Picking stocks and mutual funds grabs all the headlines but taxes quietly shape your real investment gains behind the scenes. Think about it. Tax-savvy investors can save thousands of dollars just by managing how and where they invest. Most people overlook this and end up handing far more to the IRS—just because they missed out on a few smart tax moves.

Table of Contents

- What Are Tax Implications Of Investing?

- Why Tax Implications Matter For Investors

- How Investment Returns Are Taxed

- Key Concepts In Investment Taxation Explained

- Navigating Tax Strategies For Investments

Quick Summary

| Takeaway | Explanation |

|---|---|

| Understand investment income types | Different income types include interest, dividends, and capital gains, each with unique tax rates. |

| Utilize tax-efficient accounts | Choose accounts like IRAs and Roths to minimize tax liabilities and enhance growth potential. |

| Leverage strategic tax management | Implement strategies like tax-loss harvesting to offset gains and improve after-tax returns. |

| Be mindful of capital gains taxation | Holding investments long-term can reduce tax rates on profits, maximizing net returns. |

| Optimize asset location | Place investments in accounts matching their tax implications for better overall tax efficiency. |

What Are Tax Implications of Investing?

Investing is not just about selecting the right stocks or mutual funds. Understanding the tax implications of investing plays a critical role in maximizing your financial returns and managing your overall investment strategy.

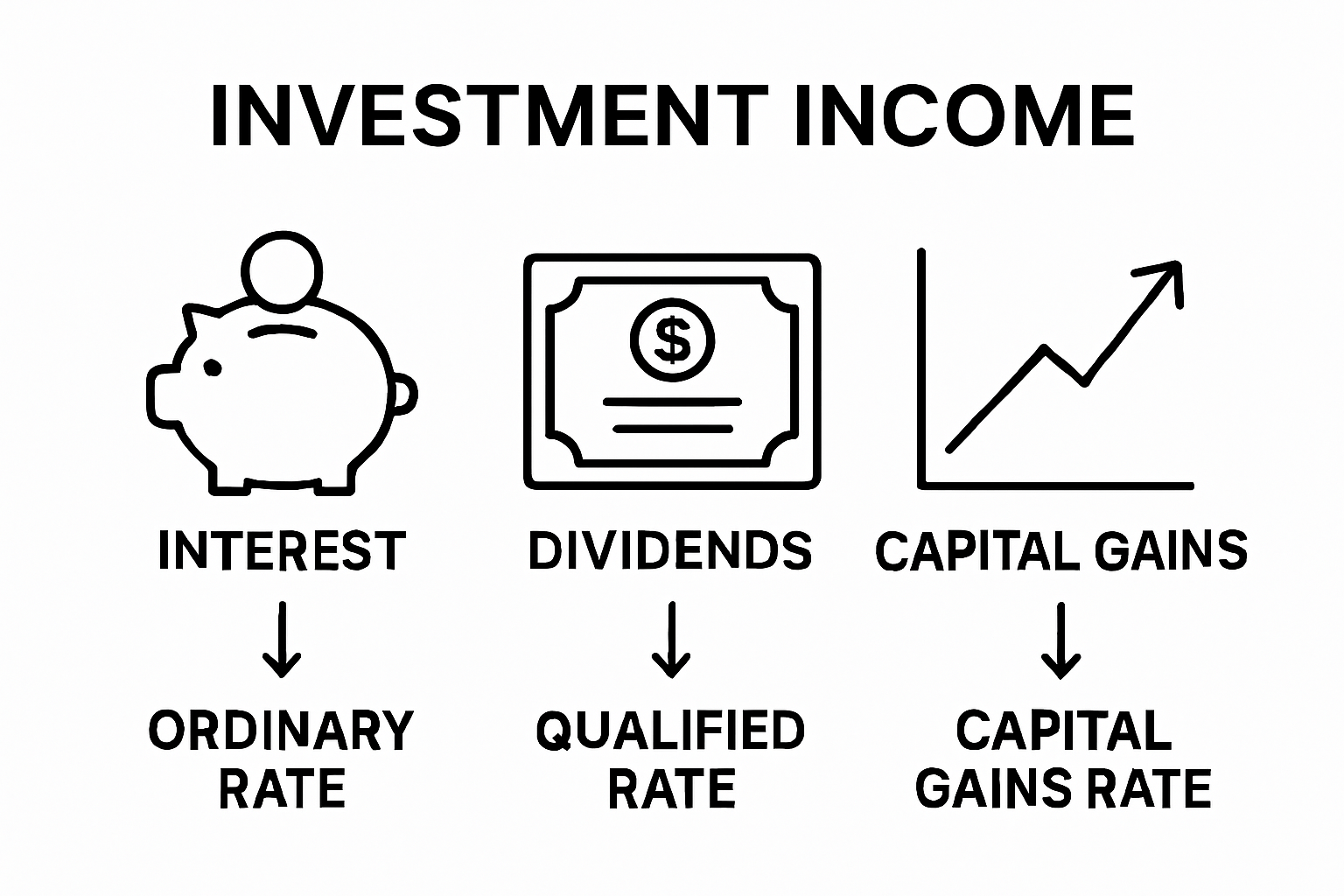

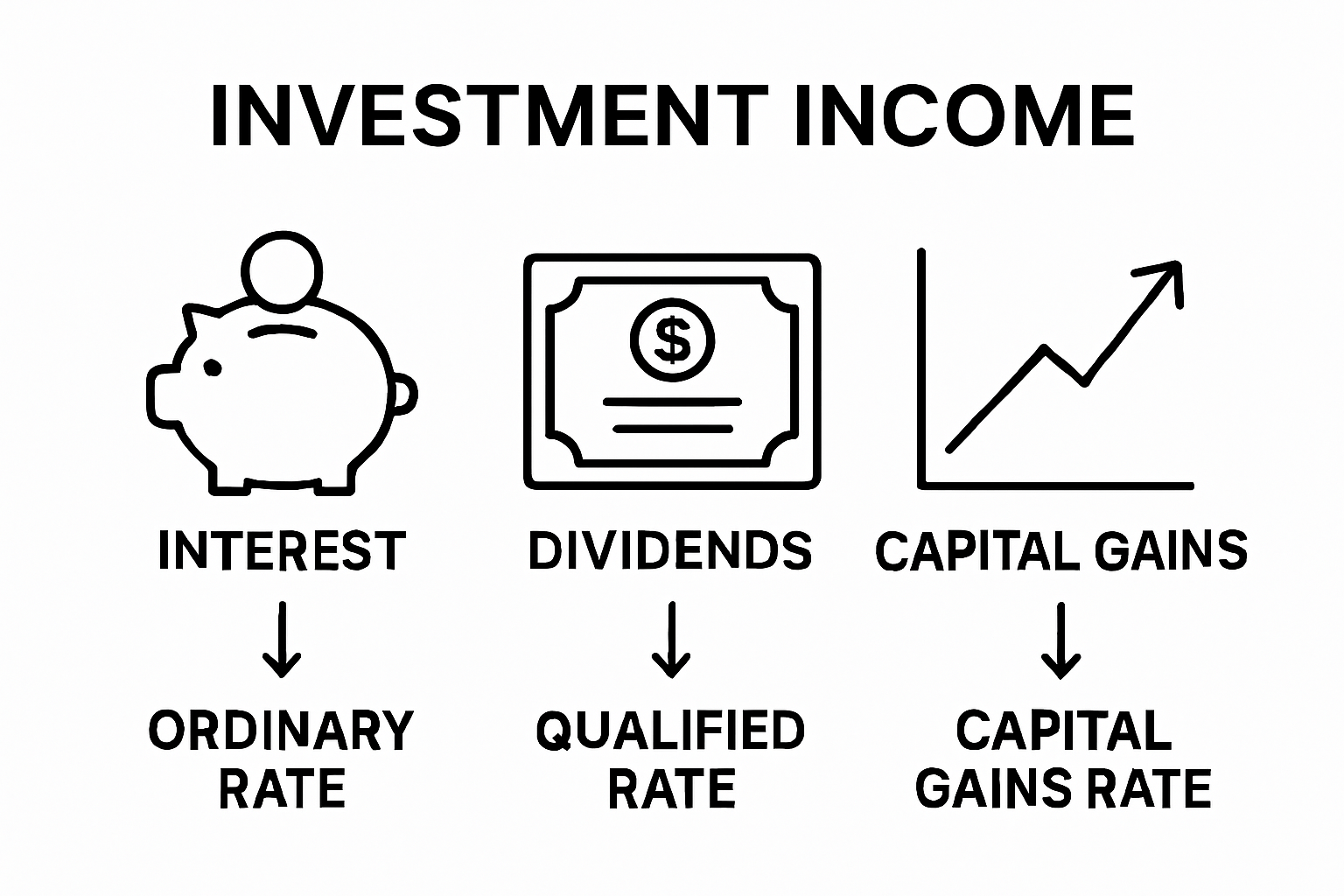

Understanding Investment Income Types

Investment income comes in three primary categories, each with unique tax consequences. Learn more about strategic investment planning:

- Interest Income: Generated from bonds, savings accounts, and certificates of deposit, typically taxed at your ordinary income tax rate

- Dividend Income: Categorized as either ordinary or qualified dividends, with qualified dividends enjoying lower tax rates

- Capital Gains: Profits from selling investments, taxed differently based on how long you hold the asset

According to the National Bureau of Economic Research, personal income taxes significantly impact household investment returns. The tax burden varies across different investment assets, making strategic tax planning crucial.

Tax Considerations for Different Investment Vehicles

Not all investment accounts are taxed equally. Retirement accounts like 401(k)s and IRAs offer unique tax advantages:

- Traditional Retirement Accounts: Contributions are often tax-deductible, with taxes paid upon withdrawal

- Roth Accounts: Contributions are made with after-tax dollars, but withdrawals are typically tax-free

- Taxable Brokerage Accounts: Investments are subject to capital gains and dividend tax rules

Understanding these tax implications helps investors make more informed decisions about where and how to allocate their investment resources.

Below is a comparison table outlining the tax characteristics of different investment account types mentioned in the article.

| Account Type | Tax Treatment on Contributions | Tax Treatment on Withdrawals | Tax Treatment on Growth |

|---|---|---|---|

| Traditional Retirement Account | Often tax-deductible | Taxed as ordinary income at withdrawal | Tax-deferred |

| Roth Account | Contributions made with after-tax dollars | Generally tax-free | Tax-free growth |

| Taxable Brokerage Account | No tax deduction | No special tax treatment; rules apply | Taxed annually on realized gains |

Why Tax Implications Matter for Investors

Understanding tax implications is crucial for investors seeking to maximize their investment returns and minimize unnecessary financial burdens. Strategic tax planning can significantly impact your overall investment performance and long-term wealth accumulation.

The Financial Impact of Taxation

Taxes represent a substantial factor in determining the actual returns on your investments. Explore advanced investment tax strategies to optimize your financial growth. Different investment types trigger varying tax consequences that directly affect your net returns:

- Ordinary Income Tax Rates: Applied to interest income and short-term capital gains, potentially reducing investment profits

- Capital Gains Tax Rates: Varying rates based on holding periods, influencing investment decision-making

- Dividend Tax Treatments: Different tax rates for qualified and non-qualified dividends

According to the Internal Revenue Service, investors must carefully consider the tax implications of their investment choices to maximize after-tax returns.

Strategic Investment Tax Management

Effective tax management involves more than just understanding current tax rates. Investors need to develop comprehensive strategies that minimize tax liabilities while maintaining robust investment portfolios:

- Tax-Loss Harvesting: Offsetting capital gains by selling investments that have decreased in value

- Asset Location Strategies: Placing investments in accounts with the most advantageous tax treatments

- Long-Term Investment Approach: Holding investments for extended periods to benefit from lower long-term capital gains rates

By proactively managing tax implications, investors can potentially save thousands of dollars and create more efficient wealth-building strategies. The goal is not just to generate returns, but to keep more of those returns by understanding and strategically navigating the complex landscape of investment taxation.

How Investment Returns Are Taxed

Taxation of investment returns is a complex process that significantly impacts an investor’s overall financial strategy. Different types of investment income are subject to unique tax treatments, making it crucial to understand how various returns are taxed.

Categories of Investment Income Taxation

Discover tax-efficient investment strategies that can help minimize your tax burden. Investment returns are typically categorized into three primary tax classifications:

- Interest Income: Taxed at ordinary income tax rates, typically the highest tax rate for most investors

- Dividend Income: Classified as either qualified or non-qualified, with different tax rate applications

- Capital Gains: Taxed based on the holding period of the investment

According to the Internal Revenue Service, the tax rate applied depends on several critical factors, including the type of investment and the duration of ownership.

Understanding Capital Gains Taxation

Capital gains taxation is particularly nuanced and depends on how long you hold an investment:

- Short-Term Capital Gains: Profits from investments held for one year or less, taxed at ordinary income tax rates

- Long-Term Capital Gains: Profits from investments held for more than one year, typically taxed at lower preferential rates

- Specific Asset Considerations: Different tax rates may apply to various assets like stocks, bonds, real estate, and cryptocurrency

The tax implications of investment returns can dramatically affect your overall investment performance.

The following table summarizes key types of investment income described in the article and highlights their tax treatment for easier understanding.

| Investment Income Type | Example Sources | Tax Rate Applied |

|---|---|---|

| Interest Income | Bonds, savings accounts | Ordinary income tax rates |

| Ordinary Dividends | Some stocks, mutual funds | Ordinary income tax rates |

| Qualified Dividends | Certain US company stocks | Preferential (lower) tax rates |

| Short-Term Capital Gains | Assets held 1 year or less | Ordinary income tax rates |

| Long-Term Capital Gains | Assets held over 1 year | Lower, preferential tax rates |

Key Concepts in Investment Taxation Explained

Investment taxation is a multifaceted domain that requires careful understanding and strategic planning. Investors must navigate complex tax rules that can significantly impact their overall financial returns and wealth accumulation strategies.

Fundamental Tax Classification of Investments

Explore advanced tax optimization techniques to maximize your investment efficiency. Investment income is fundamentally classified into three primary categories, each with distinct tax treatments:

- Interest Income: Earned from bonds, savings accounts, and certificates of deposit

- Dividend Income: Generated from stock holdings and mutual fund distributions

- Capital Gains: Profits realized from selling investments at a higher price than the purchase value

According to the Internal Revenue Service, the specific tax rate applied depends on multiple factors including income level, investment type, and holding duration.

Nuanced Tax Rate Structures

Tax rates for investments are not uniform and can vary significantly based on several critical parameters:

- Ordinary Income Tax Rates: Applied to short-term gains and certain types of investment income

- Preferential Capital Gains Rates: Lower tax rates for long-term investments held over one year

- Qualified Dividend Rates: Potentially lower tax rates for dividends meeting specific holding period requirements

The complexity of investment taxation underscores the importance of understanding how different investment vehicles are taxed. Successful investors recognize that tax efficiency is as crucial as investment performance. By comprehending these intricate tax mechanisms, investors can develop strategies that minimize tax liabilities and optimize after-tax returns, ultimately enhancing their long-term wealth accumulation potential.

Navigating Tax Strategies for Investments

Effective tax management is a critical component of successful long-term investing. Investors who understand and implement strategic tax approaches can significantly enhance their overall financial performance and minimize unnecessary tax burdens.

Asset Location and Tax Efficiency

Discover advanced tax planning techniques to optimize your investment portfolio. Strategic asset location involves deliberately placing different types of investments in accounts with the most advantageous tax treatments:

- Taxable Accounts: Best suited for investments with lower tax implications

- Tax-Deferred Accounts: Ideal for high-yield investments that generate significant taxable income

- Roth Accounts: Optimal for investments expected to generate substantial long-term growth

According to the Internal Revenue Service, understanding the tax characteristics of different investment vehicles is crucial for developing an effective tax management strategy.

Advanced Tax Minimization Strategies

Sophisticated investors employ multiple techniques to reduce their tax liabilities and maximize investment returns:

- Tax-Loss Harvesting: Strategically selling investments at a loss to offset capital gains

- Long-Term Investment Holding: Capitalizing on lower tax rates for investments held over one year

- Qualified Dividend Optimization: Structuring investments to benefit from lower tax rates on qualified dividends

The art of tax strategy goes beyond simple compliance. Successful investors view tax management as an integral part of their overall investment approach, recognizing that minimizing tax liabilities can be just as important as generating investment returns. By implementing these sophisticated strategies, investors can potentially save substantial amounts in taxes while maintaining a robust and diversified investment portfolio.

Unlock Tax-Smart Investing Strategies With Expert Guidance

Are you feeling overwhelmed by the complex tax rules that impact your investments? This article has highlighted just how much tax efficiency, asset location, and capital gains management can shape your actual investment returns. Missing out on the right strategy today could mean losing more of your gains to taxes tomorrow. If your goal is to keep more of your hard-earned money, deepening your understanding is only the first step.

Take charge of your financial future right now. Visit finblog.com to connect with seasoned advisors and access practical resources tailored to tax-smart investing. Ready for personalized strategies and powerful insights? Get started and move confidently toward keeping more of what you earn. Do not let another tax season catch you unprepared—discover your path to smarter, more efficient investing today.

Frequently Asked Questions

What are the main types of investment income and their tax implications?

Investment income can be categorized into three types: interest income, which is taxed at ordinary income tax rates; dividend income, which can be either ordinary or qualified, the latter enjoying lower tax rates; and capital gains, which are taxed differently based on how long the investment is held.

How does holding period affect capital gains tax rates?

Capital gains are taxed based on the holding period of the investment. Short-term capital gains, from investments held for one year or less, are taxed at ordinary income tax rates, while long-term capital gains, from investments held for more than a year, are taxed at lower preferential rates.

What are some strategies for managing investment taxes effectively?

Effective tax management strategies include tax-loss harvesting to offset capital gains, asset location strategies to maximize tax advantages depending on the account type, and maintaining a long-term investment approach to take advantage of lower capital gains tax rates.

Why is understanding tax implications important for investors?

Understanding tax implications is crucial as taxes can significantly impact the actual returns on investments. Strategic tax planning helps investors minimize their tax liabilities, optimize after-tax returns, and enhance overall wealth accumulation.