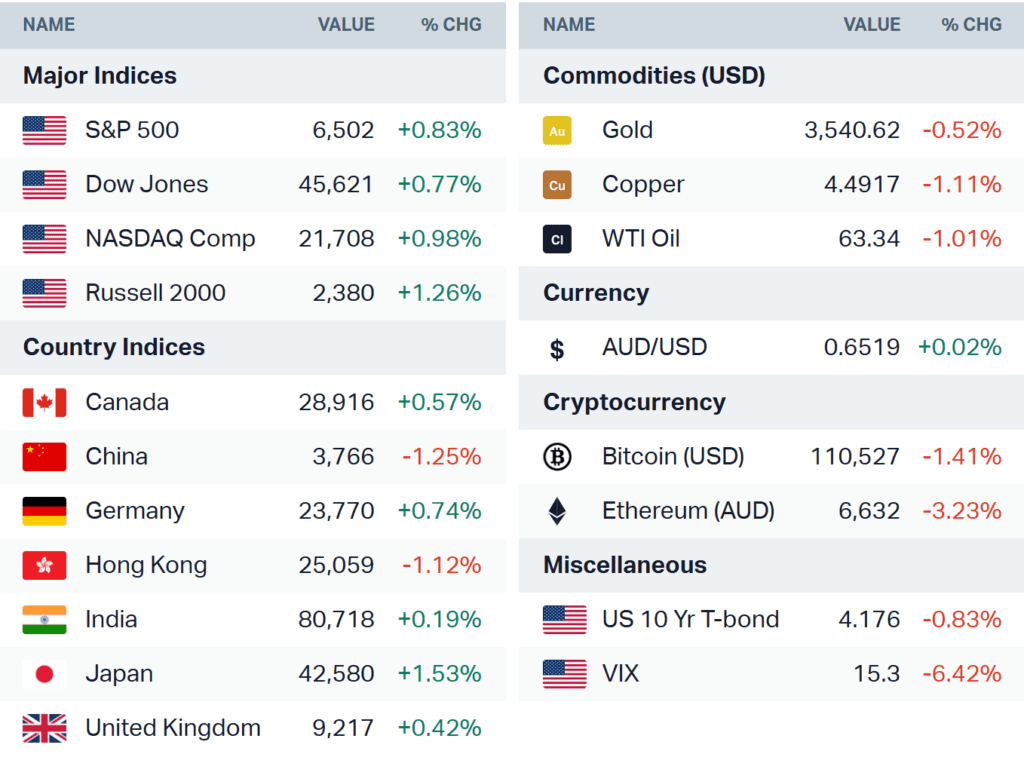

U.S. equity markets ended Thursday on a high note—S&P 500 at a record close, Nasdaq nearly there—driven by signs of a soft labor market and renewed expectations that the Fed will begin cutting rates. Futures are up modestly, and global markets are broadly higher. With little new data on deck before the Jobs number, all attention turns to Friday’s non-farm payrolls at 8:30 a.m. ET—a release that could set the tone for Fed policy and market direction.

Theme check

“Goldilocks” payrolls: Markets are betting big on a benign NFP (Non-Farm Payrolls)—weak enough to lock September cuts, not weak enough to signal recession. With claims up, ADP at +54k, hiring plans soft, and the JOLTS ratio below 1, the bar for “just right” is low: headline ~+75k and UR 4.3% would reinforce the soft-landing path.

Tariffs & inflation: Beige Book’s tariff references surged; goods inflation is already creeping higher from tariffs. Rate cuts with tariff-driven price stickiness is a tricky mix—watch services/earnings guidance for pass-through.

Mega tech relief trade: The Google ruling message to Big Tech: “Play nice, but play on.” That de-risks extreme remedies and fuels the mega-cap bid—especially with AI spend resilient and data-centre capex still a bright spot in the Beige Book.

Japan tailwind: The US-Japan tariff accord (autos to 15%) plus a clean JGB auction supports Nikkei and exporters; auto

Currencies & Commodities

- Gold: Still the safety valve—benefiting from rate-cut bets, debt concerns, and tariff-linked inflation narratives. Consolidation is possible after the parabolic move; $3,500 is a psychological line.

- Oil: -1% WTI / -0.9% Brent as OPEC+ supply talk weighs; demand expectations hinge on payrolls and global PMIs.

- FX: Dollar drift lower helps gold and EM FX; AUD finds a bid on risk tone but is sensitive to NFP.

- Crypto: Pullback after a strong run; attention stays on US ETF pipeline and broader rate path.

Friday Economic Calendar

| Time | Event |

|---|---|

| 8:30 am (EST) | Non-Farm Payrolls – consensus ~ 75K, unemployment ~ 4.3%, hourly wages ~ +0.3% |

| — | Post-NFP: Traders will monitor reactions across equities, bonds, & FX. |

What to Watch (and Why It Matters)

Jobs number reaction:

- Weak but not weak-enough: signals rate cuts and a market-friendly soft landing.

- Too strong: raises Fed pause fears, potentially flat-lining equities.

- Too weak: if it hints recession, risk-off moves could follow.

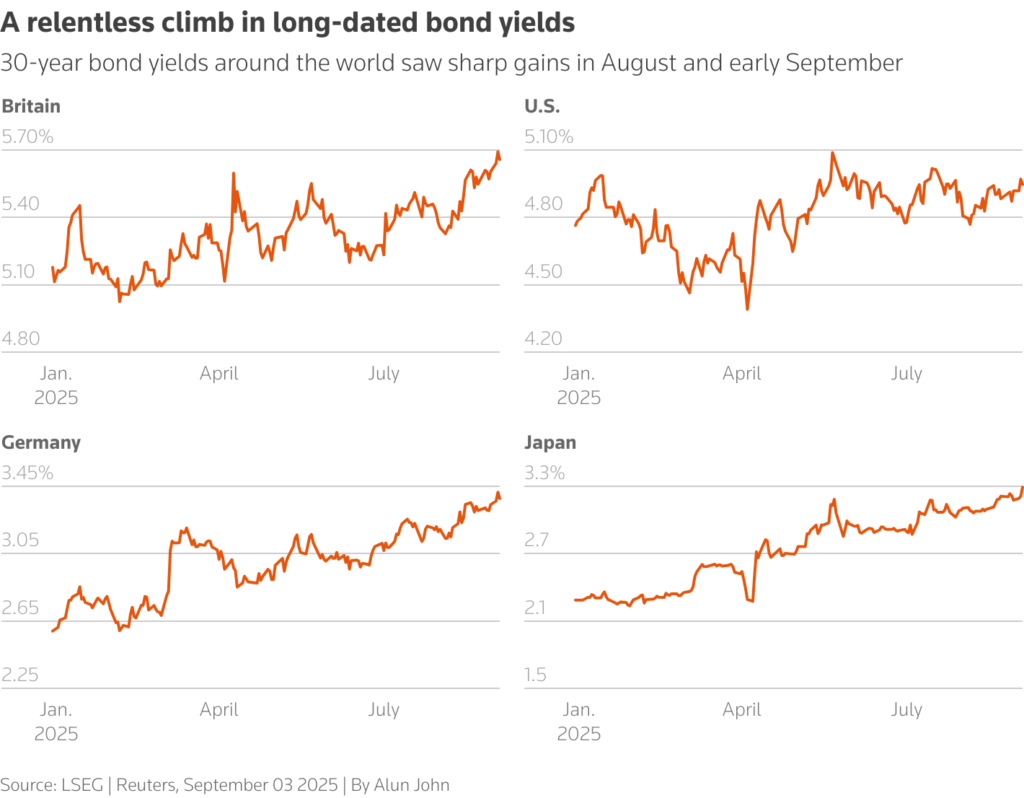

Yield curve behavior:

- Bull flattening (short rates down, long steady) supports risk assets.

- Steepening or bear flattening could pressure markets.

Market breadth: Equal-weight and small-cap ETFs labored to rally—watch if the market extends beyond tech.

Gold & FX:

- Gold near record highs (~$3,550) sensitive to job data.

- Dollar & yen movements could amplify gold and equities.

Follow-on signals:

- Tech/retail earnings after the data (e.g., Broadcom, Salesforce, etc.).

- Fed commentary remains muted; no speakers today due to blackout.

Today’s jobs report is the key, no surprises, no distractions. Markets want a read that’s weak enough for rate relief, strong enough to avoid panic. Nail that “Goldilocks” outcome, and we continue seeing record highs. Miss the mark, and volatility roars back. Welcome to Friday’s pivotal macro moment.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.