US stocks edged to fresh highs into Wednesday’s close as traders waited on Nvidia. With the chipmaker now roughly 8% of the S&P 500, the index’s late strength underscored how much sentiment hinged on this one report.

Nvidia’s results: clean beats, bigger buyback, China still excluded

After the bell, Nvidia posted $46.74B in revenue (vs. $46.23B est.) and $1.05 adjusted EPS (vs. $1.01 est.), plus a new $60B share-repurchase authorisation. The company guided Q3 revenue to ~$54B ±2%, above Wall Street’s average estimate, and said the outlook does not assume any H20 shipments to China. Management framed demand for Blackwell as “extraordinary.” Shares still fell in late trading. (More about: Nvidia Beats, But Here is Why Shares Slip)

Market reaction overnight

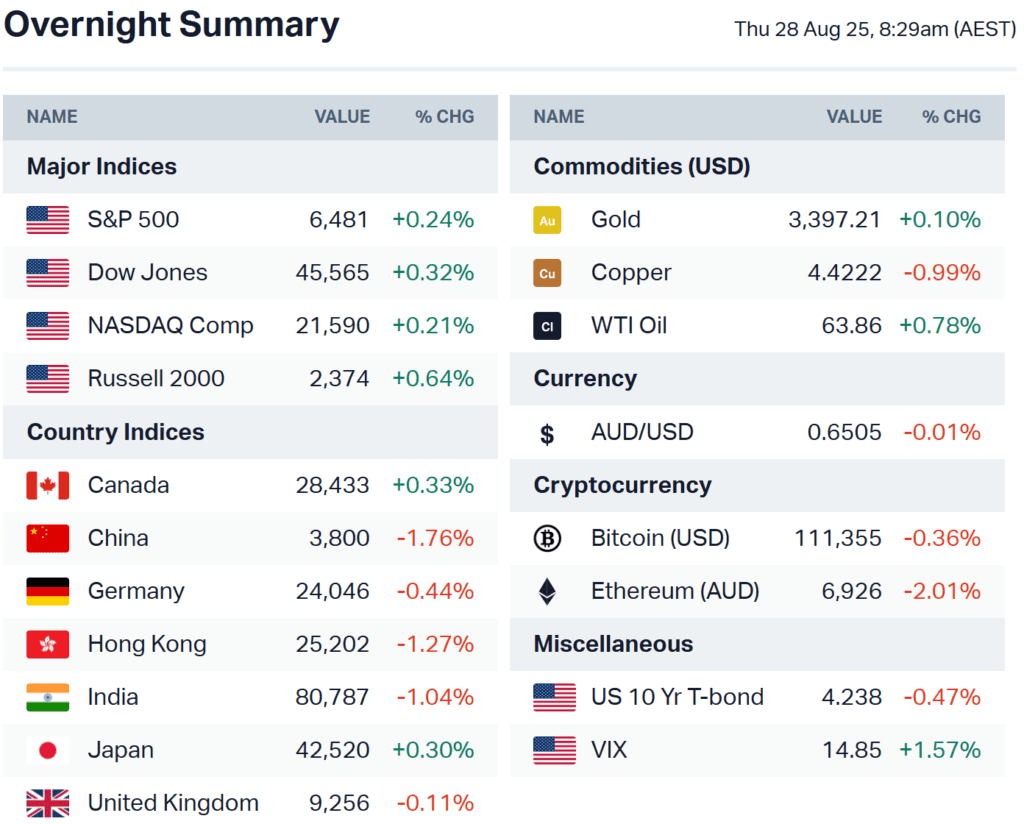

Futures softened with tech leading the pullback: S&P 500 minis dipped and Nasdaq futures slipped after the print. In Asia, the chill hit regional chip leaders like TSMC and Samsung, while Chinese chip rivals SMIC and Cambricon jumped, helping the STAR 50 swing higher. European traders took the cue for a cooler open.

Early morning snapshot

Stocks are firming this morning as traders shrug off last night’s wobble around Nvidia. Futures recovered and Europe opened higher, signalling the rally’s momentum remains intact even if the bar for AI leaders is still sky-high.

Regionally, S&P 500 futures erased early losses; Stoxx 600 is up around 0.3%, with autos and miners leading; Asia was mixed as Korean/Taiwan chip names softened while China’s domestic chipmakers outperformed. Nvidia shares were down in late trading despite the beat, but broader risk appetite stabilised into the European session.

In commodities, crude eased as the market looks past the U.S. driving season and watches India–U.S. tariff headlines; around press time, Brent hovered in the high-$67s and WTI in the mid-$63s. Gold held firm, supported by a softer dollar and lingering rate-cut hopes.

Today’s docket: U.S. Q2 GDP (second estimate), initial jobless claims, and pending home sales on deck for the macro read-through, alongside a busy earnings slate in the US and Europe—inputs that could nudge rates and keep the “soft landing + AI” narrative in focus.

| Event | US (ET) | UK (BST) |

|---|---|---|

| GDP (2nd estimate) | 8:30 AM | 1:30 PM |

| Initial Jobless Claims | 8:30 AM | 1:30 PM |

| Continuing Claims | 8:30 AM | 1:30 PM |

| Pending Home Sales | 10:00 AM | 3:00 PM |

| 7-Year Note Auction | 1:00 PM | 6:00 PM |

| Fed Governor Waller speaks | 4:00 PM | 9:00 PM |

| Event | UK (BST) | US (ET) |

|---|---|---|

| M3 Money Supply (YoY) | 6:00 PM | 1:00 PM |

| Consumer Confidence (Aug) | 7:00 PM | 2:00 PM |

| Window | Companies | US (ET) | UK (BST) |

|---|---|---|---|

| Pre-Market | Li Auto (LI), Best Buy (BBY), Baozun (BZUN), Dollar General (DG) | Before 9:30 AM | Before 2:30 PM |

| After-Market | Affirm (AFRM), SentinelOne (S), Marvell Tech (MRVL), Dell (DELL), Ulta Beauty (ULTA), Webull (BULL) | After 4:00 PM | After 9:00 PM |

TARIFFS

US tariff revenue could top $500B/yr: That implies a major fiscal inflow from duties alone. Near term, it supports government revenue; but it effectively raises import costs, which can filter into higher prices, pressure margins for import-reliant companies, and potentially cool consumer demand if firms pass costs through.

Brazilian pig iron talks with US buyers: Pig iron is a key input for US steelmaking. Negotiations signal buyers are trying to lock supply and price amid tariff uncertainty. If duties rise or exemptions narrow, expect higher raw-material costs for US mills and possible steel price firmness downstream (autos, construction, machinery).

EU mulls scrapping tariffs on US industrial goods: Brussels floating tariff relief would be a de-escalation move to stabilize transatlantic trade. If enacted, it could lower input costs for European manufacturers using US equipment/components and reduce volatility for exporters on both sides.

US imposes 50% tariffs on India: Steep duties risk slowing bilateral trade, potentially dragging India’s GDP if volumes fall. For US importers, sourcing from India could get meaningfully pricier, pushing firms to re-route supply chains or absorb margin hits until pricing resets.

CENTRAL BANKS

- Trump’s moves against Fed heighten fiscal dominance risks

- Bessent urges Powell to conduct internal review of the Fed amid Cook mortgage fraud allegations

- Trump administration looking at ways to exert more influence over Fed’s 12 regional banks

- Bank of Korea expected to keep rates paused Friday, as officials balance tariff-related headwinds against surging home prices

Yesterday’s record close says the uptrend is intact, but Nvidia’s “not-perfect” beat shows how high the bar is for AI leaders, and how any wobble can reverberate across mega-cap tech and suppliers. Layer on tariffs and Fed politics, and the tape may stay headline-sensitive into Friday’s PCE.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.